CarMax 2000 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT 41

CIRCUIT CITY STORES, INC.

included in the calculation at the end of fiscal 2000. Prior to fiscal 2000,

dilutive potential common shares of CarMax Group Stock were not

included in the calculation of diluted net loss per share because the Group

had a net loss for those periods.

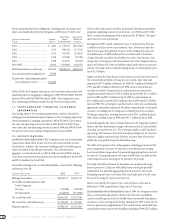

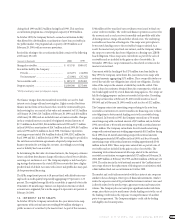

9. PENSION PLAN

The Company has a noncontributory defined benefit pension plan cover-

ing the majority of full-time employees who are at least age 21 and have

completed one year of service. The cost of the program is being funded

currently. Plan benefits generally are based on years of service and aver-

age compensation. Plan assets consist primarily of equity securities and

included 160,000 shares of Circuit City Group Stock at February 29, 2000,

and February 28, 1999. Contributions required were $12,123,000 in fiscal

2000,$10,306,000 in fiscal 1999 and $11,642,000 in fiscal 1998. The fol-

lowing tables set forth the Plan’s financial status and amounts recognized

in the consolidated balance sheets as of February 29 or 28:

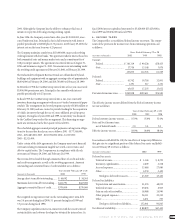

(Amounts in thousands) 2000 1999

Change in benefit obligation:

Benefit obligation at beginning of year................. $112,566 $89,124

Service cost............................................................ 14,678 11,004

Interest cost........................................................... 7,557 6,202

Actuarial (gain) loss.............................................. (16,870) 9,526

Benefits paid.......................................................... (4,151) (3,290)

Benefit obligation at end of year............................ $113,780 $112,566

Change in plan assets:

Fair value of plan assets at beginning of year ....... $ 95,678 $ 84,251

Actual return on plan assets.................................. 13,827 4,411

Employer contributions......................................... 12,123 10,306

Benefits paid.......................................................... (4,151) (3,290)

Fair value of plan assets at end of year.................. $117,477 $ 95,678

Reconciliation of funded status:

Funded status........................................................ $ 3,697 $(16,888)

Unrecognized actuarial (gain) loss ....................... (11,986) 9,720

Unrecognized transition asset............................... (404) (606)

Unrecognized prior service benefit....................... (427) (560)

Net amount recognized ......................................... $ (9,120) $ (8,334)

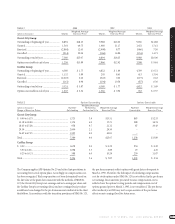

The components of net pension expense are as follows:

Years Ended February 29 or 28

(Amounts in thousands) 2000 1999 1998

Service cost ............................................. $14,678 $11,004 $ 8,584

Interest cost............................................. 7,557 6,202 5,260

Expected return on plan assets............... (9,078) (7,794) (5,133)

Amortization of prior service cost.......... (202) (105) (105)

Amortization of transitional asset.......... (134) (202) (202)

Recognized actuarial loss........................ 87 – 17

Net pension expense ............................... $12,908 $ 9,105 $ 8,421

Assumptions used in the accounting for the pension plan were:

Years Ended February 29 or 28

2000 1999 1998

Weighted average discount rate.................. 8.0% 6.8% 7.0%

Rate of increase in compensation levels..... 6.0% 5.0% 5.0%

Expected rate of return on plan assets....... 9.0% 9.0% 9.0%

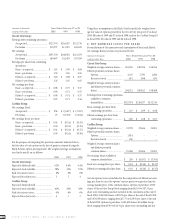

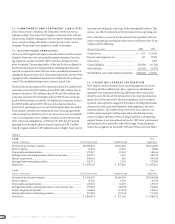

10. LEASE COMMITMENTS

The Company conducts a substantial portion of its business in leased

premises. The Company’s lease obligations are based upon contractual

minimum rates. For certain locations,amounts in excess of these mini-

mum rates are payable based upon specified percentages of sales. Rental

expense and sublease income for all operating leases are summarized

as follows:

Years Ended February 29 or 28

(Amounts in thousands) 2000 1999 1998

Minimum rentals.............................. $322,598 $296,706 $248,383

Rentals based on sales volume.......... 1,327 1,247 730

Sublease income................................ (16,425) (14,857) (12,879)

Net..................................................... $307,500 $283,096 $236,234

The Company computes rent based on a percentage of sales volumes in

excess of defined amounts in certain store locations. Most of the Com-

pany’s other leases are fixed-dollar rental commitments, with many con-

taining rent escalations based on the Consumer Price Index. Most provide

that the Company pay taxes,maintenance,insurance and certain other

operating expenses applicable to the premises.

The initial term of most real property leases will expire within the next 22

years; however, most of the leases have options providing for additional

lease terms of five years to 25 years at terms similar to the initial terms.