Audi 2009 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2009 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

198

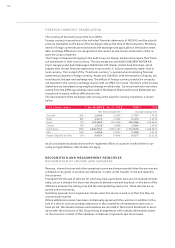

Unscheduled reductions for impairment and adjustments to depreciation rates are made to take

account of impairment losses calculated on the basis of impairment testing pursuant to IAS 36.

Based on local factors and historical values from used car marketing, updated internal and ex-

ternal information on residual value developments is incorporated into the residual value fore-

casts on an ongoing basis.

SECURITIES, CASH AND CASH EQUIVALENTS

Securities held as current assets are measured at market value, i.e. at the trading price on the

balance sheet date.

Cash and cash equivalents are stated at their market value, which corresponds to the nominal

value.

PROVISIONS FOR PENSIONS

Actuarial measurement of provisions for pensions is based on the projected unit credit method

for defined retirement benefit plans as specified in IAS 19 (Employee Benefits). This method

takes account of pensions and entitlements to future pensions known at the balance sheet date

as well as anticipated future pay and pension increases.

Actuarial gains and losses are reported in a separate line item within equity, with no effect on

income, after taking deferred tax into account.

OTHER PROVISIONS

In accordance with IAS 37, provisions are recognized if an obligation existing toward third par-

ties is likely to lead to cash outflows and where the amount of the obligation can reliably be

estimated.

Pursuant to IAS 37, the other provisions for all discernible risks and uncertain liabilities are

reported at their probable cost and are not offset against recourse entitlements.

Provisions with over one year to maturity are measured at their discounted settlement value as

of the balance sheet date. Market rates are used as the discount rates. Since the settlement value

pursuant to IAS 37 also includes the cost increases to be taken into account on the balance

sheet date, a nominal interest rate of 3.4 percent was applied in Germany.

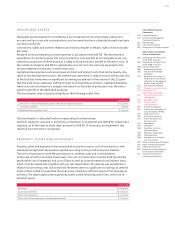

MANAGEMENT’S ESTIMATES AND ASSESSMENTS

To some degree, the preparation of the Consolidated Financial Statements entails assumptions

and estimates with regard to the level and disclosure of the recognized assets and liabilities,

income and expenditure, and contingent liabilities for the reporting period.

The assumptions and estimates relate principally to the reporting of intangible assets, the

Group-wide determination of the useful life of property, plant and equipment and investment

property, any impairment of fixed assets and inventories, the collectability of receivables, and

the recognition and measurement of provisions.