Audi 2009 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2009 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

225

Consolidated Financial

Statements

178 Income Statement

179 Statement of Recognized

Income and Expense

180 Balance Sheet

181 Cash Flow Statement

182 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

184 Development of fixed assets

in the 2009 fiscal year

186 Development of fixed assets

in the 2008 fiscal year

188 General information

192 Recognition and

measurement principles

199 Notes to the Income Statement

205 Notes to the Balance Sheet

215 Additional disclosures

236 Events occurring subsequent

to the balance sheet date

237 Statement of Interests

held by the Audi Group

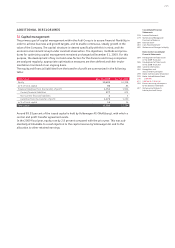

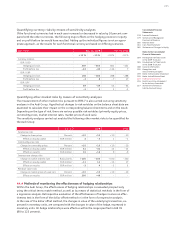

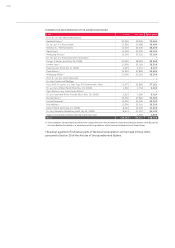

Quantifying currency risks by means of sensitivity analyses

If the functional currencies had in each case increased or decreased in value by 10 percent com-

pared with the other currencies, the following major effects on the hedging provision in equity

and on profit before tax would have resulted. Adding up the individual figures is not an appro-

priate approach, as the results for each functional currency are based on differing scenarios.

EUR million Dec. 31, 2009 Dec. 31, 2008

+ 10 % – 10 % + 10 % – 10 %

Currency relation

EUR / USD

Hedging provision 487 – 365 662 – 421

Profit before tax – 24 – 40 – 134 7

EUR / GBP

Hedging provision 184 – 182 288 – 288

Profit before tax – 3 8 – 717

EUR / JPY

Hedging provision 49 – 49 54 – 54

Profit before tax – 2 2 2 – 2

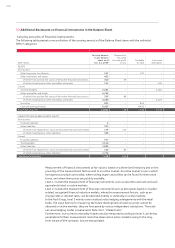

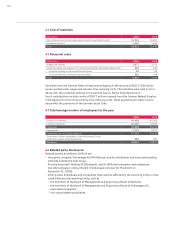

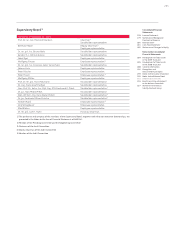

Quantifying other market risks by means of sensitivity analyses

The measurement of other market risks pursuant to IFRS 7 is also carried out using sensitivity

analyses in the Audi Group. Hypothetical changes to risk variables on the balance sheet date are

examined to calculate their impact on the corresponding balance sheet items and on the result.

Depending on the type of risk, there are various possible risk variables (primarily equity prices,

commodity prices, market interest rates, market prices of used cars).

The sensitivity analyses carried out enabled the following other market risks to be quantified for

the Audi Group:

Data in 2009 2008

Fund price risks

Change in share prices Percent + 10 – 10 + 10 – 10

Effects on equity capital EUR million 4 – 41 – 1

Commodity price risks

Change in commodity prices Percent + 10 – 10 + 10 – 10

Effects on equity capital EUR million 41 – 41 15 – 15

Effects on results EUR million 16 – 16 9 – 9

Interest rate change risks

Change in market interest rate Basis points + 100 – 100 + 100 – 100

Effects on equity capital EUR million – 11 12 – 15 17

Effects on results EUR million – 3 4 – 33

Residual value risks

Change in market prices of used cars Percent + 10 – 10 + 10 – 10

Effects on results EUR million 200 – 46 ––

34.4 Methods of monitoring the effectiveness of hedging relationships

Within the Audi Group, the effectiveness of hedging relationships is evaluated prospectively

using the critical terms match method, as well as by means of statistical methods in the form of

a regression analysis. Retrospective evaluation of the effectiveness of hedges involves an effec-

tiveness test in the form of the dollar offset method or in the form of a regression analysis.

In the case of the dollar offset method, the changes in value of the underlying transaction, ex-

pressed in monetary units, are compared with the changes in value of the hedge, expressed in

monetary units. All hedge relationships were effective within the range specified in IAS 39

(80 to 125 percent).