Audi 2009 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2009 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

220

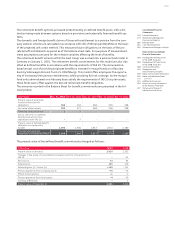

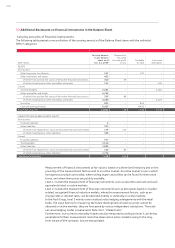

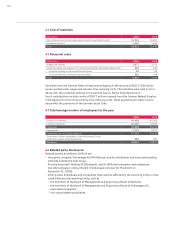

Reconciliation statement for financial instruments measured according to level 3

EUR million 2009

Positive fair values of level 3 derivative financial instruments at Jan. 1 –

Income and expense (–) recognized in the financial result 15

Income and expense (–) recognized in equity 53

Reclassification from level 3 to level 2 – 12

Positive fair values of level 3 derivative financial instruments at Dec. 31 55

Income and expense (–) recognized in the financial result from

level 3 derivative financial instruments still held at Dec. 31 4

Negative fair values of level 3 derivative financial instruments at Jan. 1 – 23

Income and expense (–) recognized in the profit from operating activities – 224

Income and expense (–) recognized in the financial result 2

Income and expense (–) recognized in equity 11

Reclassification from level 3 to level 2 10

Negative fair values of level 3 derivative financial instruments at Dec. 31 – 224

Income and expense (–) recognized in the profit from operating activities from

level 3 derivative financial instruments still held at Dec. 31 – 224

Income and expense (–) recognized in the financial result from

level 3 derivative financial instruments still held at Dec. 31 –

The residual value hedging model is categorically allocated to level 3. The reclassifications from

level 3 to level 2 contain commodity futures for whose measurement it is no longer necessary to

extrapolate the exchange rates because these can now be observed again on the active market.

The effects of market price changes of used cars resulting from hedging arrangements are

shown in detail under Note 34.3, “Market risks.”

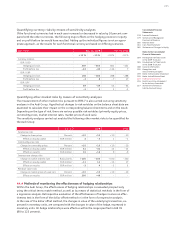

Risks resulting from residual value fluctuations of the derivative financial instruments measured

according to level 3 are calculated within the Audi Group by means of sensitivity analyses. In this

way, effects of changes in commodity price listings on profit and equity are shown. A 10 percent

rise (fall) in the commodity prices of commodity futures measured according to level 3 at

December 31, 2009 would have an effect of EUR 21 million (EUR – 21 million), primarily on

equity.

Pursuant to IFRS 7, in the first year of adopting the changes no comparative values for the pre-

vious year have to be given. The amended IFRS 7 was used in the Audi Group for the first time

in 2009.

34 Management of financial risks

34.1 Credit risks

Credit risks from financial assets comprise the risk of default by a contractual party and there-

fore do not exceed the positive fair values in respect of the contractual party in question. The

risk from non-derivative financial instruments is covered by value adjustments for expected loss

of receivables. The contractual partners for cash and capital investments, as well as currency and

raw materials hedging instruments, have impeccable credit standings. Over and above this, the

risks are restricted by a limit system that is based on the credit ratings of international rating

agencies and the equity base of the contractual parties.

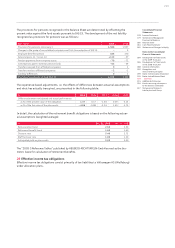

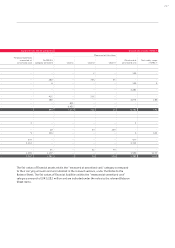

The credit quality of financial assets measured at amortized cost is shown in the following table:

EUR million

Gross carrying

amount as of

Dec. 31, 2009

Neither past

due nor

impaired Past due and

not impaired Impaired

Measured at amortized cost

Trade receivables 2,314 1,682 573 60

Other receivables 4,243 4,132 43 68

of which receivables from loans 3,966 3,965 0 1

of which miscellaneous receivables 277 167 42 67

Total 6,557 5,814 615 128