CarMax 2000 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

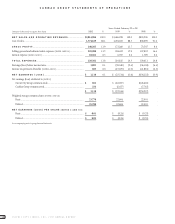

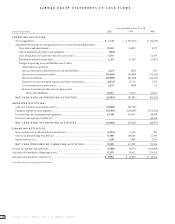

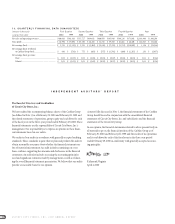

CARMAX GROUP STATEMENTS OF CASH FLOWS

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

70

Years Ended February 29 or 28

(Amounts in thousands) 2000 1999 1998

OPERATING ACTIVITIES:

Net earnings (loss)..................................................................................................................... $ 1,118 $ (23,514) $ (34,223)

Adjustments to reconcile net earnings (loss) to net cash used in operating activities:

Depreciation and amortization............................................................................................ 15,241 10,003 4,577

Gain on disposition of property and equipment.................................................................. (820) – –

Lease termination costs and write-down of assets [NOTE 13] ............................................... 4,755 – 11,500

Provision for deferred income taxes..................................................................................... 1,225 11,284 (1,867)

Changes in operating assets and liabilities,net of effects

from business acquisitions:

Increase (decrease) in deferred revenue and other liabilities......................................... 2,234 (251) 835

Increase in net accounts receivable................................................................................ (31,889) (36,498) (32,516)

Increase in inventory...................................................................................................... (39,909) (81,490) (61,710)

(Increase) decrease in prepaid expenses and other current assets................................ (2,224) 25,714 2,743

Decrease (increase) in other assets................................................................................ 1,255 (809) 63

Increase in accounts payable,accrued expenses and

other current liabilities............................................................................................. 23,921 13,570 24,472

NET CASH USED IN OPERATING ACTIVITIES............................................. (25,093) (81,991) (86,126)

INVESTING ACTIVITIES:

Cash used in business acquisitions [NOTE 4]............................................................................... (34,849) (41,562) –

Purchases of property and equipment....................................................................................... (45,395) (138,299) (234,252)

Proceeds from sales of property and equipment....................................................................... 25,340 139,332 98,098

Decrease in inter-group receivable,net...................................................................................... –– 48,147

NET CASH USED IN INVESTING ACTIVITIES.............................................. (54,904) (40,529) (88,007)

FINANCING ACTIVITIES:

(Decrease) increase in allocated short-term debt,net............................................................... (3,053) 1,220 385

Increase in allocated long-term debt,net .................................................................................. 71,896 108,584 27,386

Equity issuances,net.................................................................................................................. 3,456 3,983 2,353

NET CASH PROVIDED BY FINANCING ACTIVITIES................................ 72,299 113,787 30,124

Decrease in cash and cash equivalents............................................................................................ (7,698) (8,733) (144,009)

Cash and cash equivalents at beginning of year.............................................................................. 17,679 26,412 170,421

Cash and cash equivalents at end of year......................................................................................... $ 9,981 $ 17,679 $ 26,412

See accompanying notes to group financial statements.