CarMax 2000 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT 65

CARMAX GROUP

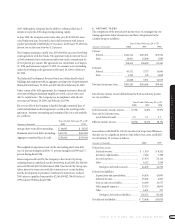

NEW-CAR FRANCHISES*

New-Car Franchises

Fiscal 2000 1999 1998 1997 1996

Integrated/Co-Located

New-Car Franchises........ 15 16 2 1 –

Stand-Alone New-Car

Franchises....................... 5 – – – –

Total New-Car Franchises..... 20 16 2 1 –

* In fiscal 2000, CarMax reclassified certain franchises as “co-located.”Prior period information

has been reclassified to reflect this change.

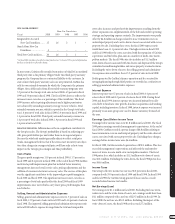

In most states,CarMax sells extended warranties on behalf of an unrelated

third party who is the primary obligor.Under this third-party warranty

program,the Company has no contractual liability to the customer. In

states where third-party warranty sales are not permitted,CarMax has

sold its own extended warranty for which the Company is the primary

obligor. Gross dollar sales from all extended warranty programs were

3.7 percent of the Group’s total sales in fiscal 2000,4.3 percent in fiscal

1999 and 3.8 percent in fiscal 1998. The fiscal 2000 decrease reflects the

increase in new-car sales as a percentage of the overall mix. The fiscal

1999 increase reflects pricing adjustments and a higher penetration

rate achieved by extending warranty coverage to more vehicles. Total

extended warranty revenue,which is reported in the Group’s total sales,

was 1.6 percent of total sales in fiscal 2000,2.0 percent in fiscal 1999 and

1.5 percent in fiscal 1998. Third-party extended warranty revenue was

1.6 percent of total sales in fiscal 2000,1.9 percent in fiscal 1999 and

1.4 percent in fiscal 1998.

IMPACT OF INFLATION. Inflation has not been a significant contributor to

the Group’s results. The Group’s profitability is based on achieving spe-

cific gross profit dollars per unit rather than on average retail prices.

Because the wholesale market generally adjusts to reflect retail price

trends,management believes that if the stores meet inventory turn objec-

tives then changes in average retail prices will have only a short-term

impact on the Group’s gross margin and thus profitability.

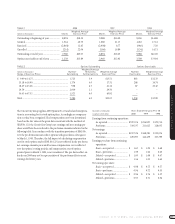

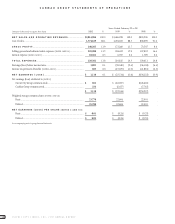

Cost of Sales

The gross profit margin was 11.9 percent in fiscal 2000,11.7 percent in

fiscal 1999 and 8.4 percent in fiscal 1998. At the end of fiscal 1998, CarMax

instituted a profit improvement plan that included better inventory

management,increased retail service sales,pricing adjustments and the

addition of consumer electronic accessory sales. The success of this plan

was the significant contributor to the improved gross profit margins in

fiscal 2000 and fiscal 1999. The significant increase in new-car sales as

a percentage of total sales partly offset the fiscal 2000 and fiscal 1999

improvements since new vehicles carry lower gross profit margins than

used vehicles.

Selling, General and Administrative Expenses

Selling, general and administrative expenses were 11.3 percent of sales in

fiscal 2000, 13.9 percent of sales in fiscal 1999 and 14.6 percent of sales in

fiscal 1998. The improved selling,general and administrative expense ratio

in fiscal 2000 reflects expense leverage from the total and comparable

store sales increases and productivity improvements resulting from the

slower expansion rate,implementation of the hub and satellite operating

strategy,and operating expense controls. The improvements were partly

offset by $4.8 million in charges related to lease termination costs on

undeveloped property and a write-down of assets associated with excess

property for sale. Excluding these costs,the fiscal 2000 expense ratio

would have been 11.1 percent of sales. The higher ratios in fiscal 1999

and fiscal 1998 reflect the costs associated with the expansion of CarMax

superstores and the below-plan sales in a number of multi-store metro-

politan markets. The fiscal 1998 ratio also includes an $11.5 million

write-down of assets associated with the closure and disposal of the Group’s

centralized reconditioning facilities and excess property at some locations.

Excluding the write-down of assets,the selling,general and administra-

tive expense ratio would have been 13.3 percent of sales in fiscal 1998.

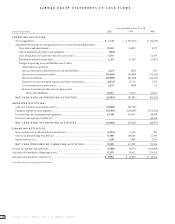

Profits generated by CarMax’s finance operation and fees received for

arranging financing through third parties are recorded as a reduction to

selling,general and administrative expenses.

Interest Expense

Interest expense was 0.5 percent of sales in fiscal 2000, 0.4 percent of

sales in fiscal 1999 and 0.2 percent of sales in fiscal 1998. During fiscal

2000 and fiscal 1999,interest expense was incurred primarily on allo-

cated debt to fund new store growth,franchise acquisitions and working

capital, including inventory. In fiscal 1998,interest expense was incurred

primarily on an inter-group note used to finance inventory for much of

the year.

Earnings (Loss) Before Income Taxes

Earnings before income taxes were $1.8 million in fiscal 2000. The fiscal

2000 pretax earnings exceeded management’s expectations. At the end of

fiscal 2000, CarMax recorded a pretax charge of $4.8 million relating to

lease termination costs on undeveloped property and the write-down of

assets associated with excess property for sale. Excluding these charges,

earnings before income taxes were $6.6 million.

For fiscal 1999,CarMax recorded a pretax loss of $38.5 million. This loss

exceeded management’s expectations and reflected the underperfor-

mance of stores in some multi-store metropolitan markets. The fiscal

1998 pretax loss,which includes an $11.5 million write-down of assets,

was $56.1 million. Excluding the write-down,the fiscal 1998 pretax loss

was $44.6 million.

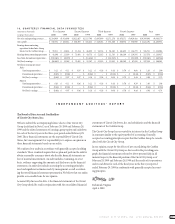

Income Taxes

The Group’s effective income tax rate was 38.0 percent in fiscal 2000,

compared with 39.0 percent in fiscal 1999 and fiscal 1998. In fiscal 1999

and fiscal 1998,the CarMax Group generated losses and as a result

recorded related income tax benefits.

Net Earnings (Loss)

Net earnings were $1.1 million in fiscal 2000. Excluding the lease termi-

nation costs and the write-down of assets, net earnings would have been

$4.1 million compared with a net loss of $23.5 million in fiscal 1999. In

fiscal 1998, the net loss was $34.2 million. Excluding the impact of the

write-down of assets,the fiscal 1998 net loss was $27.2 million.