CarMax 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

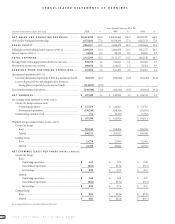

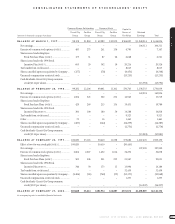

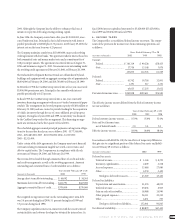

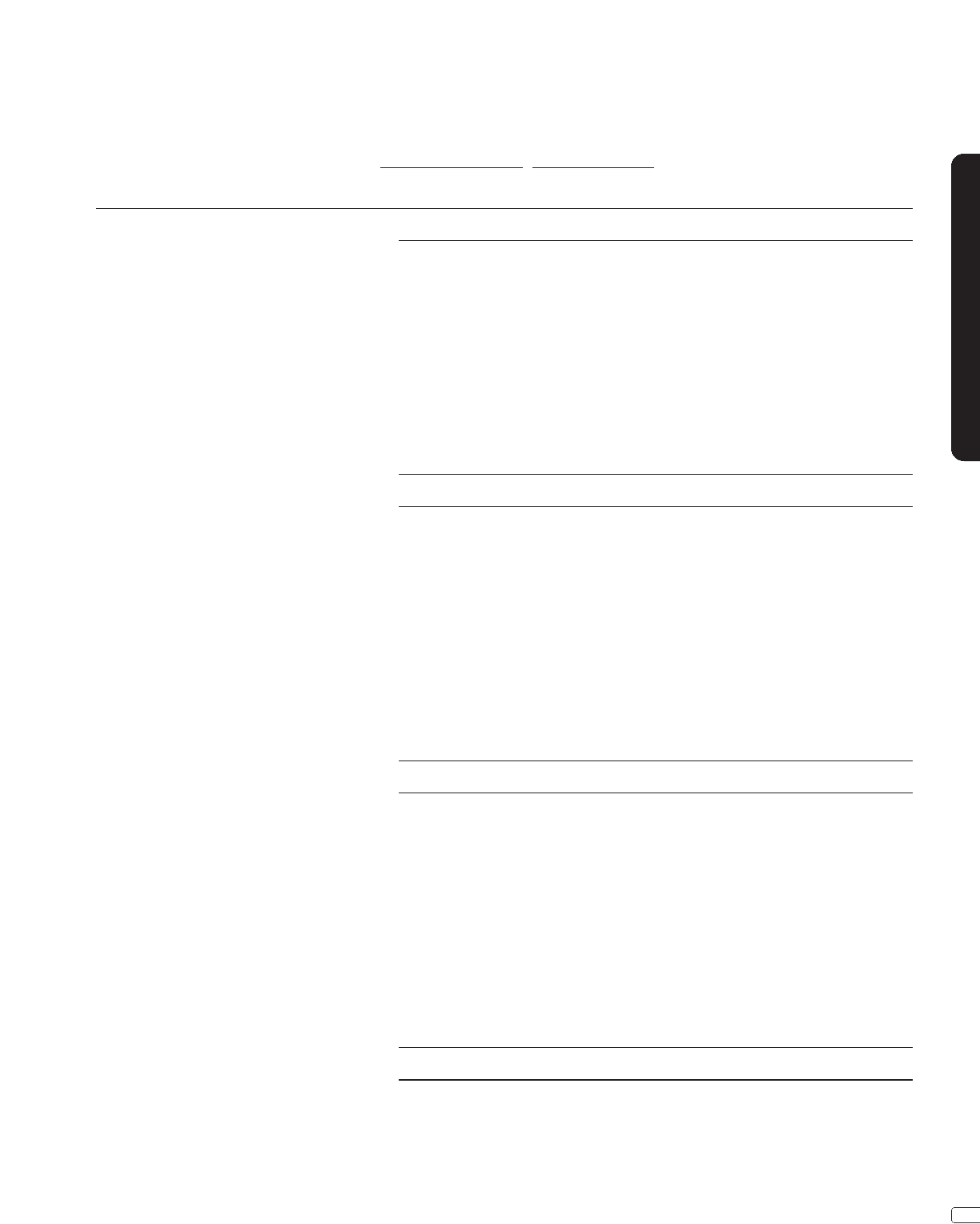

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT 33

CIRCUIT CITY STORES, INC.

Common Shares Outstanding Common Stock Capital In

Circuit City CarMax Circuit City CarMax Excess of Retained

(Amounts in thousands except per share data) Group Group Group Group Par Value Earnings Total

BALANCE AT MARCH 1, 1997..................... 98,178 21,860 $ 49,089 $10,930 $506,823 $ 1,048,014 $ 1,614,856

Net earnings.............................................................. – – – – – 104,311 104,311

Exercise of common stock options [NOTE 7].............. 483 273 241 136 6,790 – 7,167

Shares issued under Employee

Stock Purchase Plans [NOTE 7]............................. 173 51 87 26 6,648 – 6,761

Shares issued under the 1994 Stock

Incentive Plan [NOTE 7] ........................................ 605 20 302 10 20,214 – 20,526

Tax benefit from stock issued................................... – – – – 8,013 – 8,013

Shares cancelled upon reacquisition by Company ... (157) – (78) – (4,470) – (4,548)

Unearned compensation-restricted stock................ – – – – (13,255) – (13,255)

Cash dividends-Circuit City Group common

stock ($0.14 per share)........................................ – – – – – (13,792) (13,792)

BALANCE AT FEBRUARY 28, 1998......... 99,282 22,204 49,641 11,102 530,763 1,138,533 1,730,039

Net earnings.............................................................. – – – – – 142,924 142,924

Exercise of common stock options [NOTE 7].............. 1,004 543 502 272 16,945 – 17,719

Shares issued under Employee

Stock Purchase Plans [NOTE 7]............................. 429 269 215 134 19,431 – 19,780

Shares issued under the 1994 Stock

Incentive Plan [NOTE 7]........................................ 360 100 180 50 14,588 – 14,818

Tax benefit from stock issued................................... – – – – 9,523 – 9,523

Other......................................................................... 32 – 16 – 1,445 – 1,461

Shares cancelled upon reacquisition by Company ... (287) – (144) – (14,239) – (14,383)

Unearned compensation-restricted stock................ – – – – (2,770) – (2,770)

Cash dividends-Circuit City Group common

stock ($0.14 per share)........................................ – – – – – (13,981) (13,981)

BALANCE AT FEBRUARY 28, 1999......... 100,820 23,116 50,410 11,558 575,686 1,267,476 1,905,130

Effect of two-for-one stock split [NOTE 1] .................. 100,820 – 50,410 – (50,410) – –

Net earnings.............................................................. – – – – – 197,590 197,590

Exercise of common stock options [NOTE 7].............. 2,864 2,027 1,432 1,014 34,232 – 36,678

Shares issued under Employee

Stock Purchase Plans [NOTE 7] ............................. 502 506 251 253 21,547 – 22,051

Shares issued under the 1994 Stock

Incentive Plan [NOTE 7]........................................ 346 30 173 15 13,996 – 14,184

Tax benefit from stock issued................................... – – – – 32,459 – 32,459

Shares cancelled upon reacquisition by Company.... (1,484) (65) (742) (33) (52,173) – (52,948)

Unearned compensation-restricted stock................ – – – – 1,237 – 1,237

Cash dividends-Circuit City Group common

stock ($0.07 per share)........................................ – – – – – (14,207) (14,207)

BALANCE AT FEBRUARY 29, 2000............ 203,868 25,614 $101,934 $12,807 $576,574 $1,450,859 $2,142,174

See accompanying notes to consolidated financial statements.