Audi 2009 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2009 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

224

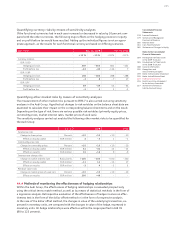

Risks from special mutual funds are generally countered by maintaining a broad mix of prod-

ucts, issuers and regional markets when investing funds, as stipulated in the investment guide-

lines. Where necessitated by the market situation, currency hedges in the form of futures con-

tracts are also used. Such measures are coordinated by AUDI AG in agreement with the Group

Treasury of Volkswagen AG (Wolfsburg) and implemented at operational level by the special

mutual funds’ risk management teams.

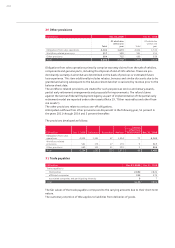

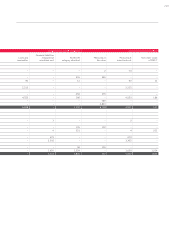

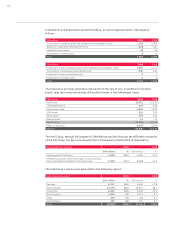

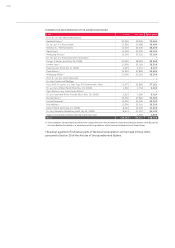

Fund price risks are measured within the Audi Group in accordance with IFRS 7 using sensitivity

analyses. Hypothetical changes to risk variables on the balance sheet date are examined to cal-

culate their impact on the prices of the financial instruments in the funds. Market prices and

indices are particularly relevant risk variables in the case of fund price risks.

Commodity price risks

Commodities are subject to the risk of fluctuating prices given the volatile nature of the com-

modity markets. Commodity futures are used to limit these risks. The hedging measures are

coordinated regularly between AUDI AG and Volkswagen AG (Wolfsburg), in accordance with the

existing Volkswagen organizational guideline. The hedging transactions are performed centrally

for AUDI AG by Volkswagen AG on the basis of an agency agreement. The results from hedging

contracts are credited or debited to the Audi Group on the basis of the proportionate share of

the Volkswagen Group’s overall hedging volume.

Hedging measures relate principally to significant quantities of the commodities aluminum and

copper. Contracts are concluded exclusively with first-rate national and international banks

whose creditworthiness is regularly examined by leading rating agencies.

Commodity price risks are also calculated using sensitivity analyses. Hypothetical changes in

listed prices are used to quantify the impact of changes in value of the hedging transactions on

equity and on profit before tax.

Interest rate risks

Interest rate risks stem from changes in market rates, above all for medium and long-term

variable-rate assets and liabilities.

The Audi Group limits interest rate risks particularly with regard to the granting of loans and

credit, by agreeing fixed interest rates.

The risks associated with changing interest rates are presented in accordance with IFRS 7 using

sensitivity analyses. These involve presenting the effects of hypothetical changes in market

interest rates at the balance sheet date on interest payments, interest income and expenses,

and, where applicable, equity.

Residual value risks

The financial crisis had a negative impact on the used car market in 2009. This is a development

that could continue in the coming years. Where losses are incurred as a result of lower residual

values in conjunction with buy-back obligations from lease agreements, these are partially as-

sumed by the Audi Group on the basis of hedging arrangements. The hedging arrangements are

based on residual value recommendations, as adopted on a half-yearly basis by the residual

value committee at the time of the contract being concluded, and then on current dealer pur-

chase values on the market at the time of the residual value hedging being settled. The residual

value recommendations are based on the forecasts provided by various independent institutions

using transaction prices.

Residual value risks are also calculated using sensitivity analyses. Hypothetical changes in the

market prices of used cars at the balance sheet date are used to quantify the impact on profit

before tax.