Advance Auto Parts 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Credit Ratings

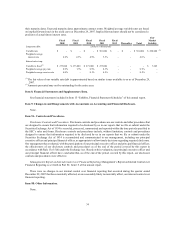

At December 29, 2007, we had a credit rating from Standard & Poor’s of BB+ and a credit rating of Ba1 from

Moody’s Investor Service. The current pricing grid used to determine our borrowing rates under our revolving credit

facility is based on such credit ratings. If these credit ratings decline, our interest expense may increase. Conversely,

if these credit ratings improve, our interest expense may decrease.

Recent Accounting Developments

Share-Based Compensation

We have share-based compensation plans as allowed under our long-term incentive plan, or LTIP. Historically,

we have granted fixed stock options and deferred stock units, or DSUs, to our employees under these plans.

Beginning in fiscal 2007, we granted primarily stock appreciation rights, or SARs, and restricted stock, or unvested

shares. We continue to grant DSUs to members of our board of directors and, beginning in 2008, we will grant

SARs to our board members rather than stock options.

The terms of the SARs authorized to be granted are essentially the same as our previously granted stock

options. The SARs are non-qualified and terminate on the seventh anniversary of the grant date. Additionally, they

vest over a three-year period in equal annual installments beginning on the first anniversary of the grant date and

contain no post-vesting restrictions other than normal trading black-out periods prescribed by our corporate

governance policies. We continue to use the Black-Scholes option-pricing model to value all awards and the

straight-line method to amortize this fair value as compensation cost over the requisite service period.

The unvested shares vest at the end of a three-year period. During this period, holders of the unvested shares are

entitled to dividend and voting rights. The unvested shares are restricted until they vest and cannot be sold by the

recipient until the restriction has lapsed at the end of the three-year period. The fair value of unvested shares is

determined based on the market price of our common stock on the date of grant.

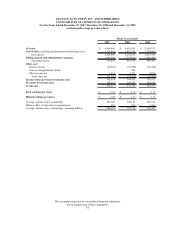

Total share-based compensation expense included in selling, general and administrative expenses in the

accompanying consolidated statements of operations for fiscal years 2007 and 2006 is $18.1 million and $19.1

million, respectively. We recognized a nominal amount of share-based compensation during fiscal year 2005 since

the adoption of SFAS No. 123 (revised 2004), "Share-Based Payment," or SFAS 123R, was effective at the

beginning of fiscal 2006. For a complete discussion of the adoption of SFAS 123R, see Note 2 of the accompanying

consolidated financial statements. As of December 29, 2007, we have $19.5 million of unrecognized compensation

expense related to non-vested share-based awards we expect to recognize over a weighted average period of 1.8

years.

Income Taxes

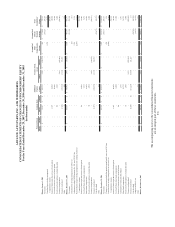

Effective December 31, 2006, we adopted the provisions of FIN 48. FIN 48 clarifies the accounting and

reporting for income taxes recognized in accordance with Statement of Financial Accounting Standards, or SFAS,

No. 109, “Accounting for Income Taxes.” The interpretation prescribes a recognition threshold and measurement

attribute for the financial statement recognition, measurement, presentation and disclosure of uncertain tax positions

taken or expected to be taken in income tax returns. As a result of the adoption of FIN 48 on December 31, 2006, we

recorded an increase of $2.3 million to the liability for unrecognized tax benefits and a corresponding decrease in

our balance of retained earnings. For a complete discussion of the adoption of FIN 48, see Note 12 of the

accompanying consolidated financial statements.

New Accounting Pronouncements

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R).” SFAS No. 158

requires recognition of the overfunded or underfunded status of defined benefit postretirement plans as an asset or

liability in the statement of financial position and to recognize changes in that funded status in comprehensive

income in the year in which the changes occur. SFAS No. 158 also requires measurement of the funded status of a

32