Advance Auto Parts 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.plan as of the date of the statement of financial position. We adopted the recognition provisions of SFAS No. 158 on

December 30, 2006 and recorded a reduction to the liability of $5.4 million and increase to other comprehensive

income of $3.3 million, net of tax (see Note 15). SFAS No. 158 is effective for the measurement date provisions for

fiscal years ending after December 15, 2008. SFAS No. 158 provides two approaches to transition to a fiscal year-

end measurement date, both of which are to be applied prospectively. We have elected to apply the alternate

transition method under which a 14-month measurement will cover the period from November 1, 2007 through

December 29, 2007. We do not expect the change in the measurement date to have a material impact on our

financial condition, results of operations or cash flows.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 clarifies the

definition of fair value, establishes a framework for measuring fair value as it related to other accounting

pronouncements that require or permit fair value measurements, and expands the disclosures on fair value

measurements. In February 2008, the FASB issued a staff position that delays the effective date of SFAS No. 157

for all nonfinancial assets and liabilities except for those recognized or disclosed at least annually. Except for the

delay for nonfinancial assets and liabilities, SFAS No. 157 is effective for fiscal years beginning after December 15,

2007 and interim periods within such years. We are currently evaluating the impact, if any, of adopting SFAS No.

157.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities.” SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items

at fair value. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. We are currently

evaluating the impact, if any, of adopting SFAS No. 159.

In December 2007, the FASB issued SFAS No. 141R, “Business Combinations,” which replaces SFAS No.

141, “Business Combinations.” SFAS No. 141R, among other things, establishes principles and requirements for

how an acquirer entity recognizes and measures in its financial statements the identifiable assets acquired, the

liabilities assumed and any controlling interests in the acquired entity; recognizes and measures the goodwill

acquired in the business combination or a gain from a bargain purchase; and determines what information to disclose

to enable users of the financial statements to evaluate the nature and financial effects of the business

combination. Costs of the acquisition will be recognized separately from the business combination. SFAS No. 141R

applies to business combinations for fiscal years beginning after December 15, 2008.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements – an amendment of ARB No. 51.” SFAS No. 160, among other things, provides guidance and establishes

amended accounting and reporting standards for a parent company’s noncontrolling interest in a subsidiary. SFAS

No. 160 is effective for fiscal years beginning on or after December 15, 2008. We do not expect the adoption of

SFAS No. 160 to have a material impact on our financial condition, results of operations or cash flows.

Item 7A. Quantitative and Qualitative Disclosures about Market Risks.

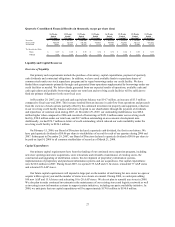

We are exposed to cash flow risk due to changes in interest rates with respect to our long-term debt. Our long-

term debt primarily consists of borrowings under a revolving and term loan credit facilities and is primarily

vulnerable to movements in the LIBOR rate. While we cannot predict the impact interest rate movements will have

on our debt, exposure to rate changes is managed through the use of hedging activities.

Our future exposure to interest rate risk is mitigated as a result of entering into an interest rate swap in fiscal

2007 on an aggregate $50 million of debt under our term loan and four interest rate swap agreements in fiscal 2006

on an aggregate of $225 million of debt under our revolving credit facility. The interest rate swaps entered into

during 2006 replaced the previously outstanding swaps terminated as a result of our refinancing in October 2006.

At December 29, 2007, our outstanding swaps fixed the Company’s LIBOR rate on an aggregate of $275

million of hedged debt at rates ranging from 4.01% to 4.98%. All of the swaps expire in October 2011.

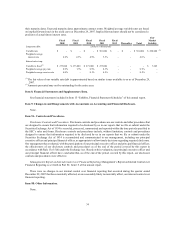

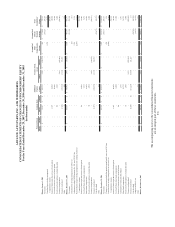

The table below presents principal cash flows and related weighted average interest rates on our long-term debt

outstanding at December 29, 2007, by expected maturity dates. Additionally, the table includes the notional amounts

of our hedged debt and the impact of the anticipated average pay and receive rates of our interest rate swaps through

33