CarMax 2000 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

36

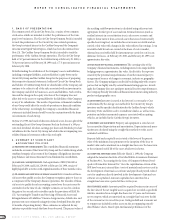

The CarMax Group is a used- and new-car retail business. The diversity

of the CarMax Group’s customers and suppliers reduces the risk that a

severe impact will occur in the near term as a result of changes in its cus-

tomer base or sources of supply. However, because of the CarMax Group’s

limited overall size,management cannot assure that unanticipated events

will not have a negative impact on the Company.

The preparation of financial statements in conformity with generally

accepted accounting principles requires management to make estimates

and assumptions that affect the reported amounts of assets,liabilities,

revenues and expenses and the disclosure of contingent assets and liabili-

ties. Actual results could differ from those estimates.

(R) CORPORATE ALLOCATIONS: The Company manages corporate general

and administrative costs and other shared services on a centralized basis.

Allocations of these corporate activities and their related expenses to the

Groups are based on methods that the Company believes to be reasonable.

The provision for federal income taxes is determined on a consolidated

basis. The financial statement provision is reflected in each Group’s finan-

cial statements in accordance with the Company’s tax allocation policy. In

general,this policy provides that the consolidated tax provision is allo-

cated between the Groups based principally upon the financial income,

taxable income,credits and other amounts directly related to each Group.

Tax benefits that cannot be used by the Group generating such attributes,

but can be utilized on a consolidated basis,are allocated to the Group that

generated such benefits.

(S) RECLASSIFICATIONS: Certain amounts in prior years have been reclassi-

fied to conform to classifications adopted in fiscal 2000.

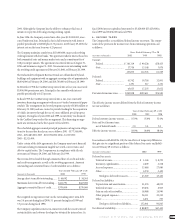

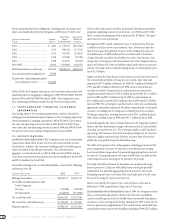

3. BUSINESS ACQUISITIONS

The CarMax Group acquired the franchise rights and the related assets of

six new-car dealerships for an aggregate cost of $34.8 million in fiscal

2000. These acquisitions were financed through available cash resources.

During fiscal 1999, CarMax acquired the franchise rights and the related

assets for four new-car dealerships for an aggregate cost of $49.6 million.

These acquisitions were financed through available cash resources and

the issuance of two promissory notes aggregating $8.0 million. Costs in

excess of the fair value of the net tangible assets acquired (primarily

inventory) have been recorded as goodwill and covenants not to compete.

These acquisitions were accounted for under the purchase method and

the results of the operations of the acquired franchises have been

included in the accompanying consolidated financial statements since the

date of acquisition. Unaudited pro-forma information related to these

acquisitions is not included as the impact of these acquisitions on the

accompanying consolidated financial statements is not material.

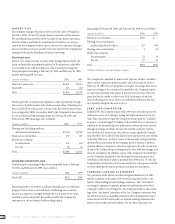

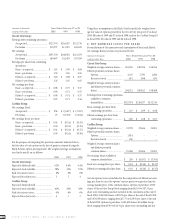

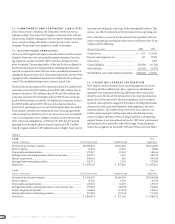

4. PROPERTY AND EQUIPMENT

Property and equipment, at cost,at February 29 or 28 is summarized as

follows:

(Amounts in thousands) 2000 1999

Land and buildings (20 to 25 years)............ $ 180,422 $ 75,875

Land held for sale........................................ 41,850 31,435

Land held for development ......................... 17,697 28,781

Construction in progress............................. 69,388 179,664

Furniture, fixtures and equipment

(3 to 8 years).......................................... 750,737 705,660

Leasehold improvements

(10 to 15 years)...................................... 586,005 549,673

Capital leases,primarily buildings

(20 years)............................................... 12,471 12,471

1,658,570 1,583,559

Less accumulated depreciation and

amortization.......................................... 693,389 577,786

Property and equipment,net ...................... $ 965,181 $1,005,773

Land held for development is land owned for future sites that are sched-

uled to open more than one year beyond the fiscal year reported.

5. DEBT

Long-term debt at February 29 or 28 is summarized as follows:

(Amounts in thousands) 2000 1999

Term loans...................................................... $405,000 $405,000

Industrial Development Revenue

Bonds due through 2006 at various

prime-based rates of interest

ranging from 5.0% to 7.0% ...................... 5,419 6,564

Obligations under capital leases [NOTE 10]...... 12,416 12,728

Note payable................................................... 3,750 5,000

Total long-term debt....................................... 426,585 429,292

Less current installments............................... 177,344 2,707

Long-term debt,excluding

current installments ................................. $249,241 $426,585

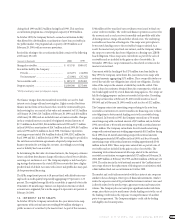

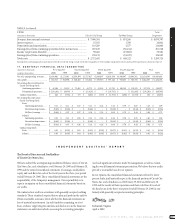

In July 1994,the Company entered into a seven-year,$100,000,000,unse-

cured bank term loan. The loan was restructured in August 1996 as a

$100,000,000,six-year unsecured bank term loan. Principal is due in full

at maturity with interest payable periodically at LIBOR plus 0.40 percent.

At February 29, 2000, the interest rate on the term loan was 6.29 percent.

In May 1995,the Company entered into a five-year,$175,000,000,unse-

cured bank term loan. Principal is due in full at maturity with interest

payable periodically at LIBOR plus 0.35 percent. At February 29, 2000, the

interest rate on the term loan was 6.23 percent. This term loan is due in

May 2000 and has been classified as a current liability as of February 29,