CarMax 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

26

Operations Outlook

For the Circuit City business,management expects that industry growth,

primarily driven by the introduction of better-featured products and

new technologies,will be the primary contributor to sales and earnings

growth during the coming decade. Management anticipates that growth

in the household penetration of products and services such as digital

television,direct broadcast satellite systems,wireless communications,

digital camcorders,DVD players,multi-function set-top boxes and broad-

band Internet access will contribute significantly to overall sales and

earnings growth.

In fiscal 2001,the Circuit City Group will build on initiatives begun

in fiscal 2000. The planned 25 new Superstores and all 571 existing

Superstores will feature new displays designed to highlight the latest

advances in technology. The Circuit City Group also will remodel 30 to

35 stores in the Richmond,Va.,and the Miami,West Palm Beach,Tampa,

Fort Myers and Orlando, Fla., markets. These remodeled Superstores will

allow management to test a concept dedicated to consumer electronics

and home office products. Superstores opened after the first fiscal quarter

also will be dedicated to consumer electronics and home office products.

In the remodel markets,Circuit City will test approximately six stand-

alone major appliance stores to create better selling space for the new

technologies in the appliance business and to increase consumer aware-

ness of Circuit City’s appliance offering. Management anticipates that the

industry’s growth, geographic expansion of Circuit City’s Superstore con-

cept,Superstore remodeling and continued strong operating controls will

enable the Circuit City business to generate earnings growth of 20 percent

to 25 percent in fiscal 2001.

In fiscal 2001,CarMax’s management will continue to focus on revenue

growth and operating margin enhancement in existing CarMax markets.

Management will concentrate on the hub and satellite operating strategy for

its used-car superstores and seek new-car franchises to integrate or co-

locate with used-car superstores. Management anticipates that in fiscal

2001 and beyond new stores will be smaller “A”stores or satellite locations.

Management believes that continued sales and profit improvement in

the Group’s existing markets will result in solid profitability in fiscal

2001 and allow the Group to resume moderate and profitable geographic

growth thereafter.

RECENT ACCOUNTING PRONOUNCEMENTS

In June 1998,the Financial Accounting Standards Board issued Statement

of Financial Accounting Standards No. 133,“Accounting for Derivative

Instruments and Hedging Activities.”SFAS No. 133, as amended by SFAS

No.137,is effective for quarters for fiscal years beginning after June 15,

2000. SFAS No.133 standardizes the accounting for derivative instruments,

including certain derivative instruments embedded in other contracts,

and requires that an entity recognize those items as either assets or liabil-

ities and measure them at fair value. The Company does not expect SFAS

No.133 to have a material impact on its financial position,results of oper-

ations or cash flows.

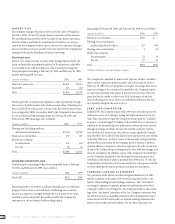

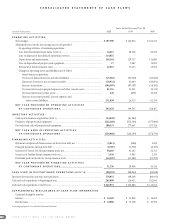

FINANCIAL CONDITION

Liquidity and Capital Resources

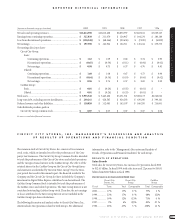

In fiscal 2000,net cash provided by operating activities of continuing

operations was $593.5 million compared with $309.5 million in fiscal

1999 and $228.2 million in fiscal 1998. The fiscal 2000 increase primarily

reflects increased earnings from the Circuit City and CarMax businesses

and increases in accounts payable for both Groups,partly offset by

increases in inventory for both Groups. The fiscal 1999 increase primarily

reflects a decrease in net accounts receivable and higher earnings for the

Circuit City business,partly offset by increased inventory for both Circuit

City and CarMax.

Most financial activities,including the investment of surplus cash and the

issuance and repayment of short-term and long-term debt,are managed

by the Company on a centralized basis. Interest-bearing loans,with terms

determined by the board of directors,are used to manage cash between

the Groups. These loans are reflected as inter-group receivables or

payables on the financial statements of each Group.

During fiscal 2000, a term loan totaling $175 million and due in

May 2000 was classified as a current liability. Although the Company

has the ability to refinance this loan,it intends to repay the debt using

existing working capital.

Capital expenditures have been funded through sale-leaseback transac-

tions,landlord reimbursements,proceeds from the February 1997 CarMax

Group equity offering and short- and long-term debt. Capital expenditures

of $222.3 million in fiscal 2000 reflect construction for Circuit City and

CarMax stores opened or remodeled during the year and a portion of the

stores opening in fiscal 2001. The sale-leaseback and landlord reimburse-

ment transactions in fiscal 2000 totaled $100.2 million.

Capital expenditures of $352.4 million in fiscal 1999 and $575.9 million

in fiscal 1998 were largely incurred in connection with the Company’s

expansion programs. Sale-leaseback and landlord reimbursement trans-

actions were $273.6 million in fiscal 1999 and $297.1 million in fiscal 1998.

During fiscal 2000,the CarMax Group acquired the Chrysler-Plymouth-Jeep

franchise rights and the related assets of Prince Chrysler-Plymouth-Jeep

Company and the franchise rights and the related assets of LAX Dodge,Inc.

in the Los Angeles market; the Jeep franchise rights and the related assets

of Red Bird Jeep-Eagle and the franchise rights of Hilltop Chrysler-

Plymouth,Inc.in the Dallas market; the franchise rights and related

assets of Fairway Chrysler-Plymouth-Jeep,Inc.in the Orlando market;

and the Nissan franchise rights and related assets of Town & Country

Pontiac Nissan,Inc.in the Washington D.C./Baltimore market for a total

of $34.8 million. These acquisitions were financed through cash resources.

Costs in excess of the acquired net tangible assets,which are primarily

inventory,have been recorded as goodwill and covenants not to compete.

During fiscal 1999,the CarMax Group acquired the Toyota franchise rights

and the related assets of Laurel Automotive Group,Inc.in the Washington

D.C./Baltimore market; the franchise rights and the related assets of

Mauro Auto Mall, Inc.in the Chicago market; the franchise rights and the

related assets of Nissan of Greenville,Inc.in the Greenville,S.C.,market;

and the Mitsubishi franchise rights and the related assets of Boomershine