Advance Auto Parts 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

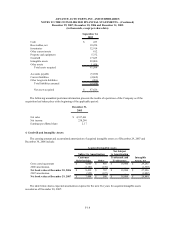

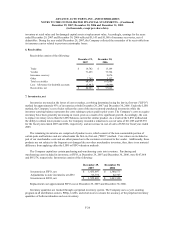

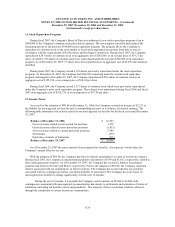

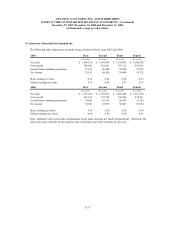

Provision (benefit) for income taxes from continuing operations for fiscal 2007, fiscal 2006 and fiscal 2005

consists of the following:

Current Deferred Total

2007-

Federal 143,726$ (17,444)$ 126,282$

State 21,126 (3,091) 18,035

164,852$ (20,535)$ 144,317$

2006-

Federal 126,726$ (4,874)$ 121,852$

State 18,433 (1,688) 16,745

145,159$ (6,562)$ 138,597$

2005-

Federal 124,978$ (1,343)$ 123,635$

State 16,430 4,133 20,563

141,408$ 2,790$ 144,198$

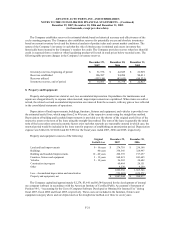

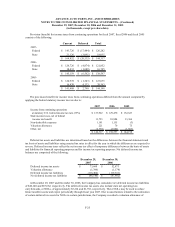

The provision (benefit) for income taxes from continuing operations differed from the amount computed by

applying the federal statutory income tax rate due to:

2007 2006 2005

Income from continuing operations

at statutory U.S. federal income tax rate (35%) 133,922$ 129,470$ 132,623$

State income taxes, net of federal

income tax benefit 11,723 10,884 13,366

Non-deductible expenses 1,181 1,155 (3)

Valuation allowance 221 70 75

Other, net (2,730) (2,982) (1,863)

144,317$ 138,597$ 144,198$

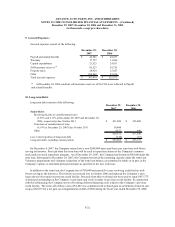

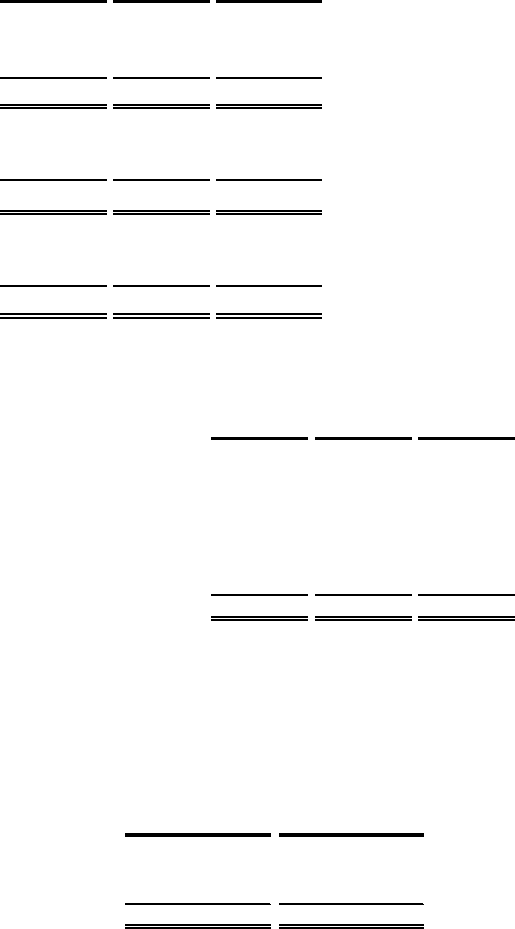

Deferred tax assets and liabilities are determined based on the differences between the financial statements and

tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to

reverse. Deferred income taxes reflect the net income tax effect of temporary differences between the basis of assets

and liabilities for financial reporting purposes and for income tax reporting purposes. Net deferred income tax

balances are comprised of the following:

December 29, December 30,

2007 2006

Deferred income tax assets 73,660$ 52,873$

Valuation allowance (1,396) (1,174)

Deferred income tax liabilities (118,404) (119,361)

Net

d

e

f

erre

d

i

ncome tax

li

a

bili

t

i

es

(

46,140

)

$

(

67,662

)

$

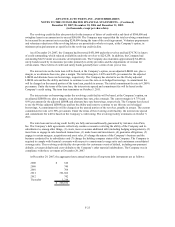

At December 29, 2007 and December 30, 2006, the Company has cumulative net deferred income tax liabilities

of $46,140 and $67,662, respectively. The deferred income tax assets also include state net operating loss

carryforwards, or NOLs, of approximately $3,214 and $1,752, respectively. These NOLs may be used to reduce

future taxable income and expire periodically through fiscal year 2027. Due to uncertainties related to the realization

of certain deferred tax assets for NOLs in certain jurisdictions, the Company recorded a valuation allowance of

F-25