Advance Auto Parts 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

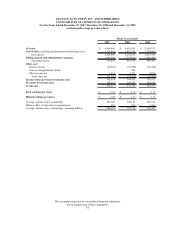

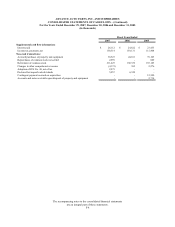

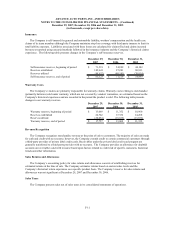

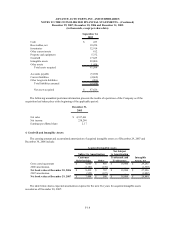

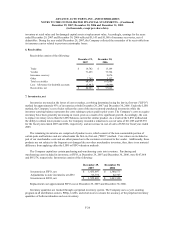

Insurance

The Company is self-insured for general and automobile liability, workers' compensation and the health care

claims of its team members although the Company maintains stop-loss coverage with third-party insurers to limit its

total liability exposure. Liabilities associated with these losses are calculated for claims filed and claims incurred

but not yet reported using actuarial methods followed in the insurance industry and the Company’s historical claims

experience. The following table presents changes in the Company’s self-insurance reserves.

December 29, December 30, December 31,

2007 2006 2005

Self-insurance reserves, beginning of period 71,519$ 54,899$ 44,102$

Reserves established 102,641 97,201 80,811

Reserves utilized (88,637) (80,581) (70,014)

Self-insurance reserves, end of period 85,523$ 71,519$ 54,899$

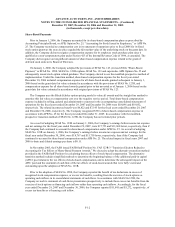

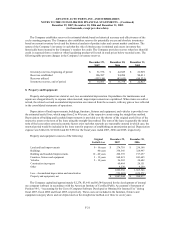

Warranty Costs

The Company's vendors are primarily responsible for warranty claims. Warranty costs relating to merchandise

(primarily batteries) sold under warranty, which are not covered by vendors' warranties, are estimated based on the

Company's historical experience and are recorded in the period the product is sold. The following table presents

changes in our warranty reserves.

December 29, December 30, December 31,

2007 2006 2005

Warranty reserves, beginning of period 13,069$ 11,352$ 10,960$

Reserves established 24,722 17,352 14,268

Reserves utilized (20,034) (15,635) (13,876)

Warranty reserves, end of period 17,757$ 13,069$ 11,352$

Revenue Recognition

The Company recognizes merchandise revenue at the point of sale to customers. The majority of sales are made

for cash and credit with no recourse; however, the Company extends credit to certain commercial customers through

a third-party provider of private label credit cards. Receivables under the private label credit card program are

generally transferred to a third-party provider with no recourse. The Company provides an allowance for doubtful

accounts on receivables sold with recourse based upon factors related to credit risk of specific customers, historical

trends and other information.

Sales Returns and Allowances

The Company’s accounting policy for sales returns and allowances consists of establishing reserves for

estimated returns at the time of sale. The Company estimates returns based on current sales levels and the

Company’s historical return experience on a specific product basis. The Company’s reserve for sales returns and

allowances was not significant at December 29, 2007 and December 30, 2006.

Sales Taxes

The Company presents sales net of sales taxes in its consolidated statements of operations.

F-11