CarMax 2000 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT 67

CARMAX GROUP

Management believes that the proceeds from sales of property and equip-

ment and receivables,future increases in the Company’s debt allocated to

the CarMax Group,inter-group loans and cash generated by operations

will be sufficient to fund the CarMax Group’s capital expenditures and

operations.

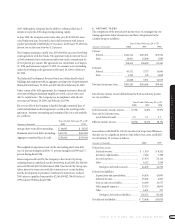

MARKET RISK

The Company manages the automobile installment loan portfolio of the

Group’s finance operation. A portion of this portfolio is securitized and,

therefore,is not presented on the Group’s balance sheets. Interest rate

exposure relating to these receivables represents a market risk exposure

that the Company has managed with matched funding and interest rate

swaps. Total principal outstanding for fixed-rate automobile loans at

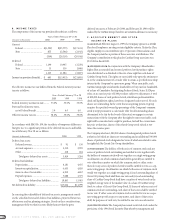

February 29, 2000, and February 28,1999,was as follows:

(Amounts in millions) 2000 1999

Fixed APR..................................................................... $932 $592

Financing for these receivables is achieved through asset securitization

programs that,in turn, issue both fixed- and floating-rate securities.

Interest rate exposure is hedged through the use of interest rate swaps

matched to projected payoffs. Receivables held by the Company for

investment or sale are financed with working capital. Financings at

February 29, 2000, and February 28,1999,were as follows:

(Amounts in millions) 2000 1999

Fixed-rate securitizations ............................................ $559 $ –

Floating-rate securitizations

synthetically altered to fixed .................................. 327 500

Floating-rate securitizations........................................ 1 39

Held by the Company:

For investment* ..................................................... 22 38

For sale................................................................... 23 15

Total ............................................................................. $932 $592

* Held by a bankruptcy remote special purpose company

The Company has analyzed its interest rate exposure and has concluded

that it did not represent a material market risk at February 29, 2000, or

February 28, 1999. Because it has a program in place to manage interest

rate exposure relating to its installment loan portfolio, the Company

expects to experience relatively little impact if interest rates fluctuate.

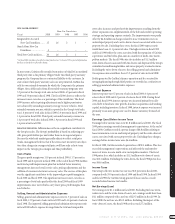

YEAR 2000 CONVERSION

Refer to the “Management’s Discussion and Analysis of Results of Opera-

tions and Financial Condition”for Circuit City Stores, Inc.for a complete

discussion of the Year 2000 issue and its impact on the Group’s financial

statements.

FORWARD-LOOKING STATEMENTS

Company statements that are not historical facts, including statements

about management’s expectations for fiscal year 2001 and beyond,are

forward-looking statements and involve various risks and uncertainties.

Refer to the “Circuit City Stores, Inc.Management’s Discussion and Analy-

sis of Results of Operations and Financial Condition”for a review of pos-

sible risks and uncertainties.