Advance Auto Parts 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

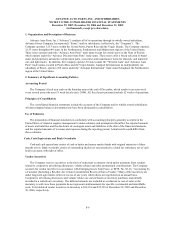

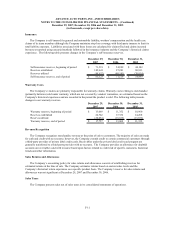

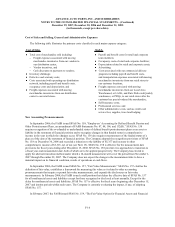

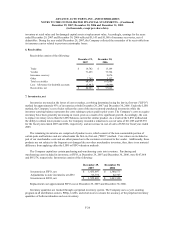

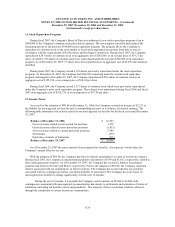

Cost of Sales and Selling, General and Administrative Expenses

The following table illustrates the primary costs classified in each major expense category:

Total cost of merchandise sold including: Payroll and benefit costs for retail and corporate

–Freight expenses associated with moving team members;

merchandise inventories from our vendors to Occupancy costs of retail and corporate facilities;

our distribution center, Depreciation related to retail and corporate assets;

–Vendor incentives, and Advertising;

–Cash discounts on payments to vendors; Costs associated with our commercial delivery

Inventory shrinkage; program, including payroll and benefit costs,

Defective and warranty costs; and transportation expenses associated with moving

Costs associated with operating our distribution merchandise inventories from our retail stores to

network, including payroll and benefit costs, our customer locations;

occupancy costs and depreciation; and Freight expenses associated with moving

Freight expenses associated with moving merchandise inventories from our Local Area

merchandise inventories from our distribution Warehoused, or LAWs, and Parts Delivered Quickly

center to our retail stores. warehouses, or PDQs, to our retail stores after the

customer has special-ordered the merchandise;

Self-insurance costs;

Professional services; and

Other administrative costs, such as credit card

service fees, supplies, travel and lodging.

Cost of Sales SG&A

New Accounting Pronouncements

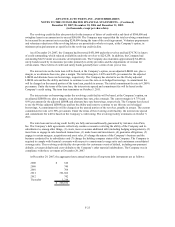

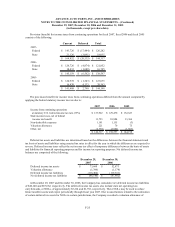

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R).” SFAS No. 158

requires recognition of the overfunded or underfunded status of defined benefit postretirement plans as an asset or

liability in the statement of financial position and to recognize changes in that funded status in comprehensive

income in the year in which the changes occur. SFAS No. 158 also requires measurement of the funded status of a

plan as of the date of the statement of financial position. The Company adopted the recognition provisions of SFAS

No. 158 on December 30, 2006 and recorded a reduction to the liability of $5,357 and increase to other

comprehensive income of $3,316, net of tax (see Note 15). SFAS No. 158 is effective for the measurement date

provisions for fiscal years ending after December 15, 2008. SFAS No. 158 provides two approaches to transition to

a fiscal year-end measurement date, both of which are to be applied prospectively. The Company has elected to

apply the alternate transition method under which a 14-month measurement will cover the period from November 1,

2007 through December 29, 2007. The Company does not expect the change in the measurement date to have a

material impact on its financial condition, results of operations or cash flows.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 clarifies the

definition of fair value, establishes a framework for measuring fair value as it related to other accounting

pronouncements that require or permit fair value measurements, and expands the disclosures on fair value

measurements. In February 2008, the FASB issued a staff position that delays the effective date of SFAS No. 157

for all nonfinancial assets and liabilities except for those recognized or disclosed at least annually. Except for the

delay for nonfinancial assets and liabilities, SFAS No. 157 is effective for fiscal years beginning after December 15,

2007 and interim periods within such years. The Company is currently evaluating the impact, if any, of adopting

SFAS No. 157.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

F-16