Audi 2009 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2009 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

209

Consolidated Financial

Statements

178 Income Statement

179 Statement of Recognized

Income and Expense

180 Balance Sheet

181 Cash Flow Statement

182 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

184 Development of fixed assets

in the 2009 fiscal year

186 Development of fixed assets

in the 2008 fiscal year

188 General information

192 Recognition and

measurement principles

199 Notes to the Income Statement

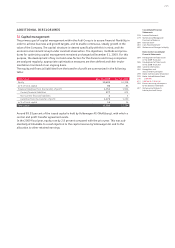

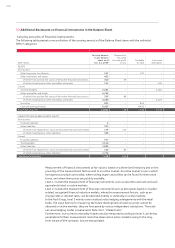

205 Notes to the Balance Sheet

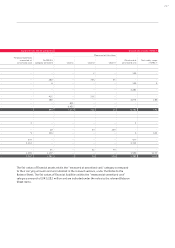

209 Liabilities

215 Additional disclosures

236 Events occurring subsequent

to the balance sheet date

237 Statement of Interests

held by the Audi Group

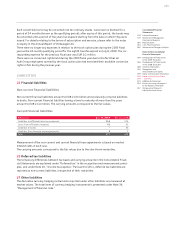

Each convertible bond may be converted into ten ordinary shares. Conversion is blocked for a

period of 24 months (known as the qualifying period); after expiry of this period, the bonds may

be converted until a period of five years has elapsed starting from the date on which they were

issued. For details relating to the terms of subscription and exercise, please refer to the notes

on equity in the Annual Report of Volkswagen AG.

There were no longer any expenses in relation to the stock option plan during the 2009 fiscal

year as the 24-month qualifying period for the eighth tranche expired on July 8, 2008. The cor-

responding expense for the previous fiscal year was EUR 0.2 million.

There were no conversion rights held during the 2009 fiscal year due to the fact that all

Audi Group employees covered by the stock option plan had exercised their available conversion

rights in full during the previous year.

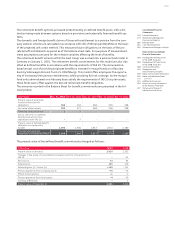

LIABILITIES

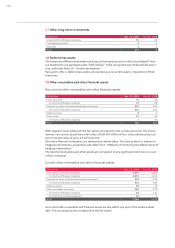

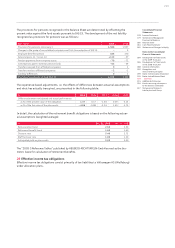

25 Financial liabilities

Non-current financial liabilities

Non-current financial liabilities amount to EUR 2 (3) million and exclusively comprise liabilities

to banks. Non-current financial liabilities having a time to maturity of more than five years

amount to EUR 2 (1) million. The carrying amounts correspond to the fair values.

Current financial liabilities

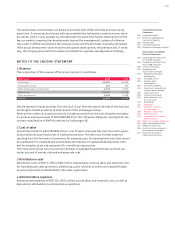

EUR million Dec. 31, 2009 Dec. 31, 2008

Liabilities to affiliated factoring companies 514 574

Loans from affiliated companies 62 62

Liabilities to banks –36

Liabilities from financial lease agreements 01

Total 577 673

Measurement of the non-current and current financial lease agreements is based on market

interest rates in each case.

The carrying amounts correspond to the fair values due to the short-term maturities.

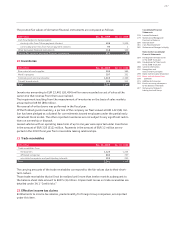

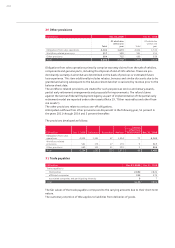

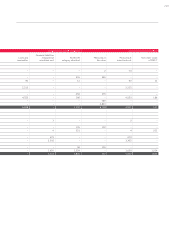

26 Deferred tax liabilities

The temporary differences between tax bases and carrying amounts in the Consolidated Finan-

cial Statements are explained under “Deferred tax” in the recognition and measurement princi-

ples, and under Note 10, “Income tax expense.” Pursuant to IAS 1, deferred tax liabilities are

reported as non-current liabilities, irrespective of their maturities.

27 Other liabilities

The derivative currency hedging instruments reported under other liabilities are measured at

market values. The total item of currency hedging instruments is presented under Note 34,

“Management of financial risks.”