CarMax 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

28

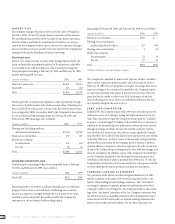

MARKET RISK

The Company manages the private-label and bank card revolving loan

portfolios of the Circuit City Group’s finance operation and the automo-

bile installment loan portfolio of the CarMax Group’s finance operation.

Portions of these portfolios are securitized and,therefore, are not pre-

sented on the Company’s balance sheets. Interest rate exposure relating to

these receivables represents a market risk exposure that the Company has

managed with matched funding and interest rate swaps.

Revolving Loans

Interest rates charged on the accounts in the managed private-label and

bank card portfolios are primarily indexed to the prime rate,adjustable

on a monthly basis,with the balance at a fixed annual percentage rate.

Total principal outstanding at February 29, 2000, and February 28, 1999,

had the following APR structure:

(Amounts in millions) 2000 1999

Indexed to prime rate................................................ $2,631 $2,714

Fixed APR.................................................................. 213 243

Total........................................................................... $2,844 $2,957

Financing for the securitization programs is achieved primarily through

the issuance of public market debt,which is issued either at floating rates

based on LIBOR or at fixed rates. Certain of the fixed-rate issuances have

been swapped to LIBOR. Receivables held by the Company for investment

or sale are financed with working capital. At February 29, 2000, and

February 28, 1999, financings were as follows:

(Amounts in millions) 2000 1999

Floating-rate (including synthetic

alteration) securitizations.................................... $2,544 $2,568

Fixed-rate securitizations.......................................... 137 187

Held by the Company:

For investment..................................................... 145 162

For sale ................................................................ 18 40

Total........................................................................... $2,844 $2,957

Automobile Installment Loans

Total principal outstanding for fixed-rate automobile loans at February

29,2000,and February 28, 1999, was as follows:

(Amounts in millions) 2000 1999

Fixed APR..................................................................... $932 $592

Financing for these receivables is achieved through asset securitization

programs that,in turn, issue both fixed- and floating-rate securities.

Interest rate exposure is hedged through the use of interest rate swaps

matched to projected payoffs. Receivables held by the Company for

investment or sale are financed with working capital.

Financings at February 29,2000,and February 28, 1999, were as follows:

(Amounts in millions) 2000 1999

Fixed-rate securitization.............................................. $559 $ –

Floating-rate securitizations

synthetically altered to fixed................................... 327 500

Floating-rate securitizations........................................ 1 39

Held by the Company:

For investment*....................................................... 22 38

For sale…............................................................... 23 15

Total.............................................................................. $932 $592

* Held by a bankruptcy remote special purpose company

The Company has analyzed its interest rate exposure and has concluded

that it did not represent a material market risk at February 29, 2000, or

February 28, 1999. Because programs are in place to manage interest rate

exposure relating to the consumer loan portfolios,the Company expects

to experience relatively little impact if interest rates fluctuate. The Com-

pany also has the ability to adjust fixed-APR revolving cards and the

index on floating-rate cards, subject to cardholder ratification,but does

not currently anticipate the need to do so.

YEAR 2000 CONVERSION

In fiscal 1997, the Company began a Year 2000 date conversion project to

address necessary code changes,testing and implementation for its sys-

tems. Since the project began, the Company has expensed $17.1 million

in project costs,including $3.9 million in fiscal 2000. These costs were in

addition to the normal budget for information systems and were funded

through operating cash flows. Because the CarMax computer systems

were developed in recent years,they did not require significant remedia-

tion; therefore, the CarMax Group did not incur any material costs related

to the Year 2000 issue. To date,because of the extensive testing and reme-

diation efforts undertaken by the Company prior to January 1,2000,no

material adverse consequences have been experienced by the Circuit City

Group or the CarMax Group resulting from the Year 2000 date change,and

none are anticipated. In addition,as part of the Company’s Year 2000 pro-

ject, the Company identified its key third-party business partners and

coordinated with them to address potential Year 2000 issues. To date,the

Company has not experienced any material adverse consequences related

to its key third-party business partners,and none are anticipated.

FORWARD-LOOKING STATEMENTS

The provisions of the Private Securities Litigation Reform Act of 1995,

which became law in December 1995,provide companies with a “safe

harbor”when making forward-looking statements. This “safe harbor”

encourages companies to provide prospective information about their

companies without fear of litigation. The Company wishes to take advan-

tage of the “safe harbor”provisions of the Act. Company statements that

are not historical facts, including statements about management’s expec-

tations for fiscal 2001 and beyond,are forward-looking statements and

involve various risks and uncertainties. Factors that could cause the