Advance Auto Parts 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

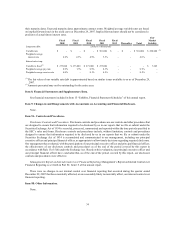

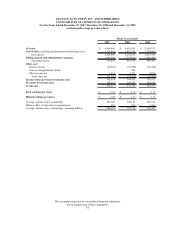

their maturity dates. Expected maturity dates approximate contract terms. Weighted average variable rates are based

on implied forward rates in the yield curve at December 29, 2007. Implied forward rates should not be considered a

predictor of actual future interest rates.

Fair

Fiscal Fiscal Fiscal Fiscal Fiscal Market

2008 2009 2010 2011 2012 Thereafter Total Liability

Long-term debt: (dollars in thousands)

Variable rate -$ -$ -$ 501,000$ -$ -$ 501,000$ 498,000$

(1)

Weighted average

interest rate 4.8% 4.3% 4.9% 5.3% - - 4.8% -

Interest rate swap:

Variable to fixed

(2)

275,000$ 275,000$ 275,000$ 275,000$ - - - 7,645$

Weighted average pay rate 0.9% 1.3% 0.9% 0.5% - - 0.9% -

Weighted average receive rate 0.0% - 0.1% 0.5% - - 0.2% -

(1) The fair value of our variable rate debt is approximated based on similar issues available to us as of December 29,

2007.

(2) Amounts presented may not be outstanding for the entire year.

Item 8. Financial Statements and Supplementary Data.

See financial statements included in Item 15 “Exhibits, Financial Statement Schedules” of this annual report.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Disclosure Controls and Procedures. Disclosure controls and procedures are our controls and other procedures that

are designed to ensure that information required to be disclosed by us in our reports that we file or submit under the

Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in

the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures

designed to ensure that information required to be disclosed by us in our reports that we file or submit under the

Securities Exchange Act of 1934 is accumulated and communicated to our management, including our principal

executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure.

Our management has evaluated, with the participation of our principal executive officer and principal financial officer,

the effectiveness of our disclosure controls and procedures as of the end of the period covered by this report in

accordance with Rule 13a-15(b) under the Exchange Act. Based on this evaluation, our principal executive officer and

our principal financial officer have concluded that, as of the end of the period covered by this report, our disclosure

controls and procedures were effective.

Management's Report on Internal Control over Financial Reporting. Management’s Report on Internal Control over

Financial Reporting is set forth in Part IV, Item 15 of this annual report.

There were no changes in our internal control over financial reporting that occurred during the quarter ended

December 29, 2007 that have materially affected, or are reasonably likely to materially affect, our internal control over

financial reporting.

Item 9B. Other Information.

None.

34