CarMax 2000 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT 57

CIRCUIT CITY GROUP

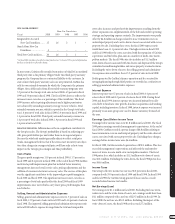

2000. Although the Company has the ability to refinance this loan,it

intends to repay the debt using existing working capital.

In June 1996,the Company entered into a five-year,$130,000,000,unse-

cured bank term loan. Principal is due in full at maturity with interest

payable periodically at LIBOR plus 0.35 percent. At February 29, 2000, the

interest rate on the term loan was 6.23 percent.

The Company maintains a multi-year,$150,000,000,unsecured revolving

credit agreement with four banks. The agreement calls for interest based

on both committed rates and money market rates and a commitment fee

of 0.18 percent per annum. The agreement was entered into as of August

31,1996,and terminates August 31,2002. No amounts were outstanding

under the revolving credit agreement at February 29,2000,or February

28,1999.

The Industrial Development Revenue Bonds are collateralized by land,

buildings and equipment with an aggregate carrying value of approximately

$8,404,000 at February 29,2000,and $10,740,000 at February 28,1999.

Under certain of the debt agreements,the Company must meet financial

covenants relating to minimum tangible net worth,current ratios and

debt-to-capital ratios. The Company was in compliance with all such

covenants at February 29,2000,and February 28, 1999.

Short-term debt of the Company is funded through committed lines of

credit and informal credit arrangements, as well as the revolving credit

agreement. Amounts outstanding and committed lines of credit available

are as follows:

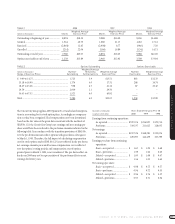

Years Ended February 29 or 28

(Amounts in thousands) 2000 1999

Average short-term debt outstanding ...... $ 44,692 $ 54,505

Maximum short-term debt outstanding.. $411,791 $463,000

Aggregate committed lines of credit ........ $370,000 $370,000

The weighted average interest rate on the outstanding short-term debt

was 5.6 percent during fiscal 2000, 5.1 percent during fiscal 1999 and 5.7

percent during fiscal 1998.

Interest expense allocated by the Company to the Circuit City Group,

excluding interest capitalized,was $13,844,000 in fiscal 2000,$21,926,000

in fiscal 1999 and $25,072,000 in fiscal 1998. The Circuit City Group capi-

talizes interest in connection with the construction of certain facilities

and the development or purchase of software for internal use. In fiscal

2000,interest capitalized amounted to $2,166,000 ($2,749,000 in fiscal

1999 and $4,759,000 in fiscal 1998).

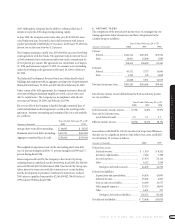

6. INCOME TAXES

The components of the provision for income taxes on earnings from con-

tinuing operations before income taxes and Inter-Group Interest in the

CarMax Group are as follows:

Years Ended February 29 or 28

(Amounts in thousands) 2000 1999 1998

Current:

Federal ................................ $141,514 $123,001 $75,554

State..................................... 16,901 15,694 5,989

158,415 138,695 81,543

Deferred:

Federal ................................ 40,572 5,773 14,060

State..................................... 1,256 178 2,859

41,828 5,951 16,919

Provision for income taxes........ $200,243 $144,646 $98,462

The effective income tax rate differed from the Federal statutory income

tax rate as follows:

Years Ended February 29 or 28

2000 1999 1998

Federal statutory income tax rate......... 35.0% 35.0% 35.0%

State and local income taxes,

net of Federal benefit...................... 3.0 3.1 3.3

Effective income tax rate ...................... 38.0% 38.1% 38.3%

In accordance with SFAS No.109,the tax effects of temporary differences

that give rise to a significant portion of the deferred tax assets and liabili-

ties at February 29 or 28 are as follows:

(Amounts in thousands) 2000 1999

Deferred tax assets:

Deferred revenue........................................... $ 1,055 $ 8,202

Inventory capitalization................................ 7,264 7,198

Accrued expenses.......................................... 27,974 24,110

Other ............................................................. 6,112 5,246

Total gross deferred tax assets................. 42,405 44,756

Deferred tax liabilities:

Depreciation and amortization..................... 44,854 43,600

Deferred revenue........................................... 29,656 6,903

Gain on sales of receivables........................... 14,069 10,337

Other prepaid expenses................................. 23,023 18,835

Other ............................................................. 6,651 707

Total gross deferred tax liabilities ........... 118,253 80,382

Net deferred tax liability ..................................... $ 75,848 $35,626