Advance Auto Parts 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

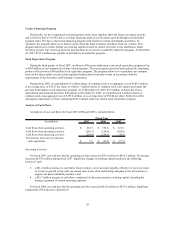

x$54.3 million decrease in financed vendor accounts payable;

x$504.0 million cash inflow resulting from an increase in net borrowings;

x$433.8 million used for early extinguishment of debt in fiscal 2006;

x$19.2 million paid in dividends in fiscal 2006;

x$36.0 million increase in cash used to repurchase shares of our common stock under our stock repurchase

program;

x$15.1 million decrease in proceeds from the exercise of stock options; and

x$26.3 million increase resulting from the repayment of secured borrowings in fiscal 2005.

Off-Balance-Sheet Arrangements

As of December 29, 2007, we had outstanding $74.7 million in letters of credit and $2.5 million of surety

bonds. These items are considered off-balance-sheet arrangements as defined in Item 303 of Regulation S-K

promulgated by the Securities and Exchange Commission.

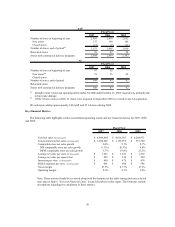

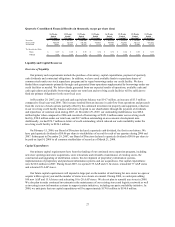

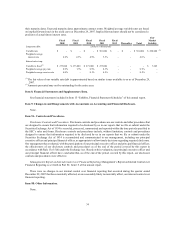

Contractual Obligations

In addition to our revolving credit facility, we also utilize operating leases as another source of financing. The

amounts payable under these operating leases are included in our schedule of contractual obligations. Our future

contractual obligations related to long-term debt, operating leases and other contractual obligations at December 29,

2007 were as follows:

Fiscal Fiscal Fiscal Fiscal Fiscal

Contractual Obligations Total 2008 2009 2010 2011 2012 Thereafter

(in thousands)

Long-term debt 505,672$ 610$ 740$ 704$ 501,662$ 742$ 1,214$

Interest payments 102,509$ 26,397$ 25,244$ 26,522$ 24,301$ 44$ 1$

Operating leases

(1)

2,142,659$ 265,506$ 236,655$ 218,592$ 196,658$ 173,768$ 1,051,480$

Purchase obligations

(2)

8,727$ 8,727$ -$ -$ -$ -$ -$

Other long-term liabilities

(3)

50,781$ -$ -$ -$ -$ -$ -$

(1)

(2)

(3)

We lease certain store locations, distribution centers, office space, equipment and vehicles. Our property

leases generally contain renewal and escalation clauses and other concessions. These provisions are

considered in our calculation of our minimum lease payments which are recognized as expense on a

straight-line basis over the applicable lease term. In accordance with SFAS No. 13, “Accounting for

Leases,” as amended by SFAS No. 29, “Determining Contingent Rental,” any lease payments that are

based upon an existing index or rate, are included in our minimum lease payment calculations.

For the purposes of this table, purchase obligations are defined as agreements that are enforceable and

legally binding and that specify all significant terms, including: fixed or minimum quantities to be

purchased; fixed, minimum or variable price provisions; and the approximate timing of the transaction. Our

open purchase orders are based on current inventory or operational needs and are fulfilled by our vendors

within short periods of time. We currently do not have minimum purchase commitments under our vendor

supply agreements nor are our open purchase orders for goods and services binding agreements.

Accordingly, we have excluded open purchase orders from this table. The purchase obligations consist of

the amount of fuel required to be purchased by us under certain fixed price fuel supply agreements and

certain commitments for training and development. All of these agreements expire in 2008.

Primarily includes employee benefits accruals, restructuring and closed store liabilities and deferred income

taxes for which no contractual payment schedule exists and we expect the payments to occur beyond 12

months from December 29, 2007. Additionally, other long-term liabilities include $20.4 million of

unrecognized income tax benefits as a result of our adoption on FIN 48 on December 31, 2006. During the

next 12 months, it is possible that we could conclude on $2 to $3 million of the contingencies associated

with these tax uncertainties, a portion of which may be settled in cash. We do not anticipate any significant

impact on our liquidity and capital resources due to the conclusion of these tax matters.

30