Advance Auto Parts 2007 Annual Report Download - page 69

Download and view the complete annual report

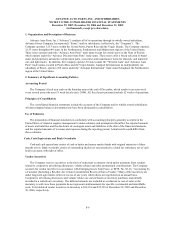

Please find page 69 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

The Company recognizes other promotional incentives earned under long-term agreements as a reduction to

cost of sales. These incentives are recognized based on the cumulative net purchases as a percentage of total

estimated net purchases over the life of the agreement. The Company's margins could be impacted positively or

negatively if actual purchases or results from any one year differ from its estimates; however, the impact over the

life of the agreement would be the same. Short-term incentives (terms less than one year) are recognized as a

reduction to cost of sales over the course of the agreements.

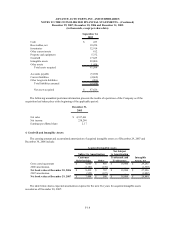

Amounts received or receivable from vendors that are not yet earned are reflected as deferred revenue in the

accompanying consolidated balance sheets. Management's estimate of the portion of deferred revenue that will be

realized within one year of the balance sheet date has been included in other current liabilities in the accompanying

consolidated balance sheets. Total deferred revenue is $9,238 and $8,006 at December 29, 2007 and December 30,

2006, respectively. Earned amounts that are receivable from vendors are included in receivables, net except for that

portion expected to be received after one year, which is included in other assets, net on the accompanying

consolidated balance sheets.

Preopening Expenses

Preopening expenses, which consist primarily of payroll and occupancy costs, are expensed as incurred.

Income Taxes

The Company accounts for income taxes under the asset and liability method, which requires the recognition of

deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the

financial statements. Under this method, deferred tax assets and liabilities are determined based on the differences

between the financial statements and tax basis of assets and liabilities using enacted tax rates in effect for the year in

which the differences are expected to reverse. The effect of a change in tax rates on deferred tax assets and liabilities

is recognized in income in the period of the enactment date.

The Company records net deferred tax assets to the extent it believes these assets will more likely than not be

realized. In making such determination, the Company considers all available positive and negative evidence,

including scheduled reversals of deferred tax liabilities, projected future taxable income, tax planning strategies and

recent financial operations. In the event the Company was to determine that it would be able to realize the

Company’s deferred income tax assets in the future in excess of their net recorded amount, the Company would

make an adjustment to the valuation allowance which would reduce the provision for income taxes.

In July 2006, the FASB issued Financial Interpretation No. 48, “Accounting for Uncertainty in Income Taxes,”

or FIN 48, which clarifies the accounting for uncertainty in income taxes recognized in the financial statements in

accordance with SFAS No. 109, “Accounting for Income Taxes.” FIN 48 provides that a tax benefit from an

uncertain tax position may be recognized when it is more likely than not that the position will be sustained upon

examination, including resolutions of any related appeals or litigation processes, based on the technical merits.

Income tax positions must meet a more-likely-than-not recognition threshold at the effective date to be

recognized upon the adoption of FIN 48 and in subsequent periods. This interpretation also provides guidance on

measurement, derecognition of benefits, classification, interest and penalties, accounting in interim periods,

disclosure and transition. The Company adopted the provisions of FIN 48 on December 31, 2006. Refer to Note 12

for further discussion of income taxes and the impact of adopting FIN 48.

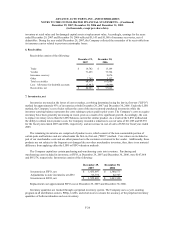

Advertising Costs

The Company expenses advertising costs as incurred in accordance with the American Institute of Certified

Public Accountant’s Statement of Position, or SOP, 93-7, “Reporting on Advertising Costs.” Gross advertising

expense incurred was approximately $78,823, $97,215 and $95,702 in fiscal 2007, 2006 and 2005, respectively.

F-10