CarMax 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. ANNUAL REPORT 2000

MAKING IT EASIER.

Circuit City

Table of contents

-

Page 1

C I R C U I T C I T Y S T O R E S , I N C . A N N U A L R E P O R T 2 0 0 0 Circuit City MAKING IT EASIER. -

Page 2

...offer that delivers low, no-haggle prices, a broad selection and high-quality customer service. At the end of ï¬scal year 2000, CarMax operated 40 locations, including 34 used-car superstores and 20 new-car franchises. IN THIS REPORT, WE USE THE FOLLOWING TERMS AND DEFINITIONS: Circuit City Stores... -

Page 3

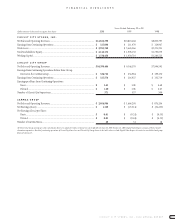

... in thousands except per share data) CIRCUIT CITY STORES, INC. 2000 Years Ended February 29 or 28 1999 1998 Net Sales and Operating Revenues ...Earnings from Continuing Operations...Total Assets ...Total Stockholders' Equity...Working Capital...CIRCUIT CITY GROUP $12,614,390 $ 327,830 $ 3,955... -

Page 4

... Internet. We also enhanced our Superstore design to help ensure that we are maximizing the sales opportunity in all areas, adding displays for digital televisions, digital imaging and broadband Internet access. In all stores opened during the fall, we signiï¬cantly expanded the number of products... -

Page 5

... opportunities of the Internet. At the end of ï¬scal 2000, we introduced a redesigned CarMax Web site that provides online access to all the vehicle information available at our stores. Consistent with our commitment to service, carmax.com offers dedicated Internet sales consultants for customers... -

Page 6

...Circuit City. A long history of sales training, a national store base and alliances with industry-leading vendors will help position us at the forefront of this cycle. W. ALAN MCCOLLOUGH Our company is entering an exciting period. At Circuit City, the focus is on the future. We are entering the new... -

Page 7

... in April, all sales counselors were able to access our Web store inventory from any point-of-sale terminal, and customers were able to conveniently access our site via our premiere position on AOL's Shop@ locations. While no one can be certain what industry Web sales may be, we are committed... -

Page 8

...locations in the industry. While the average new-car dealer sells 1,150 new and used vehicles per year, the average CarMax superstore sells more than 4,100 used vehicles alone per year. Our Laurel, Md., superstore produces the largest used-car sales volume in the nation, with used-car sales 20 times... -

Page 9

...offer ï¬rm prices on all new vehicles. In addition, we began testing alliances with popular online automotive sites that refer consumers to carmax.com. Our online buying service is staffed by dedicated Internet sales consultants, and by the end of the ï¬scal year, W. Austin Ligon President CarMax... -

Page 10

Making it easier to the benefits of new -

Page 11

... demonstrations and in-store informational displays help explain the amazing products and services emerging in today's exciting environment of digital advances. And, we are offering consumers new ways to shop, with an expanded assortment of self-service products in many stores and a Web site that is... -

Page 12

... embracing the high quality and flexibility of digital camcorders. New video game platforms and digital audio recording products such as MP3 offer sales growth opportunities. Consumers can see the amazing picture quality of digital television at side-by-side displays. At Circuit City, consumers... -

Page 13

... number of Internet retailers. The competitive nature of the consumer electronics industry means Circuit City customers often ï¬nd store prices that are lower than prices on a variety of Web sites. Information. Given selection and attractive prices, the key to making shopping easier is making... -

Page 14

Portable memory devices such as Memory Stick allow today's products to offer ease of use in a compact size. New technology displays and increased self-service merchandise displays are features of our newest store design. Informative merchandise displays help consumers sort through complex choices.... -

Page 15

...our wireless communications, The key to making shopping easier is taking the mystery out of technology. Well-trained, knowledgeable sales counselors and hands-on product demonstrations help Circuit City customers understand and purchase the new technologies that are driving industry growth. digital... -

Page 16

...convenient Circuit City Superstore. Circuitcity.com tightly integrates cyber-shopping with our nationwide brick-and-mortar presence. In our test lab, consumers provide valuable input into the development of circuitcity.com. Superior customer service is the number one goal of Associates throughout... -

Page 17

...Web site provides the same commitment to selection, price, information and service found in Circuit City stores. Merchandise Selection. At the end of ï¬scal 2000, circuitcity.com offered more than 1,500 products for sale and information on more than 2,100 products. We continue to expand the product... -

Page 18

Making it easier at car-buying process. -

Page 19

...and friendly service-lets our sales consultants focus on the customer,not "the deal." And,these sales consultants help the customer throughout the transaction, extending our price commitment to trade-ins, ï¬nancing and warranties. Shopping for a car The CarMax Way is shopping for a car the consumer... -

Page 20

All CarMax customers receive low prices without having to negotiate. Browsing our extensive selection is easy with our customer-friendly online inventory system. The CarMax goal: make buying a car easy. 18 C I R C U I T C I T Y S T O R E S , I N C . 2 0 0 0 A N N U A L R E P O R T -

Page 21

... used cars, CarMax employs its low-price, no-haggle selling process with new cars. At all new-car locations, the full selection of the manufacturer's models is available. CarMax new-car franchises include Chrysler, Plymouth, inventory with the tastes of local purchasers. The same sales consultant... -

Page 22

....com, customers find comprehensive information and prices on each vehicle from the comfort of their home. The 10,000-vehicle inventory is updated daily. CarMax certifies the quality of each vehicle following a thorough inspection and reconditioning. CarMax Associates are setting a new industry... -

Page 23

... store to pick up the new vehicle. In the Los Angeles market, CarMax is testing free home delivery as part of this online service. Trafï¬c on carmax.com grew rapidly throughout the year, and by year end, 10 percent of all CarMax new-car transactions were completed by CarMax online sales consultants... -

Page 24

... $ 160 Cash dividends per share paid on Circuit City Group common stock...$ 0.07 Return on average stockholders' equity (%)...9.8 Number of Associates at year-end...60,083 Number of Circuit City retail units at year-end ...616 Number of CarMax retail units at year-end...40 $ 0.07 7.9 53,710 587 31... -

Page 25

... $10.81 billion from $8.87 billion in ï¬scal 1998. PERCENTAGE SALES CHANGE FROM PRIOR YEAR Circuit City Circuit City Stores, Inc. Group Fiscal Total Total Comparable CarMax Group Total Comparable 2000...1999...1998...1997...1996... 17% 22% 16% 9% 26% 13% 17% 12% 6% 23% 8)% 8)% (1)% (8)% 5)% 37... -

Page 26

... used-car superstore business. Management believes their exit from the Dallas/Fort Worth, Houston, San Antonio, Tampa and Miami markets, where the two companies competed, will help eliminate consumer confusion over the two offers and increase customer ï¬,ow for CarMax. In most states, CarMax sells... -

Page 27

... price environment partly offset by better inventory management and increased sales of better-featured products and, for the CarMax Group, the impact of the proï¬t improvement plan partly offset by the increase in new-car sales as a percentage of total sales. Selling, General and Administrative... -

Page 28

... Circuit City Group also will remodel 30 to 35 stores in the Richmond,Va., and the Miami,West Palm Beach, Tampa, Fort Myers and Orlando, Fla., markets. These remodeled Superstores will allow management to test a concept dedicated to consumer electronics and home ofï¬ce products. Superstores opened... -

Page 29

... and $370 million in committed seasonal lines that are renewed annually with various banks. The Groups rely on the external debt of Circuit City Stores, Inc. to provide working capital needed to fund net assets not otherwise ï¬nanced through sale-leasebacks or the securitization of receivables. All... -

Page 30

... on the accounts in the managed private-label and bank card portfolios are primarily indexed to the prime rate, adjustable on a monthly basis, with the balance at a ï¬xed annual percentage rate. Total principal outstanding at February 29, 2000, and February 28, 1999, had the following APR structure... -

Page 31

... series: Circuit City Stores, Inc.-Circuit City Group Common Stock and Circuit City Stores, Inc.-CarMax Group Common Stock. Both Group stocks are traded on the New York Stock Exchange. The quarterly dividend data Circuit City Group* Market Price of Common Stock Fiscal Quarter HIGH 2000 LOW HIGH 1999... -

Page 32

... income tax beneï¬t...Loss from discontinued operations ...N E T E A R N I N G S ... Net earnings (loss) attributed to [NOTES 1 AND 2]: Circuit City Group common stock: Continuing operations ...$ 327,574 Discontinued operations...(130,240) CarMax Group common stock ...256 $ Weighted average common... -

Page 33

...7]: 1,406,159 249,241 130,020 27,754 1,813,174 1,540,136 Circuit City Group common stock, $0.50 par value; 350,000,000 shares authorized; 203,868,000 shares issued and outstanding (100,820,000 in 1999) ...CarMax Group common stock, $0.50 par value; 175,000,000 shares authorized; 25,614,000 shares... -

Page 34

...734) (Payments on) proceeds from issuance of short-term debt, net ...Principal payments on long-term debt...Issuances of Circuit City Group common stock, net...Issuances of CarMax Group common stock, net...Dividends paid on Circuit City Group common stock...NET CASH PROVIDED BY FINANCING ACTIVITIES... -

Page 35

...issued under Employee Stock Purchase Plans [NOTE 7] ...Shares issued under the 1994 Stock Incentive Plan [NOTE 7] ...Tax beneï¬t from stock issued ...Shares cancelled upon reacquisition by Company ...Unearned compensation-restricted stock ...Cash dividends-Circuit City Group common stock ($0.14 per... -

Page 36

... along industry, product and geographic areas. (E) INVENTORY: Inventory is stated at the lower of cost or market. Cost is determined by the average cost method for the Circuit City Group's inventory and by speciï¬c identiï¬cation for the CarMax Group's vehicle inventory. Parts and labor used to... -

Page 37

... extended warranty plans is recognized at the time of sale, since the third parties are the primary obligors under these contracts. Basic net earnings (loss) per share for CarMax Group Stock is computed by dividing net earnings (loss) attributed to CarMax Group Stock by the weighted average number... -

Page 38

... results could differ from those estimates. (R) CORPORATE ALLOCATIONS: The Company manages corporate general and administrative costs and other shared services on a centralized basis. Allocations of these corporate activities and their related expenses to the Groups are based on methods that the... -

Page 39

... had a total program capacity of $160 million at February 29, 2000, and was created to provide funding for the acquisition of vehicle inventory through the use of a non-afï¬liated special-purpose company. During ï¬scal years 2000 and 1999, no inventory was ï¬nanced by the CarMax Group under this... -

Page 40

...a right to purchase, for half the current market price at that time, shares of the related Group stock valued at two times the exercise price. (D) RESTRICTED STOCK: The Company has issued restricted stock under the provisions of the 1994 Stock Incentive Plan whereby management and key employees are... -

Page 41

.... Had compensation cost been determined based on the fair value at the grant date consistent with the methods of SFAS No. 123, the Circuit City Group's net earnings and net earnings per share and the CarMax Group's net earnings (loss) and net earnings (loss) per share would have been changed to the... -

Page 42

... option-pricing model. The weighted average assumptions used in the model are as follows: 2000 1999 1998 25,788 256 0.01 0.01 22,604 22,001 Circuit City Group: Expected dividend yield ...0.2% Expected stock volatility...38% Risk-free interest rates...6% Expected lives (in years)...5 CarMax Group... -

Page 43

... PLAN The Company has a noncontributory deï¬ned beneï¬t pension plan covering the majority of full-time employees who are at least age 21 and have completed one year of service. The cost of the program is being funded currently. Plan beneï¬ts generally are based on years of service and average... -

Page 44

... of retained interests, the Company estimates future cash ï¬,ows from ï¬nance charge collections reduced by net defaults, servicing cost and interest cost. The Company employs a risk-based pricing strategy that increases the stated annual percentage rate for accounts that have a higher predicted... -

Page 45

...purpose company $539,000 $575,000 The ï¬nance charges from the transferred receivables are used to fund interest costs, charge-offs and servicing fees. Rights recorded for future ï¬nance income from serviced assets that exceed the contractually speciï¬ed servicing fees are carried at fair value... -

Page 46

... on June 16, 1999. Prior year ï¬nancial information has been adjusted to reï¬,ect this change. Financial information for these segments for ï¬scal 2000, 1999 and 1998 are shown in Table 3. Circuit City Group CarMax Group Total Segments Revenues from external customers ...$10,599,406 Interest... -

Page 47

... 2000 1999 Fourth Quarter 2000 1999 Year 2000 1999 Net sales and operating revenues ...Gross proï¬t...Net earnings (loss) attributed to: Circuit City Group Stock: Continuing operations ...Discontinued operations...CarMax Group Stock ...Net earnings (loss) per share: Circuit City Group Stock... -

Page 48

...to the customer. In states where third-party warranty sales are not permitted, the Group sells a Circuit City extended warranty for which the Company is the primary obligor. Gross dollar sales from all extended warranty programs were 5.4 percent of the Group's total sales in ï¬scal 2000 and ï¬scal... -

Page 49

... on allocated debt used to fund store expansion and working capital. Income Taxes STORE MIX. In ï¬scal 2000, the Group opened 38 Superstores. The openings The Group classiï¬es its Circuit City Superstores into four categories based on square footage. At the end of ï¬scal 2000, selling space for... -

Page 50

... States. In ï¬scal 2001, the Group will continue to expand its Superstore concept into new trade areas, adding approximately 25 stores that are either new-market entries or ï¬ll-in locations in existing Circuit City markets. Management anticipates that the industry's growth, geographic expansion... -

Page 51

... on the accounts in the managed private-label and bank card portfolios are primarily indexed to the prime rate, adjustable on a monthly basis, with the balance at a ï¬xed annual percentage rate. Total principal outstanding at February 29, 2000, and February 28, 1999, had the following APR structure... -

Page 52

...,632 98,462 100.0 75.4 24.6 21.1 0.3 21.4 3.2 1.2 Selling, general and administrative expenses [NOTES 3 AND 11] ...Interest expense [NOTES 3 AND 5] ...T O T A L E X P E N S E S ... Earnings from continuing operations before income taxes and Inter-Group Interest in the CarMax Group...Provision for... -

Page 53

...881,882 286,865 107,070 33,536 C I T Y Current installments of long-term debt [NOTES 5 AND 10]...$ 85,735 Accounts payable ...884,172 Short-term debt [NOTE 5] ...1,453 Accrued expenses and other current liabilities...184,705 Deferred income taxes [NOTE 6] ...53,971 $ 1,457 739,895 3,411 135,029... -

Page 54

...to Inter-Group Interest in the CarMax Group...(862) Depreciation and amortization...132,923 (Gain) loss on sales of property and equipment...(418) Provision for deferred income taxes...41,828 Decrease in deferred revenue and other liabilities...(17,799) Decrease (increase) in net accounts receivable... -

Page 55

... 148,381 42,165 (13,981) 576 1,825,473 197,334 50,205 (14,207) (4,085) G R O U P Net earnings...Equity issuances, net ...Cash dividends ...Inter-Group Interest adjustment [NOTE 2] ...B A L A N C E A T F E B R U A R Y 2 8 , 1 9 9 8 ... Net earnings ...Equity issuances, net ...Cash dividends ...Inter... -

Page 56

... Group's ï¬nancial position, annual results of operations or liquidity. Prior to ï¬scal 2000, the Company capitalized pre-opening costs for new store locations. Beginning in the month after the store opened for business, the pre-opening costs were amortized over the remainder of the ï¬scal year... -

Page 57

...No. 123,"Accounting for Stock-Based Compensation." (O) DERIVATIVE FINANCIAL INSTRUMENTS: The Company enters into interest rate swap agreements to manage exposure to interest rates and to more closely match funding costs to the use of funding. Interest rate swaps relating to long-term debt are classi... -

Page 58

... the weighted average interest rate of such pooled debt as a whole. (B) CORPORATE GENERAL AND ADMINISTRATIVE COSTS: Corporate general and administrative costs and other shared services generally have been allocated to the Circuit City Group based upon utilization of such services by the Group. Where... -

Page 59

... February 29, 2000, the interest rate on the term loan was 6.23 percent. The Company maintains a multi-year, $150,000,000, unsecured revolving credit agreement with four banks. The agreement calls for interest based on both committed rates and money market rates and a commitment fee of 0.18 percent... -

Page 60

... per year. At February 29, 2000, a total of 864,046 shares remained available under the Circuit City Group Plan. During ï¬scal 2000, 501,984 shares were issued to or purchased on the open market for employees (858,710 shares in ï¬scal 1999 and 901,396 in ï¬scal 1998). The average price per share... -

Page 61

... 20.43 - - $13.89 G R O U P Total ...7,380 The Circuit City Group applies APB Opinion No. 25 and related interpretations in accounting for its stock option plans. Accordingly, no compensation cost has been recognized. Had compensation cost been determined based on the fair value at the grant date... -

Page 62

...$ 8,223 The Company has a noncontributory deï¬ned beneï¬t pension plan covering the majority of full-time employees who are at least age 21 and have completed one year of service. The cost of the program is being funded currently. Plan beneï¬ts generally are based on years of service and average... -

Page 63

... in selling, general and administrative expenses in the accompanying state- 61 C I R C U I T Future minimum ï¬xed lease obligations,excluding taxes,insurance and other costs payable directly by the Circuit City Group,as of February 29,2000,were: C I T Y The initial term of most real property... -

Page 64

... of retained interests, the Company estimates future cash ï¬,ows from ï¬nance charge collections, reduced by net defaults, servicing cost and interest cost. The Company employs a risk-based pricing strategy that increases the stated annual percentage rate for accounts that have a higher predicted... -

Page 65

... position of the Circuit City Group as of February 29, 2000 and February 28, 1999 and the results of its operations and its cash ï¬,ows for each of the ï¬scal years in the three-year period ended February 29, 2000 in conformity with generally accepted accounting principles. Richmond,Virginia... -

Page 66

... the used-car superstore business. Management believes their exit from the Dallas/Fort Worth, Houston, San Antonio, Tampa and Miami markets, where the two companies competed, will help eliminate consumer confusion over the two offers and increase customer ï¬,ow for CarMax. STORE MIX* Fiscal 2000... -

Page 67

...ï¬cant increase in new-car sales as a percentage of total sales partly offset the ï¬scal 2000 and ï¬scal 1999 improvements since new vehicles carry lower gross proï¬t margins than used vehicles. Selling, General and Administrative Expenses The Group's effective income tax rate was 38.0 percent... -

Page 68

... of the CarMax offer. In ï¬scal 2000, CarMax began a new advertising campaign; enhanced its Web site, carmax.com; and launched an online buying service that provides ï¬rm prices on new vehicles. Management believes that continued sales and profit improvement in the Group's existing markets will... -

Page 69

... "Circuit City Stores, Inc. Management's Discussion and Analysis of Results of Operations and Financial Condition" for a review of possible risks and uncertainties. Financing for these receivables is achieved through asset securitization programs that, in turn, issue both ï¬xed- and ï¬,oating-rate... -

Page 70

... ...Income tax provision (beneï¬t) [NOTES 3 AND 8] ...N E T E A R N I N G S ( L O S S ) ... Net earnings (loss) attributed to [NOTE 1]: Circuit City Group common stock...$ CarMax Group common stock...$ Weighted average common shares [NOTES 2 AND 10]: Basic ...Diluted...N E T E A R N I N G S ( LO... -

Page 71

...LIABILITIES AND GROUP EQUITY CURRENT LIABILITIES: 425,670 211,856 37,969 $675,495 Current installments of long-term debt [NOTE 7]...$ 91,609 Accounts payable ...75,959 Short-term debt [NOTE 7] ...1,552 Accrued expenses and other current liabilities...19,856 Deferred income taxes [NOTE 8] ...7,147... -

Page 72

...(86,126) (25,093) Cash used in business acquisitions [NOTE 4]...Purchases of property and equipment...Proceeds from sales of property and equipment...Decrease in inter-group receivable, net...N E T C A S H U S E D I N I N V E S T I N G A C T I V I T I E S ...FINANCING ACTIVITIES: (34,849) (45,395... -

Page 73

... issuances, net...B A L A N C E A T F E B R U A R Y 2 8 , 1 9 9 8... Net loss...Equity issuances, net...B A L A N C E A T F E B R U A R Y 2 8 , 1 9 9 9... Net earnings ...Equity issuances, net...B A L A N C E A T F E B R U A R Y 2 9 , 2 0 0 0...See accompanying notes to group ï¬nancial statements... -

Page 74

...the Group's ï¬nancial position, annual results of operation or liquidity. Prior to ï¬scal 2000, the Company capitalized pre-opening costs for new store locations. Beginning in the month after the store opened for business, the pre-opening costs were amortized over the remainder of the ï¬scal year... -

Page 75

... its own contracts at one location where third-party warranty sales were not permitted. Contracts usually have terms of coverage between 12 and 72 months. Inasmuch as the Company is the primary obligor on these contracts, revenue from the sale of the CarMax Group's own service contracts was deferred... -

Page 76

... of retained interests, the Company estimates future cash ï¬,ows from ï¬nance charge collections, reduced by net defaults, servicing cost and interest cost. The Company employs a risk-based pricing strategy that increases the stated annual percentage rate for accounts that have a higher predicted... -

Page 77

... for development is land owned for future sites that are scheduled to open more than one year beyond the ï¬scal year reported. 7. DEBT Long-term debt of the Company at February 29 or 28 is summarized as follows: (Amounts in thousands) 2000 1999 Term loans...$405,000 Industrial Development Revenue... -

Page 78

... tax assets at February 29, 2000, and February 28, 1999, will be realized by the CarMax Group; therefore,no valuation allowance is necessary. 9. ASSOCIATE BENEFIT AND STOCK INCENTIVE PLANS (A) 401(K) PLAN: Effective August 1, 1999, the Company sponsors a 401(k) Current: Federal ...$(1,395) State... -

Page 79

...$7,500 per year. At February 29, 2000, a total of 1,058,693 shares remained available under the CarMax Group Plan. During ï¬scal 2000, 580,000 shares were issued to or purchased on the open market on behalf of the employees (268,532 in ï¬scal 1999 and 92,775 in ï¬scal 1998). The average price per... -

Page 80

...indicated, the fair value of each option on the date of grant is estimated using the BlackScholes option-pricing model. The weighted average assumptions used in the model are as follows: 2000 1999 1998 Eligible employees of the CarMax Group participate in the Company's plan. Pension costs for these... -

Page 81

... RATE SWAPS 2001...$ 34,331 2002...33,088 2003...32,877 2004...32,257 2005...31,919 After 2005...458,031 Total minimum lease payments...$622,503 In ï¬scal 2000, the Company entered into sale-leaseback transactions on behalf of the CarMax Group with unrelated parties at an aggregate selling price... -

Page 82

... position of the CarMax Group as of February 29, 2000 and February 28, 1999 and the results of its operations and its cash ï¬,ows for each of the ï¬scal years in the three-year period ended February 29, 2000 in conformity with generally accepted accounting principles. Richmond,Virginia April... -

Page 83

...Ofï¬cer, CSX Corporation; Richmond,Virginia Edward Villanueva (4,5) Financial Consultant, Retired, Former Vice President and Treasurer (1) Compensation and Personnel Committee Member (2) Nominating and Governance Committee Member (3) Executive Committee Member (4) Audit Committee Member (5) Pension... -

Page 84

... Vice President Marketing and Strategy Mark F. O'Neil Vice President and Division President Operations Edwin J. Hill Assistant Vice President Service Operations Scott A. Rivas Assistant Vice President Human Resources Angela C. Schwarz Assistant Vice President First North American Credit Corporation... -

Page 85

... Web Sites Circuit City Stores, Inc. 9950 Mayland Drive Richmond,Virginia 23233-1464 Shareholder Inquiries Virginia Los Angeles (4) Florida Atlanta (3) Illinois Greenville Tennessee Richmond Washington, D.C./ Baltimore (5) http://www.circuitcity.com http://www.carmax.com Investor Information... -

Page 86

CIRCUIT CITY STORES, INC. 9950 MAYLAND DRIVE RICHMOND, VIRGINIA 23233-1464