CarMax 2000 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT 29

CIRCUIT CITY STORES, INC.

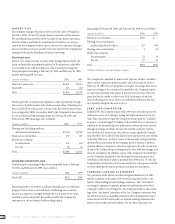

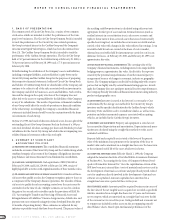

Company’s actual results to differ materially from management’s projec-

tions,forecasts, estimates and expectations include,but are not limited to,

the following:

(a) changes in the amount and degree of promotional intensity exerted by

current competitors and potential new competition from both retail

stores and alternative methods or channels of distribution such as online

and telephone shopping services and mail order;

(b) changes in general U.S. or regional U.S. economic conditions includ-

ing,but not limited to,consumer credit availability,consumer credit

delinquency and default rates,interest rates,inflation,personal discre-

tionary spending levels and consumer sentiment about the economy in

general;

(c) the presence or absence of,or consumer acceptance of,new products

or product features in the merchandise categories the Company sells and

changes in the Company’s actual merchandise sales mix;

(d) significant changes in retail prices for products sold by any of the

Company’s businesses,including changes in prices for new and used cars

and the relative consumer demand for new or used cars;

(e) lack of availability or access to sources of supply for appropriate

Circuit City or CarMax inventory;

(f) the ability to retain and grow an effective management team in a

dynamic environment or changes in the cost or availability of a suitable

work force to manage and support the Company’s service-driven operat-

ing strategies;

(g) changes in availability or cost of capital expenditure and working cap-

ital financing,including the availability of long-term financing to support

development of the Company’s businesses and the availability of securiti-

zation financing for credit card and automobile installment loan receivables;

(h) changes in production or distribution costs or cost of materials for the

Company’s advertising;

(i) availability of appropriate real estate locations for expansion;

(j) the imposition of new restrictions or regulations regarding the sale of

products and/or services the Company sells,changes in tax rules and reg-

ulations applicable to the Company or its competitors,the imposition of

new environmental restrictions,regulations or laws or the discovery of

environmental conditions at current or future locations or any failure to

comply with such laws or any adverse change in such laws;

(k) adverse results in significant litigation matters;

(l) changes in levels of competition in the car business from either tradi-

tional competitors and/or new nontraditional competitors utilizing auto

superstore or other formats;

(m) the inability of the CarMax business to reach expected mature sales

and earnings potential; and

(n) limited or lack of availability of new-car franchises within a suitable

radius of existing and proposed CarMax stores or limited manufacturer

approval of franchise acquisitions.

The United States retail industry and the specialty retail industry in partic-

ular are dynamic by nature and have undergone significant changes over

the past several years. The Company’s ability to anticipate and success-

fully respond to continuing challenges is key to achieving its expectations.

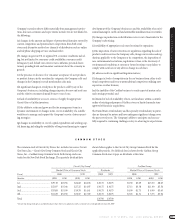

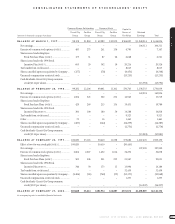

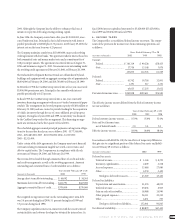

Circuit City Group* CarMax Group

Market Price of Common Stock Dividends Market Price of Common Stock

Fiscal 2000 1999 2000 1999 2000 1999

Quarter HIGH LOW HIGH LOW HIGH LOW HIGH LOW

1st ................................................. $39.19 $25.94 $24.82 $18.78 $.0175 $.0175 $5.50 $3.69 $13.50 $8.63

2nd................................................ $52.97 $35.44 $27.25 $14.97 $.0175 $.0175 $7.13 $3.38 $11.00 $5.56

3rd................................................. $53.88 $35.00 $19.78 $14.41 $.0175 $.0175 $4.00 $1.75 $ 8.00 $3.63

4th................................................. $51.69 $32.50 $32.07 $17.69 $.0175 $.0175 $3.25 $1.31 $ 5.75 $3.94

Total $.0700 $.0700

*Circuit City Group stock prices and dividends per share have been adjusted to reflect a two-for-one stock split effective June 30, 1999.

The common stock of Circuit City Stores,Inc.includes two series: Circuit

City Stores,Inc.

—

Circuit City Group Common Stock and Circuit City

Stores,Inc.

—

CarMax Group Common Stock. Both Group stocks are

traded on the New York Stock Exchange. The quarterly dividend data

shown below applies to the Circuit City Group Common Stock for the

applicable periods. No dividend data is shown for the CarMax Group

Common Stock since it pays no dividends at this time.

COMMON STOCK