Advance Auto Parts 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

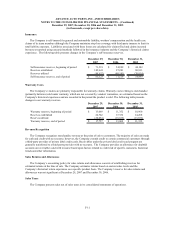

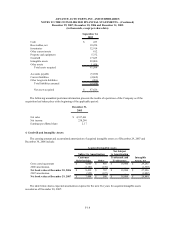

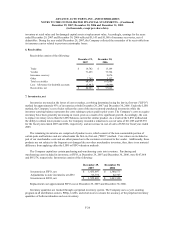

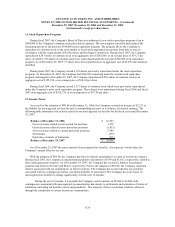

The Company establishes reserves for estimated shrink based on historical accuracy and effectiveness of the

cycle counting program. The Company also establishes reserves for potentially excess and obsolete inventories

based on current inventory levels and the historical analysis of product sales and current market conditions. The

nature of the Company’s inventory is such that the risk of obsolescence is minimal and excess inventory has

historically been returned to the Company’s vendors for credit. The Company provides reserves when less than full

credit is expected from a vendor or when liquidating product will result in retail prices below recorded costs. The

following table presents changes in the Company’s inventory reserves.

December 29, December 30, December 31,

2007 2006 2005

Inventory reserves, beginning of period 31,376$ 22,825$ 21,929$

Reserves established 106,387 94,206 90,431

Reserves utilized (102,198) (85,655) (89,535)

Inventory reserves, end of period 35,565$ 31,376$ 22,825$

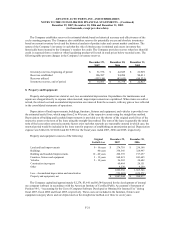

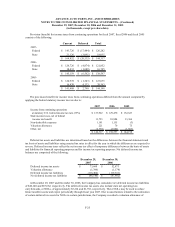

8. Property and Equipment:

Property and equipment are stated at cost, less accumulated depreciation. Expenditures for maintenance and

repairs are charged directly to expense when incurred; major improvements are capitalized. When items are sold or

retired, the related cost and accumulated depreciation are removed from the accounts, with any gain or loss reflected

in the consolidated statements of operations.

Depreciation of land improvements, buildings, furniture, fixtures and equipment, and vehicles is provided over

the estimated useful lives, which range from 2 to 40 years, of the respective assets using the straight-line method.

Depreciation of building and leasehold improvements is provided over the shorter of the original useful lives of the

respective assets or the term of the lease using the straight-line method. The term of the lease is generally the initial

term of the lease unless external economic factors exist such that renewals are reasonably assured in which case, the

renewal period would be included in the lease term for purposes of establishing an amortization period. Depreciation

expense was $146,182, $138,064 and $119,938 for the fiscal years ended 2007, 2006 and 2005, respectively.

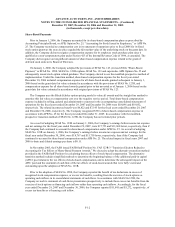

Property and equipment consists of the following:

Original

Useful Lives

December 29,

2007

December 30,

2006

Land and land improvements 0 - 10 years 274,710$ 238,186$

Buildings 40 years 358,366 328,997

Building and leasehold improvements 10 - 40 years 208,395 197,657

Furniture, fixtures and equipment 3 - 12 years 868,421 843,645

Vehicles 2 - 10 years 26,382 24,682

Construction in progress 60,464 28,151

Other 4,230 4,230

1,800,968 1,665,548

Less - Accumulated depreciation and amortization (753,024) (670,571)

Property and equipment, net 1,047,944$ 994,977$

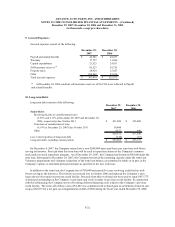

The Company capitalized approximately $2,274, $3,641 and $6,584 incurred for the development of internal

use computer software in accordance with the American Institute of Certified Public Accountant’s Statement of

Position 98-1, “Accounting for the Cost of Computer Software Developed or Obtained for Internal Use” during

fiscal 2007, fiscal 2006 and fiscal 2005, respectively. These costs are included in the furniture, fixtures and

equipment category above and are depreciated on the straight-line method over three to seven years.

F-21