CarMax 2000 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

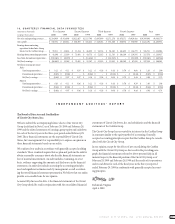

CARMAX GROUP MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

64

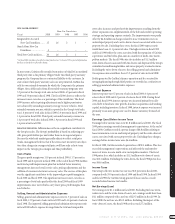

The common stock of Circuit City Stores,Inc.consists of two common

stock series,which are intended to reflect the performance of the Com-

pany’s two businesses. The CarMax Group Common Stock is intended to

track the performance of the CarMax stores and related operations. The

Circuit City Group Common Stock is intended to track the performance of

the Circuit City stores and related operations and the Group’s retained

interest in the CarMax Group. The effects of the retained interest held by

the Circuit City Group on the CarMax Group’s financial statements are

identified by the term “Inter-Group.”The Inter-Group Interest is not con-

sidered outstanding CarMax Group stock. Therefore,the net earnings or

losses attributed to the Inter-Group Interest are not included in the

CarMax Group’s per share calculations.

The following discussion and analysis relates to the CarMax Group.

Reported earnings and losses attributed to the CarMax Group Common

Stock exclude the earnings and losses attributed to the Circuit City

Group’s Inter-Group Interest, which was 74.7 percent at February 29,

2000,76.6 percent at February 28,1999,and 77.3 percent at February 28,

1998. For additional information,refer to the “Management’s Discussion

and Analysis of Results of Operations and Financial Condition”for Circuit

City Stores,Inc.and for the Circuit City Group.

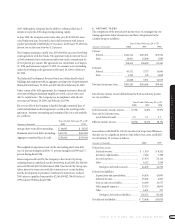

RESULTS OF OPERATIONS

Sales Growth

Total sales for the CarMax Group increased 37 percent in fiscal 2000 to

$2.01 billion. In fiscal 1999, total sales increased 68 percent to $1.47 bil-

lion from $874.2 million in fiscal 1998. The fiscal 2000 total sales increase

reflects a 2 percent increase in comparable store sales and the addition of

superstores and new-car franchises.

PERCENTAGE SALES CHANGE FROM PRIOR YEAR

Fiscal Total Comparable

2000...................................................................... 37% 2)%

1999...................................................................... 68% (2)%

1998...................................................................... 71% 6)%

1997...................................................................... 85% 23)%

1996...................................................................... 258% 12)%

PERCENT VEHICLE SALES BY CATEGORY

2000 1999 1998 1997 1996

Vehicle Dollars:

Used Vehicles........................... 79% 90% 89% 88% 100%

New Vehicles............................ 21% 10% 11% 12% 0%

Vehicle Units:

Used Vehicles........................... 86% 94% 93% 92% 100%

New Vehicles............................ 14% 6% 7% 8% 0%

During the past five years,geographic expansion of the CarMax used-car

superstore concept and the addition of new-car franchises have been the

primary contributors to CarMax’s total sales growth. During the second

half of fiscal 1998,the Group’s used-car sales began to fall below manage-

ment’s expectations. New-car sales remained strong. These trends con-

tinued through fiscal 1999 when strong comparable store sales growth in

new cars was more than offset by the weak used-car sales trend.

Late in fiscal 1999, CarMax adopted a hub and satellite operating strategy

in existing multi-store markets. In fiscal 1999,five superstores were con-

verted to satellite locations in the Miami,Houston,Dallas and Chicago

markets. Under the hub and satellite operating process,a satellite store

uses the reconditioning,purchasing and business office operations of a

nearby hub store. The display capacity and consumer offer are identical

in both the hub and satellite stores. A prototypical satellite store operates

on a four- to six-acre site with a 12,000- to 14,000-square-foot facility that

houses sales offices,a showroom and four to seven service bays for regu-

lar maintenance and warranty service. At the end of fiscal 1999, CarMax

classified two stores as prototype satellite stores.

In fiscal 2000,CarMax limited its geographic expansion to focus on build-

ing sales and profitability in existing markets. During the year,CarMax

opened one used-car superstore in Nashville, Tenn., and one in Duarte,

Calif. CarMax converted one existing store into a satellite operation. In

the markets of Dallas/Fort Worth and Houston,CarMax added two proto-

typical satellite stores that opened at year-end. The sales pace at CarMax’s

used-car superstores, including those stores with integrated new-car

franchises,improved,and the Group generated comparable store sales

growth for the last two quarters and for the fiscal year.

In fiscal 2000,CarMax also opened five stand-alone new-car stores, relo-

cated its Laurel, Md.,Toyota franchise next to its Laurel superstore and

acquired a Nissan franchise that was added to an existing used-car super-

store location in the Washington,D.C./Baltimore market.While the per-

formance of the used-car superstores and integrated used- and new-car

superstores exceeded expectations,management was disappointed in the

performance of the stand-alone new-car stores during fiscal 2000.

Although operations at these stores have improved significantly versus their

levels prior to acquisition,they remain below management’s expectations.

CarMax is actively pursuing opportunities to integrate or co-locate as

many of these franchises with existing used-car superstores as possible.

Late in fiscal 2000, CarMax’s primary competitor exited the used-car

superstore business. Management believes their exit from the Dallas/Fort

Worth, Houston,San Antonio, Tampa and Miami markets,where the two

companies competed,will help eliminate consumer confusion over the

two offers and increase customer flow for CarMax.

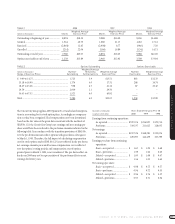

STORE MIX*

Retail Units at Year-End

Fiscal 2000 1999 1998 1997 1996

“C”and “B”Stores ................. 14 13 8 2 1

“A”Store................................. 17 16 10 5 3

Satellite Prototype Store........ 4 2 – – –

Stand-Alone New-Car Store... 5 – – – –

Total ...................................... 40 31 18 7 4

* CarMax opened two prototypical satellite stores in late fiscal 1999 and two prototypical satel-

lite stores in fiscal 2000. In addition to the four satellite prototype stores in operation, six “A,”“B”

or “C”stores have been converted to satellite operations.“C”stores represent the largest format. In

fiscal 2000, CarMax reclassified certain stores on the basis of square footage. Prior year informa-

tion has been reclassified to reflect this change.