Audi 2009 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2009 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

194

In accordance with IAS 17, property, plant and equipment used on the basis of lease agree-

ments is capitalized in the Balance Sheet if the conditions of a finance lease are met (in other

words, if the significant risks and opportunities which result from its use have passed to the

lessee). Capitalization is performed at the time of the agreement, at the lower of fair value or

present value of the minimum lease payments. The straight-line depreciation method is based

on the shorter of economic life or term of lease contract. The payment obligations resulting

from the future lease installments are recognized as a liability at the present value of the leas-

ing installments.

Where Group companies have entered into operating leases as the lessee, in other words if not

all risks and opportunities associated with title have passed to them, leasing installments and

rents are expensed directly in the Income Statement.

INVESTMENT PROPERTY

Investment property comprises real estate held as a financial investment and vehicles leased as

part of operating lease agreements with a contractual term of more than one year.

Real estate held as investment property is reported in the Balance Sheet at amortized cost.

Buildings are depreciated on a straight-line basis over a useful life of 33 years.

Leased vehicles, in the case of operating lease agreements, are capitalized at cost of sales and

depreciated to the calculated residual value on a straight-line basis over the contractual term.

Unscheduled reductions for impairment and adjustments to depreciation rates are made to take

account of impairment losses calculated on the basis of impairment testing pursuant to IAS 36.

Based on local factors and historical values from used car marketing, updated internal and ex-

ternal information on residual value developments is incorporated into the residual value fore-

casts on an ongoing basis.

INVESTMENTS ACCOUNTED FOR USING THE EQUITY METHOD

Companies in which AUDI AG is directly or indirectly able to exercise significant influence on

financial and operating policy decisions (associated companies) are accounted for using the

equity method. The pro rata equity of these companies is regularly recorded under long-term

investments and the share of earnings recorded as income under the financial result.

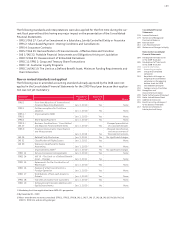

IMPAIRMENT TESTS

Fixed assets are tested regularly for impairment as of the balance sheet date. Impairment tests

are carried out for development activities and property, plant and equipment on the basis of

expected product life cycles, the respective revenue and cost situation, current market expecta-

tions and currency-specific factors.

Expected future cash flows to intangible assets and fixed tangible assets are discounted with

country-specific discount rates that adequately reflect the risk and amount to 9.1 percent be-

fore tax.

Impairment losses pursuant to IAS 36 are recognized where the recoverable amount, i.e. the

higher amount from either the use or disposal of the asset in question, has declined below its

carrying amount.