Advance Auto Parts 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

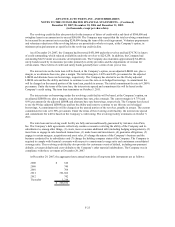

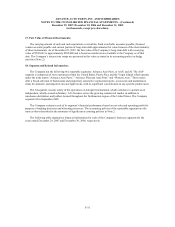

17. Fair Value of Financial Instruments:

The carrying amount of cash and cash equivalents, receivables, bank overdrafts, accounts payable, financed

vendor accounts payable and current portion of long-term debt approximates fair value because of the short maturity

of those instruments. As of December 29, 2007, the fair value of the Company’s long-term debt with a carrying

value of $505,062 is approximately $502,000 and is based on similar issues available to the Company as of that

date. The Company’s interest rate swaps are presented at fair value as stated in its accounting policy on hedge

activities (Note 2).

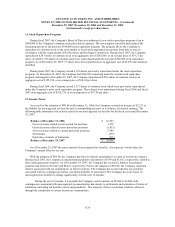

18. Segment and Related Information:

The Company has the following two reportable segments: Advance Auto Parts, or AAP, and AI. The AAP

segment is comprised of store operations within the United States, Puerto Rico and the Virgin Islands which operate

under the trade names “Advance Auto Parts,” “Advance Discount Auto Parts” and “Western Auto.” These stores

offer a broad selection of brand name and proprietary automotive replacement parts, accessories and maintenance

items for domestic and imported cars and light trucks, with no significant concentration in any specific product area.

The AI segment consists solely of the operations of Autopart International, which continues to operate as an

independent, wholly-owned subsidiary. AI’s business serves the growing commercial market in addition to

warehouse distributors and jobbers located throughout the Northeastern region of the United States. The Company

acquired AI in September 2005.

The Company evaluates each of its segment’s financial performance based on net sales and operating profit for

purposes of making decisions and allocating resources. The accounting policies of the reportable segments are the

same as those described in the summary of significant accounting policies in Note 2.

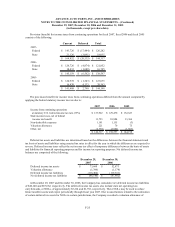

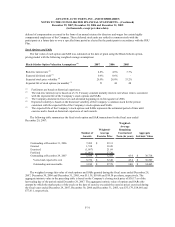

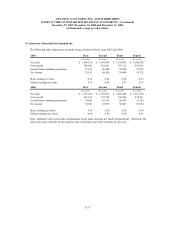

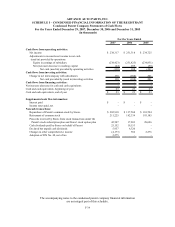

The following table summarizes financial information for each of the Company's business segments for the

years ended December 29, 2007 and December 30, 2006, respectively.

F-33