Advance Auto Parts 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

Liabilities.” SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items

at fair value. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. The Company is

currently evaluating the impact, if any, of adopting SFAS No. 159.

In December 2007, the FASB issued SFAS No. 141R, “Business Combinations,” which replaces SFAS No.

141, “Business Combinations.” SFAS No. 141R, among other things, establishes principles and requirements for

how an acquirer entity recognizes and measures in its financial statements the identifiable assets acquired, the

liabilities assumed and any controlling interests in the acquired entity; recognizes and measures the goodwill

acquired in the business combination or a gain from a bargain purchase; and determines what information to disclose

to enable users of the financial statements to evaluate the nature and financial effects of the business

combination. Costs of the acquisition will be recognized separately from the business combination. SFAS No. 141R

applies to business combinations for fiscal years beginning after December 15, 2008.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements – an amendment of ARB No. 51.” SFAS No. 160, among other things, provides guidance and establishes

amended accounting and reporting standards for a parent company’s noncontrolling interest in a subsidiary. SFAS

No. 160 is effective for fiscal years beginning on or after December 15, 2008. The Company does not expect the

adoption of SFAS No. 160 to have a material impact on its financial condition, results of operations or cash flows.

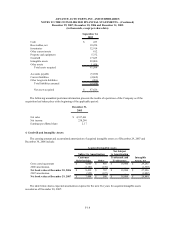

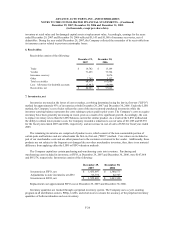

3. Acquisitions:

On September 14, 2005, the Company acquired Autopart International, Inc., or AI. The acquisition, which

included 61 stores throughout New England and New York, a distribution center and AI’s wholesale distribution

business, complements the Company’s growing presence in the Northeast. AI serves the growing commercial

market in addition to warehouse distributors and jobbers.

The acquisition has been accounted for under the provisions of SFAS No. 141, “Business Combinations”, or

SFAS No. 141. The total purchase price of $87,626 primarily consisted of $74,940 paid upon closing and an

additional $12,500 of contingent consideration paid in March 2006 based upon AI satisfying certain earnings before

interest, taxes, depreciation and amortization targets through December 31, 2005. Furthermore, an additional

$12,500 is payable upon the achievement of certain merchandise cost reduction synergies through fiscal 2008, of

which $11,633 has been paid as of December 29, 2007. In accordance with SFAS No. 141, this additional payment

does not represent contingent consideration and will be reflected in the statement of operations when considered

probable and estimable. The Company recognized $8,519 and $3,114 in cost of goods sold due to such synergies for

the year ended December 29, 2007 and December 30, 2006, respectively.

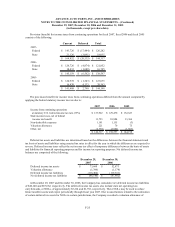

During the third quarter of fiscal 2006, the Company finalized the allocation of the purchase price to the assets

acquired and liabilities assumed. The Company allocated $29,000 to intangible assets based on a valuation study. A

portion of these intangible assets are subject to amortization and are being amortized over their estimated useful

lives ranging from 5 to 10 years using straight-line methods. Remaining adjustments to the fair value of assets and

liabilities acquired primarily included inventory and deferred income taxes. Accordingly, the Company’s initial

goodwill balance was adjusted down to $17,625 as a result of these adjustments, all of which is deductible for tax

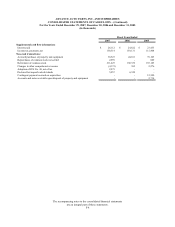

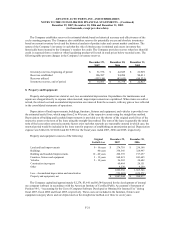

purposes. The following table summarizes the final allocation of amounts assigned to assets acquired and liabilities

assumed as of the date of acquisition:

F-17