Audi 2009 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2009 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

193

Consolidated Financial

Statements

178 Income Statement

179 Statement of Recognized

Income and Expense

180 Balance Sheet

181 Cash Flow Statement

182 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

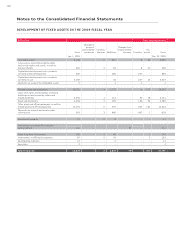

184 Development of fixed assets

in the 2009 fiscal year

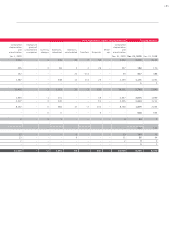

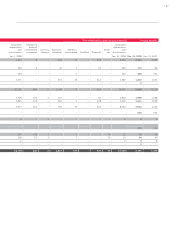

186 Development of fixed assets

in the 2008 fiscal year

188 General information

188 Accounting principles

190 Group of consolidated

companies

191 Key effects of changes to

the group of consolidated

companies on the opening

balance sheet for 2009

191 Consolidation principles

192 Foreign currency translation

192 Recognition and

measurement principles

192 Recognition of income

and expenses

193 Intangible assets

193 Property, plant

and equipment

194 Investment property

194 Investments accounted for

using the equity method

194 Impairment tests

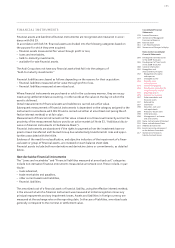

195 Financial instruments

197 Other receivables and

financial assets

197 Deferred tax

197 Inventories

198 Securities, cash and

cash equivalents

198 Provisions for pensions

198 Other provisions

198 Management’s estimates

and assessments

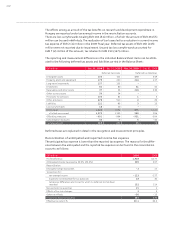

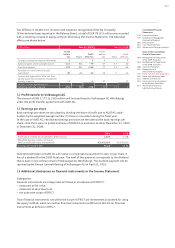

199 Notes to the Income Statement

205 Notes to the Balance Sheet

215 Additional disclosures

236 Events occurring subsequent

to the balance sheet date

237 Statement of Interests

held by the Audi Group

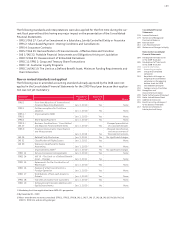

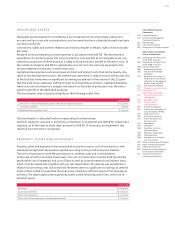

INTANGIBLE ASSETS

Intangible assets acquired for consideration are recognized at cost of purchase, taking into

account ancillary costs and cost reductions, and are amortized on a scheduled straight-line basis

over their useful life.

Concessions, rights and licenses relate to purchased computer software, rights of use and subsi-

dies paid.

Research costs are treated as current expenses in accordance with IAS 38. The development

expenditure for products going into series production is recognized as an intangible asset, pro-

vided that production of these products is likely to bring economic benefit to the Audi Group. If

the conditions stated in IAS 38 for capitalization are not met, the costs are expensed in the

Income Statement in the year in which they occur.

Capitalized development costs encompass all direct and indirect costs that can be directly allo-

cated to the development process. No interest was capitalized in relation to borrowing costs due

to the fact that there were no significant borrowings as defined in the criteria of IAS 23 given

that the Audi Group maintains sufficient levels of net liquidity at all times. Capitalized develop-

ment costs are amortized on a straight-line basis from the start of production over the antici-

pated model life of the developed products.

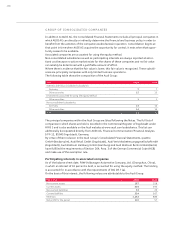

The amortization plan is based principally on the following useful lives:

Useful life

Concessions, industrial property rights and similar rights and assets 3–15 years

of which software 3 years

Capitalized development costs 5–9 years

The amortization is allocated to the corresponding functional areas.

Goodwill created or acquired in a business combination is recognized and tested for impairment

regularly, as of the balance sheet date, pursuant to IAS 36. If necessary, an impairment loss

resulting from this test is recognized.

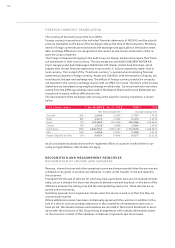

PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are measured at acquisition cost or cost of construction, with

scheduled straight-line depreciation applied according to the pro rata temporis method.

The costs of purchase include the purchase price, ancillary costs and cost reductions.

In the case of self-constructed fixed assets, the cost of construction includes both the directly

attributable cost of materials and cost of labor as well as indirect materials and indirect labor,

which must be capitalized, together with pro rata depreciation. No interest was capitalized in

relation to borrowing costs due to the fact that there were no significant borrowings as defined

in the criteria of IAS 23 given that the Audi Group maintains sufficient levels of net liquidity at

all times. The depreciation plan is generally based on the following useful lives, which are re-

assessed yearly:

Useful life

Buildings 14–50 years

Land improvements 10–33 years

Plant and machinery 6–12 years

Plant and office equipment including special tools 3–15 years