Advance Auto Parts 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

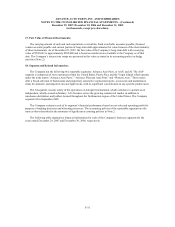

Prior to December 31, 2006, the Company accrued for tax contingencies when it was probable that a liability to

a taxing authority had been incurred and the amount of the contingency could be reasonably estimated, based on past

experience. Effective December 31, 2006, the accounting for income tax contingencies changed with the adoption of

FIN 48 as previously explained in the Company’s income tax footnote. The Company’s tax contingency reserve at

December 30, 2006 was $6,415. It is the opinion of the Company’s management that the possibility is remote that

costs in excess of those reserved for will have a material adverse impact on the Company’s financial position, results

of operations or liquidity.

The Company has entered into employment agreements with certain team members that provide severance pay

benefits under certain circumstances, including termination of employment of the team member by the Company.

The maximum contingent liability under these employment agreements is approximately $3,306 and $5,590 at

December 29, 2007 and December 30, 2006, respectively, of which nothing has been accrued.

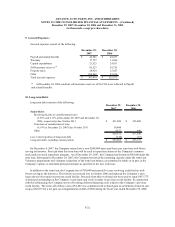

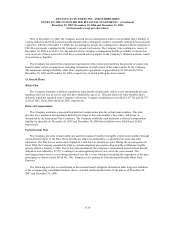

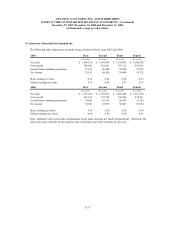

15. Benefit Plans:

401(k) Plan

The Company maintains a defined contribution team member benefit plan, which covers substantially all team

members after one year of service and who have attained the age of 21. The plan allows for team member salary

deferrals, which are matched at the Company’s discretion. Company contributions were $8,234, $7,726 and $6,779

in fiscal 2007, fiscal 2006 and fiscal 2005, respectively.

Deferred Compensation

The Company maintains a non-qualified deferred compensation plan for certain team members. This plan

provides for a minimum and maximum deferral percentage of the team member’s base salary and bonus, as

determined by the Retirement Plan Committee. The Company establishes and maintains a deferred compensation

liability for this plan. At December 29, 2007 and December 30, 2006 these liabilities were $4,668 and $3,402,

respectively.

Postretirement Plan

The Company provides certain health care and life insurance benefits for eligible retired team members through

a postretirement plan, or the Plan. These benefits are subject to deductibles, co-payment provisions and other

limitations. The Plan has no assets and is funded on a cash basis as benefits are paid. During the second quarter of

fiscal 2004, the Company amended the Plan to exclude outpatient prescription drug benefits to Medicare eligible

retirees effective January 1, 2006. Due to this plan amendment, the Company's accumulated postretirement benefit

obligation was reduced by $7,557, resulting in an unrecognized prior service cost in the same amount. The

unrecognized prior service cost is being amortized over the 13-year estimated remaining life expectancy of the plan

participants as allowed under SFAS No. 106, “Employers Accounting for Postretirement Benefits Other Than

Pensions.”

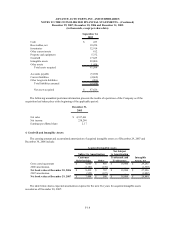

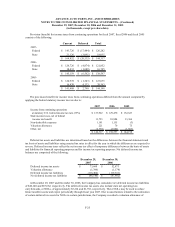

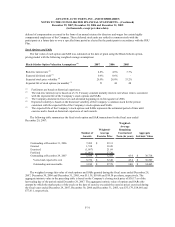

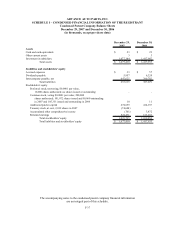

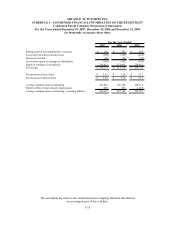

The following provides a reconciliation of the accrued benefit obligation included in other long-term liabilities

in the accompanying consolidated balance sheets, recorded and the funded status of the plan as of December 29,

2007 and December 30, 2006:

F-28