CarMax 2000 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

60

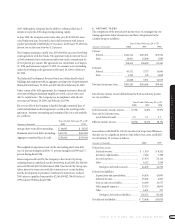

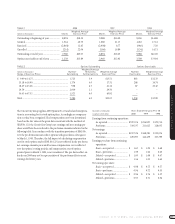

For the purpose of computing the pro forma amounts indicated,the fair

value of each option on the date of grant is estimated using the Black-

Scholes option-pricing model. The weighted average assumptions used

in the model are as follows:

2000 1999 1998

Expected dividend yield ............................ 0.2% 0.4% 0.4%

Expected stock volatility............................ 38% 33% 33%

Risk-free interest rates............................... 6% 6% 6%

Expected lives (in years)............................ 5 5 4

Using these assumptions in the Black-Scholes model,the weighted aver-

age fair value of options granted for the Circuit City Group is $17 in fiscal

2000,$8 in fiscal 1999 and $7 in fiscal 1998.

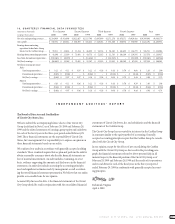

8. EARNINGS PER SHARE

Reconciliations of the numerator and denominator of basic and diluted

earnings per share from continuing operations are presented below.

(Amounts in thousands Years Ended February 29 or 28

except per share data) 2000 1999 1998

Weighted average common shares.... 201,345 198,304 196,054

Dilutive potential common shares:

Options........................................ 2,145 1,700 1,684

Restricted stock........................... 831 808 670

Weighted average common shares

and dilutive potential

common shares ........................... 204,321 200,812 198,408

Earnings from continuing operations

available to common

shareholders................................ $327,574 $216,927 $132,710

Basic earnings per share from

from continuing operations ........ $ 1.63 $ 1.09 $ 0.68

Diluted earnings per share from

continuing operations................. $ 1.60 $ 1.08 $ 0.67

Certain options were not included in the computation of diluted earnings

per share because the options’exercise prices were greater than the average

market price of the common shares. Options to purchase 2,900 shares of

Circuit City Group Stock ranging from $43.03 to $47.53 per share were

outstanding and not included in the calculation at the end of fiscal 2000;

2,000,000 shares at $29.50 per share at the end of fiscal 1999; and 3,020,000

shares ranging from $17.74 to $29.50 per share at the end of fiscal 1998.

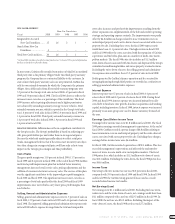

9. PENSION PLAN

The Company has a noncontributory defined benefit pension plan covering

the majority of full-time employees who are at least age 21 and have com-

pleted one year of service. The cost of the program is being funded

currently. Plan benefits generally are based on years of service and average

compensation. Plan assets consist primarily of equity securities and

included 160,000 shares of Circuit City Stock at February 29,2000,and

February 28,1999.

Eligible employees of the Circuit City Group participate in the Company’s

plan. Pension costs for these employees have been allocated to the Circuit

City Group based on its proportionate share of the projected benefit obli-

gation. The following tables set forth the Circuit City Group’s share of the

Plan’s financial status and amounts recognized in the balance sheets as of

February 29 or 28:

(Amounts in thousands) 2000 1999

Change in benefit obligation:

Benefit obligation at beginning of year................. $110,001 $ 88,166

Service cost............................................................ 13,428 10,479

Interest cost........................................................... 7,384 6,135

Actuarial (gain) loss.............................................. (17,325) 8,511

Benefits paid.......................................................... (4,151) (3,290)

Benefit obligation at end of year............................ $109,337 $110,001

Change in plan assets:

Fair value of plan assets at beginning of year ....... $ 94,125 $ 83,009

Actual return on plan assets.................................. 13,568 4,342

Employer contributions......................................... 11,498 10,064

Benefits paid.......................................................... (4,151) (3,290)

Fair value of plan assets at end of year.................. $115,040 $ 94,125

Reconciliation of funded status:

Funded status........................................................ $ 5,703 $(15,876)

Unrecognized actuarial (gain) loss ....................... (13,326) 8,657

Unrecognized transition asset............................... (398) (598)

Unrecognized prior service benefit....................... (421) (552)

Net amount recognized ......................................... $ (8,442) $ (8,369)

The components of net pension expense are as follows:

Years Ended February 29 or 28

(Amounts in thousands) 2000 1999 1998

Service cost ............................................. $13,428 $10,479 $ 8,365

Interest cost............................................. 7,384 6,135 5,221

Expected return on plan assets............... (8,919) (7,675) (5,060)

Amortization of prior service cost.......... (199) (104) (104)

Amortization of transitional asset.......... (132) (199) (199)

Recognized actuarial loss........................ 10 – –

Net pension expense ............................... $11,572 $ 8,636 $ 8,223

Assumptions used in the accounting for the pension plan were:

Years Ended February 29 or 28

2000 1999 1998

Weighted average discount rate ................. 8.0% 6.8% 7.0%

Rate of increase in compensation levels .... 6.0% 5.0% 5.0%

Expected rate of return on plan assets ...... 9.0% 9.0% 9.0%