Advance Auto Parts 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

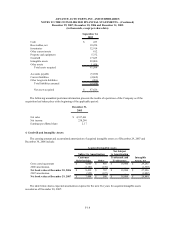

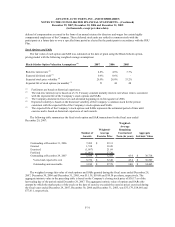

11. Stock Repurchase Program:

During fiscal 2007, the Company's Board of Directors authorized a new stock repurchase program of up to

$500,000 of the Company's common stock plus related expenses. The new program cancelled and replaced the

remaining portion of the previous $300,000 stock repurchase program. The program allows the Company to

repurchase its common stock on the open market or in privately negotiated transactions from time to time in

accordance with the requirements of the Securities and Exchange Commission. During fiscal 2007, the Company

repurchased 8,341 shares of common stock at an aggregate cost of $285,869, or an average price of $34.27 per

share, of which 1,330 shares of common stock were repurchased under the previous $300,000 stock repurchase

program. As of December 29, 2007, 77 shares have been repurchased at an aggregate cost of $2,959 and remained

unsettled.

During fiscal 2007, the Company retired 6,329 shares previously repurchased under the stock repurchase

programs. At December 29, 2007, the Company had $260,567 remaining under the current stock repurchase

program. Subsequent to December 29, 2007, the Company repurchased 4,563 shares of common stock at an

aggregate cost of $155,350, or an average price of $34.04 per share.

During fiscal 2006, the Company retired 5,117 shares of common stock which were previously repurchased

under the Company’s prior stock repurchase program. These shares were repurchased during fiscal 2006 and fiscal

2005 at an aggregate cost of $192,339, or an average price of $37.59 per share.

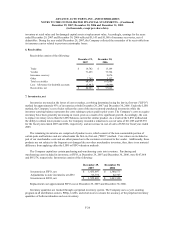

12. Income Taxes:

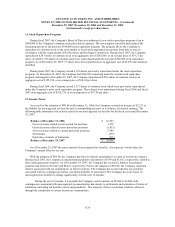

As a result of the adoption of FIN 48 on December 31, 2006, the Company recorded an increase of $2,275 to

the liability for unrecognized tax benefits and a corresponding decrease in its balance of retained earnings. The

following table summarizes the activity related to our unrecognized tax benefits for the fiscal year ended December

29, 2007:

Balance at December 31, 2006 16,453$

Gross increases related to prior period tax positions 1,279

Gross decreases related to prior period tax positions (1,853)

Gross increases related to current period tax positions 5,340

Settlements (539)

Expiration of statute of limitations (271)

Balance at December 29, 2007 20,409$

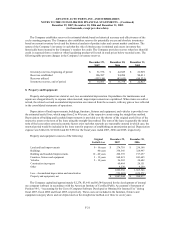

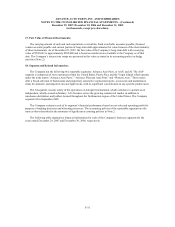

As of December 29, 2007 the entire amount of unrecognized tax benefits, if recognized, would reduce the

Company’s annual effective tax rate.

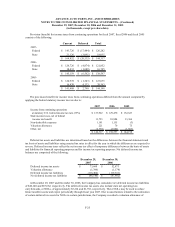

With the adoption of FIN 48, the Company provides for interest and penalties as a part of income tax expense.

During fiscal 2007, the Company accrued potential penalties and interest of $709 and $1,827, respectively, related to

these unrecognized tax benefits. As of December 29, 2007, the Company has recorded a liability for potential

penalties and interest of $1,843 and $4,421, respectively. Prior to the adoption of FIN 48, the Company classified

interest associated with tax contingencies in interest expense. The Company has not provided for any penalties

associated with tax contingencies unless considered probable of assessment. The Company does not expect its

unrecognized tax benefits to change significantly over the next 12 months.

During the next 12 months, it is possible the Company could conclude on $2,000 to $3,000 of the

contingencies associated with unrecognized tax uncertainties due mainly to settlements and expiration of statute of

limitations (including tax benefits, interest and penalties). The majority of these resolutions would be achieved

through the completion of current income tax examinations.

F-24