Advance Auto Parts 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

$1,396 as of December 29, 2007 and $1,174 as of December 30, 2006. The amount of deferred income tax assets

realizable, however, could change in the near future if estimates of future taxable income are changed.

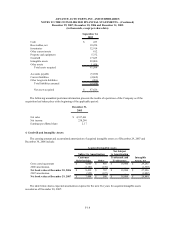

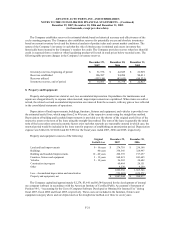

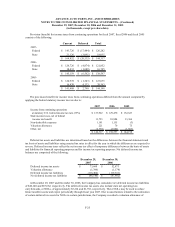

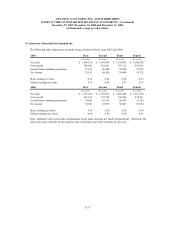

Temporary differences which give rise to significant deferred income tax assets (liabilities) are as follows:

December 29, December 30,

2007 2006

Current deferred income tax liabilities

Inventory differences (86,012)$ (79,071)$

Accrued medical and workers compensation 26,125 22,114

Accrued expenses not currently deductible for tax 13,635 15,213

Net operating loss carryforwards 817 130

Total current deferred income tax assets (liabilities) (45,435)$ (41,614)$

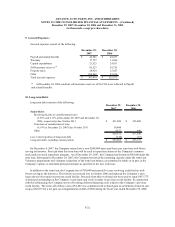

Long-term deferred income tax liabilities

Property and equipment (32,392) (40,194)

Postretirement benefit obligation 3,661 4,423

Share-based compensation 12,854 7,671

Net operating loss carryforwards 2,397 1,622

Valuation allowance (1,396) (1,174)

Other, net 14,171 1,604

Total long-term deferred income tax assets (liabilities) (705)$ (26,048)$

These amounts are recorded in other current liabilities and other long-term liabilities in the accompanying

consolidated balance sheets, as appropriate.

The Company files U.S. and state income tax returns in jurisdictions with varying statutes of limitations. The

2004 through 2007 tax years generally remain subject to examination by federal and most state tax authorities. In

management's opinion, any amounts assessed will not have a material effect on the Company's financial position,

results of operations or liquidity.

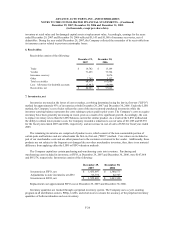

13. Lease Commitments:

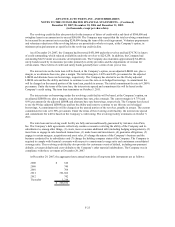

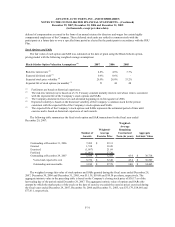

At December 29, 2007, future minimum lease payments due under non-cancelable operating leases with lease

terms ranging from 1 year to 20 years through the year 2027 for all open stores are as follows:

Total

2008 265,506$

2009 236,655

2010 218,592

2011 196,658

2012 173,768

Thereafter 1,051,480

2,142,659$

At December 29, 2007 and December 30, 2006, future minimum sub-lease income to be received under non-

cancelable operating leases is $7,596 and $7,333, respectively.

F-26