Audi 2009 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2009 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

201

Consolidated Financial

Statements

178 Income Statement

179 Statement of Recognized

Income and Expense

180 Balance Sheet

181 Cash Flow Statement

182 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

184 Development of fixed assets

in the 2009 fiscal year

186 Development of fixed assets

in the 2008 fiscal year

188 General information

192 Recognition and

measurement principles

199 Notes to the Income Statement

205 Notes to the Balance Sheet

215 Additional disclosures

236 Events occurring subsequent

to the balance sheet date

237 Statement of Interests

held by the Audi Group

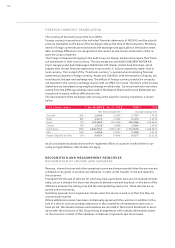

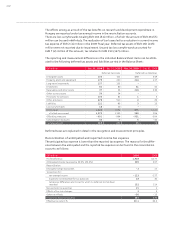

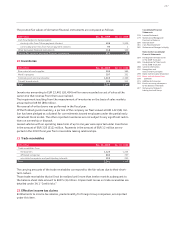

9Other financial results

EUR million 2009 2008

Investment result 21 123

of which income from investments 45 39

of which income from profit transfer agreements 54

of which income from reversal of impairment losses on investments –70

of which income from the disposal of investments –33

of which expenses from the transfer of losses – 20 – 16

of which expenses from investments – 9– 7

Net income from the sale of securities – 18 – 24

Impairments on non-derivative financial instruments – 3– 60

Income and expense from fair value measurement of derivative financial

instruments 106 41

Interest and similar income 274 483

of which from affiliated companies 235 396

Other income 103 78

of which from affiliated companies 103 78

Total other financial results 483 641

Income from investments primarily relates to a share in the profits of Volkswagen Logistics

GmbH & Co. OHG (Wolfsburg).

Income from the reversal of impairment losses on investments and from the disposal of invest-

ments resulted from the revaluation of assets of AUDI DO BRASIL E CIA. (Curitiba, Brazil) and

from the sale of the company.

Income and expense from the fair value measurement of derivative financial instruments com-

prise the ineffective portions of cash flow hedges and the fluctuations in the fair value of deriva-

tive financial instruments that do not fully meet the effectiveness criteria set out under IAS 39.

The total position in relation to hedging instruments is presented under Note 34.4, “Methods of

monitoring the effectiveness of hedging relationships.”

Interest income is attributed on an accrual basis.

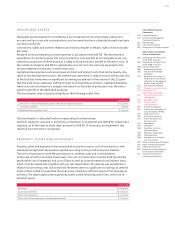

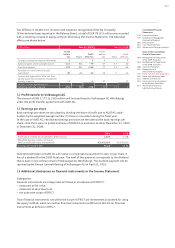

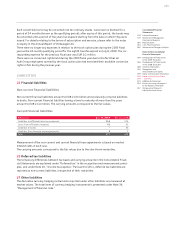

10 Income tax expense

Income tax expense includes taxes passed on by Volkswagen AG (Wolfsburg) on the basis of the

single-entity relationship between the two companies for tax purposes, along with taxes owed

by AUDI AG and its consolidated subsidiaries, as well as deferred taxes.

Tax expense consists of the following:

EUR million 2009 2008

Actual income tax expense 789 983

of which for Germany 680 801

of which for other countries 109 182

of which income from the reversal of tax provisions – 6– 1

Deferred tax income – 208 – 13

of which for Germany – 185 52

of which for other countries – 23 – 65

Income tax expense 581 970

of which non-periodic tax expenses 15 1

EUR 673 (799) million of the actual income tax expense was passed on by Volkswagen AG.

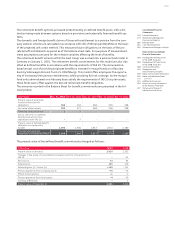

The actual taxes in Germany are calculated at a tax rate of 29.5 (29.5) percent. This represents

the sum of the corporation income tax rate of 15.0 percent, the solidarity surcharge of 5.5 per-

cent and the average trade earnings tax rate for the Group. The deferred taxes for companies in

Germany are calculated at a rate of 29.5 (29.5) percent. The local income tax rates applied to

foreign companies range from 0 percent to 41 percent.