Audi 2009 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2009 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

141

Management Report

132 Audi Group

132 Structure

134 Strategy

137 Shares

139 Disclosures required under

takeover law

140 Corporate Management

declaration

140 System of remuneration for

the Supervisory Board and

Board of Management

140 Business and

underlying situation

140 Economic environment

143 Research and development

146 Procurement

147 Production

149 Deliveries and distribution

153 Financial performance

indicators

157 Social and ecological aspects

168 Risks, opportunities

and outlook

177 Disclaimer

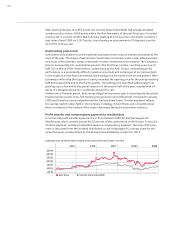

unemployment and the loss of wealth brought on by the real estate crisis in particular eroded

consumer spending.

Economic output in Western Europe fell sharply by 3.9 (+ 0.5) percent in 2009. All countries

throughout the region experienced a significant decline in gross domestic product. For example

the economy in the UK contracted by 4.8 (+ 0.6) percent, in Italy also by 4.8 (– 1.0) percent and

in Spain by 3.6 (+ 0.9) percent. Initial signs of a recovery began appearing in several countries

from mid-2009 onward. The global economic crisis caused unemployment in the euro zone to

rise from 8.2 percent at the start of 2009 to 10.0 percent at the end of 2009.

The German economy suffered an exceptionally sharp setback at the start of 2009, mainly due

to falling exports. A mild economic recovery only set in during the course of the year. The

brighter global economic prospects induced a modest improvement in export demand. One

factor that played a significant role in shoring up the economy was the government environment

bonus for those buying new cars; this measure accounted for the slight growth in consumer

spending in Germany. In all, gross domestic product for Germany fell by 5.0 (+ 1.3) percent in

the course of 2009. The German economy therefore contracted more sharply than at any time

since the founding of the Federal Republic of Germany.

The national economies of Central and Eastern Europe were also unable to stave off the global

downward trend in 2009, and some of those countries experienced a sharp fall in their economic

output. The Russian economy in particular fell deeply into recession in the year under review.

Economic development in Latin America stabilized following the cyclical slump mid-way through

2009, with the countries in that region benefiting in particular from the recovery in demand for

raw materials.

Emerging countries in Asia recovered rapidly from the adverse effects of the global economic

crisis and were able to report a healthy economic uplift from spring 2009. Economic growth in

China of 8.7 (9.0) percent virtually emulated the prior-year figure. In India, too, the economy

grew vigorously by 6.5 (7.3) percent. On the other hand gross domestic product in Japan de-

clined by 5.2 (– 1.2) percent in 2009.

International car market

Global demand for cars was significantly down in 2009 following the global economic crisis.

Western industrial nations, the countries of Central and Eastern Europe and Japan in particular

witnessed an unprecedented slump in sales in the first few months of the year. Many countries

responded with programs to stabilize car sales, which stimulated demand in the latter part of

the year in particular. Worldwide, vehicle sales in the year under review nevertheless fell overall

by 6.0 percent to 52.4 (55.7) million passenger cars.

In the United States, the consequences of the severe recession in the year under review caused

demand for cars to deteriorate once again. The market mood was dominated by continuing

consumer reticence; moreover the availability of credit for vehicle financing remained tight.

Unit sales of cars in 2009 consequently fell even further by 21.3 percent compared with

the already weak prior-year level, to just 10.4 million passenger cars and light commercial

vehicles.

Registrations of new cars in Western Europe (excluding Germany) totaled 9.9 million units in

2009, down 6.2 percent on the prior-year figures despite the extensive support measures in

many countries. Of Western Europe’s major car markets, Spain and the UK were the worst af-

fected with registrations down 17.9 percent and 6.4 percent respectively. The Italian car market

also retreated slightly by 0.2 percent. The French car market fared better, achieving year-on-year

growth of 10.7 percent.

The rapid expansion of recent years in demand for cars in Central and Eastern Europe came to an

abrupt end in 2009. Demand for passenger cars collapsed in many countries throughout the

region. The market volume in Russia halved compared with the previous year’s figure, to 1.3

million passenger cars.