Audi 2009 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2009 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

216

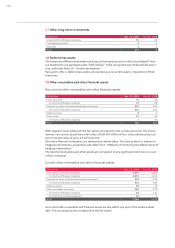

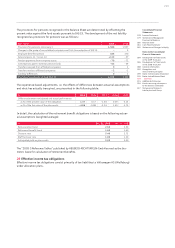

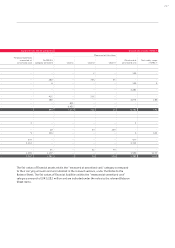

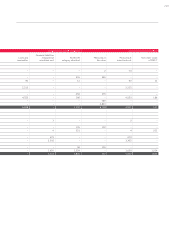

33 Additional disclosures on financial instruments in the Balance Sheet

Carrying amounts of financial instruments

The following table presents a reconciliation of the carrying amounts of the Balance Sheet items with the individual

IFRS 7 categories:

EUR million

Carrying amount

as per balance

sheet as of

Dec. 31, 2009

Measured at

fair value

through profit

or loss Available

for sale Loans and

receivables

ASSETS

Non-current

Other long-term investments 107 – 107 – –

Other receivables and assets 422

of which from positive fair values of derivative financial instruments 310 29 – – –

of which miscellaneous other receivables and assets 111 – – 105 –

Current

Trade receivables 2,281 – – 2,281 –

Other receivables and assets 4,764

of which from positive fair values of derivative financial instruments 505 89 – – –

of which miscellaneous other receivables and assets 4,260 – – 4,073 –

Securities 821 – 821 – –

Cash and cash equivalents 6,455 – 6,455 – –

Total financial assets 14,850 118 7,384 6,459 –

LIABILITIES AND SHAREHOLDERS’ EQUITY

Non-current

Financial liabilities 2– – – –

Other liabilities 527

of which from negative fair values of derivative financial instruments 179 151 – – –

of which miscellaneous other liabilities 348 – – – –

Current

Financial liabilities 577 – – – –

Trade payables 3,114 – – – –

Other liabilities 2,895

of which from negative fair values of derivative financial instruments 120 85 – – –

of which miscellaneous other liabilities 2,776 – – – –

Total financial liabilities 7,115 236 – – –

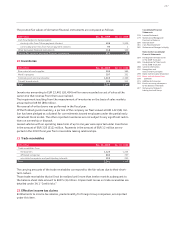

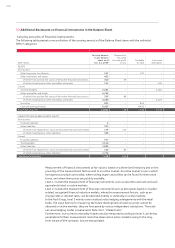

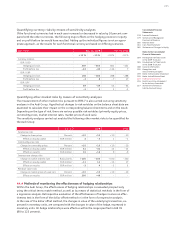

Measurement of financial instruments at fair value is based on a three-level hierarchy and on the

proximity of the measurement factors used to an active market. An active market is one in which

homogenous products are traded, where willing buyers and sellers can be found for them at all

times, and where their prices are publicly available.

Level 1 involves the measurement of financial instruments, such as securities and cash and cash

equivalents listed on active markets.

Level 2 involves the measurement of financial instruments such as derivatives based on market-

related, recognized financial valuation models, where the measurement factors, such as ex-

change rates or interest rates, can be observed directly or indirectly on active markets.

In the Audi Group, level 3 mainly covers residual value hedging arrangements with the retail

trade. The input factors for measuring the future development of used car prices cannot be

observed on active markets; they are forecasted by various independent institutions. The resid-

ual value hedging model is explained in Note 34.3, “Market risks.”

Furthermore, non-current commodity futures are also measured according to level 3, as the key

parameters for their measurement cannot be observed on active markets owing to the long-

term nature of the contracts, but are extrapolated.