Audi 2009 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2009 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

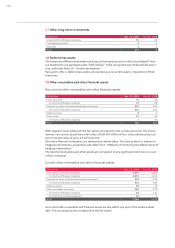

211

Consolidated Financial

Statements

178 Income Statement

179 Statement of Recognized

Income and Expense

180 Balance Sheet

181 Cash Flow Statement

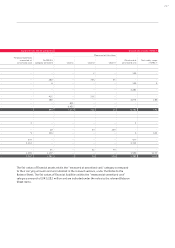

182 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

184 Development of fixed assets

in the 2009 fiscal year

186 Development of fixed assets

in the 2008 fiscal year

188 General information

192 Recognition and

measurement principles

199 Notes to the Income Statement

205 Notes to the Balance Sheet

209 Liabilities

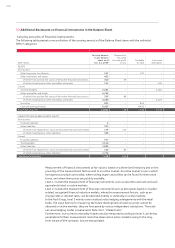

215 Additional disclosures

236 Events occurring subsequent

to the balance sheet date

237 Statement of Interests

held by the Audi Group

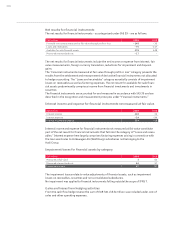

The retirement benefit systems are based predominantly on defined benefit plans, with a dis-

tinction being made between systems based on provisions and externally financed benefit sys-

tems.

The domestic and foreign benefit claims of those with entitlement to a pension from the com-

pany pension scheme are calculated in accordance with IAS 19 (Employee Benefits) on the basis

of the projected unit credit method. This measures future obligations on the basis of the pro

rata benefit entitlements acquired as of the balance sheet date. For purposes of measurement,

trend assumptions are used for the relevant variables affecting the level of benefits.

The retirement benefit scheme within the Audi Group was evolved into a pension fund model in

Germany on January 1, 2001. The retirement benefit commitments for this model are also clas-

sified as defined benefits in accordance with the requirements of IAS 19. The remuneration-

based annual cost of providing employee benefits is invested in mutual funds on a fiduciary

basis by Volkswagen Pension Trust e.V. (Wolfsburg). This model offers employees the opportu-

nity of increasing their pension entitlements, while providing full risk coverage. As the mutual

fund units administered on a fiduciary basis satisfy the requirements of IAS 19 as plan assets,

these funds were offset against the derived retirement benefit obligations.

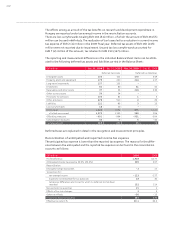

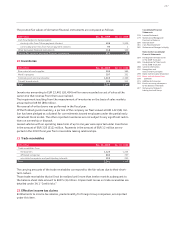

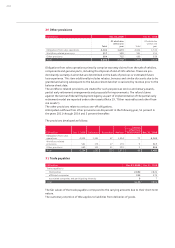

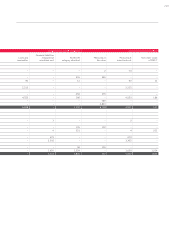

The amounts recorded in the Balance Sheet for benefit commitments are presented in the fol-

lowing table:

EUR million Dec. 31, 2009 Dec. 31, 2008 Dec. 31, 2007 Dec. 31, 2006 Dec. 31, 2005

Present value of externally

funded defined benefit

obligations 586 464 368 306 238

Fair value of plan assets 583 471 368 306 238

Financing status (balance) 3 – 7–––

Due to the limit on a defined

benefit asset amount not

capitalized under IAS 19 – 7–––

Present value of defined benefit

obligations not externally

funded 2,096 1,946 1,957 1,974 2,180

Provisions for pensions

recognized in the Balance Sheet 2,098 1,946 1,957 1,974 2,180

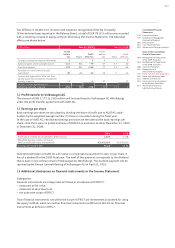

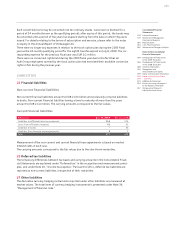

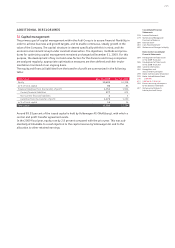

The present value of the defined benefit commitments changed as follows:

EUR million 2009 2008

Present value on January 1 2,410 2,325

Changes in the group of consolidated companies and first-time adoption of

IAS 19 –91

Service cost 74 64

Interest cost 135 129

Actuarial gains (–) / losses (+) + 148 – 111

Pension payments from company assets – 79 – 72

Effects from transfers – 12

Pension payments from fund assets – 4– 19

Currency differences –1

Present value on December 31 2,681 2,410