Audi 2009 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2009 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

191

Consolidated Financial

Statements

178 Income Statement

179 Statement of Recognized

Income and Expense

180 Balance Sheet

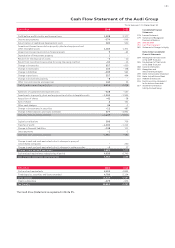

181 Cash Flow Statement

182 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

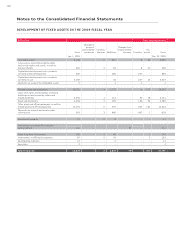

184 Development of fixed assets

in the 2009 fiscal year

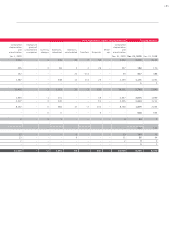

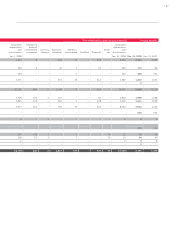

186 Development of fixed assets

in the 2008 fiscal year

188 General information

188 Accounting principles

190 Group of consolidated

companies

191 Key effects of changes to

the group of consolidated

companies on the opening

balance sheet for 2009

191 Consolidation principles

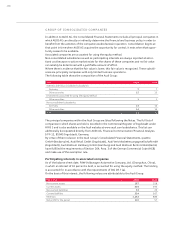

192 Foreign currency translation

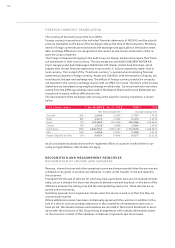

192 Recognition and

measurement principles

199 Notes to the Income Statement

205 Notes to the Balance Sheet

215 Additional disclosures

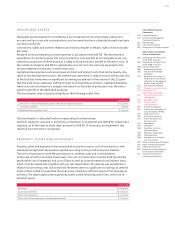

236 Events occurring subsequent

to the balance sheet date

237 Statement of Interests

held by the Audi Group

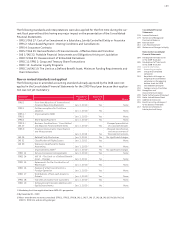

KEY EFFECTS OF CHANGES TO THE GROUP OF CONSOLIDATED

COMPANIES ON THE OPENING BALANCE SHEET FOR 2009

There have been no major changes to the group of consolidated companies since December 31,

2008. The merger between an insignificant investment and a fully consolidated company re-

sulted in a slight adjustment to the opening balance for 2009 of EUR 1 thousand.

CONSOLIDATION PRINCIPLES

The assets and liabilities of the domestic and foreign companies included in the Consolidated

Financial Statements are recognized in accordance with the standard accounting and measure-

ment policies of the Audi Group.

In the case of subsidiaries that are being consolidated for the first time, the assets and liabilities

are to be measured at their fair value at the time of acquisition. Any realized hidden reserves and

expenses are amortized, depreciated or reversed in accordance with the development of the

corresponding assets and liabilities as part of the subsequent consolidation process. Where the

acquisition values of the investments exceed the Group share in the equity of the relevant com-

pany as calculated in this manner, goodwill is created. Goodwill acquired in a business combina-

tion is tested for impairment regularly at the balance sheet date, and an impairment loss is

recognized if necessary.

Within the Audi Group, the predecessor method is applied in relation to common control trans-

actions. Under this method, the assets and liabilities of the acquired company or business op-

erations are measured at the gross carrying amounts of the previous parent company. The

predecessor method thus means that no adjustment to the fair value of the acquired assets and

liabilities is performed at the time of acquisition; any goodwill arising during initial consolida-

tion is adjusted against equity, without affecting income.

The Consolidated Financial Statements also include securities funds whose assets are attribut-

able in substance to the Group.

Receivables and liabilities between consolidated companies are netted, and expenses and in-

come eliminated. Interim profits and losses are eliminated from Group inventories and fixed

assets.

Consolidation processes affecting income are subject to deferrals of income taxes; deferred tax

assets and liabilities are offset where the term and tax creditor are the same.

The same accounting policies for determining the pro rata equity are applied to Audi Group

companies accounted for using the equity method. This is done on the basis of the last set of

audited financial statements of the company in question.