CarMax 2000 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

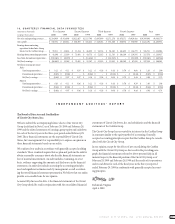

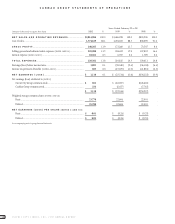

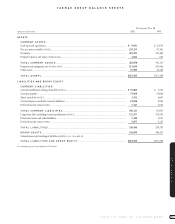

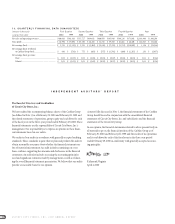

NOTES TO CARMAX GROUP FINANCIAL STATEMENTS

CIRCUIT CITY STORES, INC. 2000 ANNUAL REPORT

72

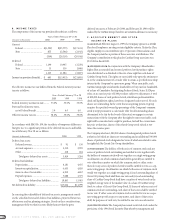

1. BASIS OF PRESENTATION

The common stock of Circuit City Stores,Inc.consists of two common

stock series,which are intended to reflect the performance of the Com-

pany’s two businesses. The Circuit City Group Common Stock is intended

to track the performance of the Circuit City store-related operations,the

Group’s retained interest in the CarMax Group and the Company’s invest-

ment in Digital Video Express,which has been discontinued. The effects

of this retained interest on the Circuit City Group’s financial statements

are identified by the term “Inter-Group.”The CarMax Group Common

Stock is intended to track the performance of the CarMax Group’s opera-

tions. The Inter-Group Interest is not considered outstanding CarMax

Group Stock. Therefore,any net earnings or loss attributed to the Inter-

Group Interest is not included in the CarMax Group’s per share calcula-

tions. The Circuit City Group held a 74.7 percent interest in the CarMax

Group at February 29,2000,76.6 percent interest at February 28, 1999,

and a 77.3 percent interest at February 28, 1998.

Notwithstanding the attribution of the Company’s assets and liabilities,

including contingent liabilities,and stockholders’equity between the

CarMax Group and the Circuit City Group for the purposes of preparing

their respective financial statements,holders of CarMax Group Stock and

holders of Circuit City Group Stock are shareholders of the Company and

continue to be subject to all of the risks associated with an investment in

the Company and all of its businesses,assets and liabilities. Such attribu-

tion and the change in the equity structure of the Company does not

affect title to the assets or responsibility for the liabilities of the Company

or any of its subsidiaries. The results of operations or financial condition

of one Group could affect the results of operations or financial condition of

the other Group. Accordingly, the CarMax Group financial statements

included herein should be read in conjunction with the Company’s consoli-

dated financial statements and the Circuit City Group financial statements.

2. SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

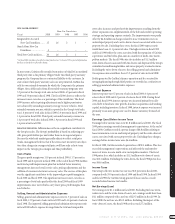

(A) CASH AND CASH EQUIVALENTS: Allocated cash equivalents of $1,770,000

at February 29, 2000, and $14,750,000 at February 28,1999,consist of

highly liquid debt securities with original maturities of three months or less.

(B) TRANSFERS AND SERVICING OF FINANCIAL ASSETS: For transfers of finan-

cial assets that qualify as sales, the Company recognizes gains or losses as

a component of the Company’s finance operations. For transfers of finan-

cial assets to qualify for sale accounting, control over the assets must be

surrendered at the time of sale. Multiple estimates are used to calculate

the gain or loss on sales of receivables under the provisions of SFAS No.

125,“Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities.”Finance charge income,default rates and

payment rates are estimated using projections developed from the prior

12 months of operating history. These estimates are adjusted for any

industry or portfolio trends that have been observed. The present value

of the resulting cash flow projections is calculated using a discount rate

appropriate for the type of asset and risk. Retained interests (such as

residual interests in a securitization trust,cash reserve accounts and

rights to future interest from serviced assets that exceed contractually

specified servicing fees) are included in net accounts receivable and are

carried at fair value with changes in fair value reflected in earnings. Loan

receivables held for sale are carried at the lower of cost or market,

whereas loan receivables held for investment are carried at cost less an

allowance for losses. At February 29,2000,and February 28, 1999, cost

approximates fair value.

(C) FAIR VALUE OF FINANCIAL INSTRUMENTS: The Company enters into finan-

cial instruments on behalf of the CarMax Group. The carrying value of

the CarMax Group’s financial instruments approximates fair value. Credit

risk is the exposure to the potential nonperformance of another material

party to an agreement because of changes in economic, industry or geo-

graphic factors and is mitigated by dealing only with counterparties that

are highly rated by several financial rating agencies. Accordingly, the

CarMax Group does not anticipate material loss for nonperformance.

All financial instruments are broadly diversified along industry, product

and geographic areas.

(D) INVENTORY: Inventory is stated at the lower of cost or market. Vehicle

inventory cost is determined by specific identification. Parts and labor used

to recondition vehicles,as well as transportation and other incremental

expenses associated with acquiring vehicles,are included in inventory.

(E) PROPERTY AND EQUIPMENT: Property and equipment is stated at cost

less accumulated depreciation. Depreciation is calculated using the

straight-line method over the assets’ estimated useful lives.

(F) COMPUTER SOFTWARE COSTS: Effective March 1,1998,the Company

adopted the American Institute of Certified Public Accountants Statement

of Position 98-1,“Accounting for the Costs of Computer Software Devel-

oped or Obtained for Internal Use.”Once the capitalization criteria of the

SOP have been met,external direct costs of materials and services used in

the development of internal-use software and payroll and payroll-related

costs for employees directly involved in the development of internal-use

software are capitalized. Amounts capitalized are amortized on a

straight-line basis over a period of three to five years.

(G) INTANGIBLE ASSETS: Amounts paid for acquired businesses in excess of

the fair value of the net tangible assets acquired are recorded as goodwill,

which is amortized on a straight-line basis over 15 years,and covenants

not to compete,which are amortized on a straight-line basis over the life

of the covenant not to exceed five years. Both goodwill and covenants not

to compete are included in other assets on the accompanying CarMax

Group balance sheets. Based upon the financial performance of the

acquired businesses,the carrying values of intangible assets are periodi-

cally reviewed by the Company and impairments are recognized when the

expected future undiscounted operating cash flows derived from such

intangible assets are less than the carrying values.

(H) PRE-OPENING EXPENSES: Effective March 1,1999,the Company adopted

SOP 98-5,“Reporting on the Costs of Start-Up Activities.”SOP 98-5

requires costs of start-up activities, including organization and pre-

opening costs, to be expensed as incurred. Adoption of SOP 98-5 did not

have a material impact on the Group’s financial position,annual results

of operation or liquidity. Prior to fiscal 2000,the Company capitalized

pre-opening costs for new store locations. Beginning in the month after

the store opened for business,the pre-opening costs were amortized over

the remainder of the fiscal year.