Advance Auto Parts 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vendor Financing Program

Historically, we have negotiated extended payment terms from suppliers that help finance inventory growth,

and we believe that we will be able to continue financing much of our inventory growth through such extended

payment terms. We have a short-term financing program with a bank for certain merchandise purchases. In

substance, the program allows us to borrow money from the bank to finance purchases from our vendors. This

program allows us to reduce further our working capital invested in current inventory levels and finance future

inventory growth. Our revolving and term loan facilities do not restrict availability under this program. At December

29, 2007, $153.5 million was payable to the bank by us under this program.

Stock Repurchase Program

During the third quarter of fiscal 2007, our Board of Directors authorized a new stock repurchase program of up

to $500 million of our common stock plus related expenses. The new program cancelled and replaced the remaining

portion of the previous $300 million stock repurchase program. The program allows us to repurchase our common

stock on the open market or in privately negotiated transactions from time to time in accordance with the

requirements of the Securities and Exchange Commission.

During fiscal 2007, we repurchased 8.3 million shares of common stock at an aggregate cost of $285.9 million,

or an average price of $34.27 per share, of which 1.3 million shares of common stock were repurchased under the

previous $300 million stock repurchase program. As of December 29, 2007, $3.0 million of shares have been

repurchased and remained unsettled. Subsequent to December 29, 2007, we repurchased 4.6 million shares of

common stock at an aggregate cost of $155.4 million, or an average price of $34.04 per share. Reflective of the

subsequent repurchases, we have remaining $105.2 million under our current stock repurchase program.

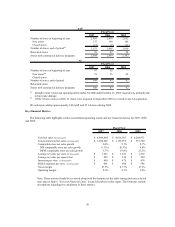

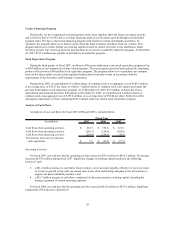

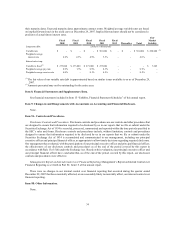

Analysis of Cash Flows

An analysis of our cash flows for fiscal 2007, 2006 and 2005 is included below.

(in millions) 2007 2006 2005

Cash flows from operating activities 410.5$ 333.6$ 321.6$

Cash flows from investing activities (202.1) (258.6) (302.8)

Cash flows from financing activities (204.9) (104.6) (34.3)

Net increase (decrease) in cash and

cash equivalents 3.5$ (29.6)$ (15.5)$

Fiscal Year

Operating Activities

For fiscal 2007, net cash provided by operating activities increased $76.9 million to $410.5 million. Net income

increased by $7.0 million during fiscal 2007. Significant changes in working capital resulted in the following

sources of cash:

xa $41.2 million increase in cash flows from inventory, net of accounts payable, reflective of our slow down

of inventory growth in line with our current sales trend, while maintaining adequate levels of inventory to

support our parts availability initiative; and

xa $35.7 million increase in cash flows comprised of other movements in working capital, including the

timing in payment of certain operating expenses.

For fiscal 2006, net cash provided by operating activities increased $12.0 million to $333.6 million. Significant

components of this increase consisted of:

28