Advance Auto Parts 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

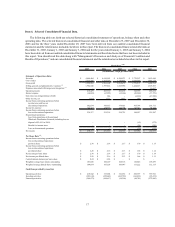

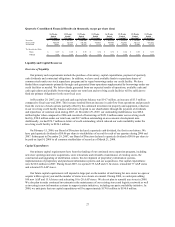

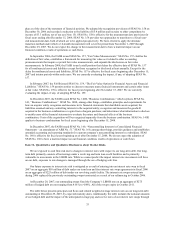

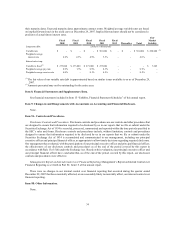

Quarterly Consolidated Financial Results (in thousands, except per share data)

16-Weeks 12-Weeks 12-Weeks 12-Weeks 16-Weeks 12-Weeks 12-Weeks 12-Weeks

Ended Ended Ended Ended Ended Ended Ended Ended

4/22/2006 7/15/2006 10/7/2006 12/30/2006 4/21/2007 7/14/2007 10/6/2007 12/29/2007

Net sales 1,393,010$ 1,107,857$ 1,099,486$ 1,016,150$ 1,468,120$ 1,169,859$ 1,158,043$ 1,048,382$

Gross

p

rofi

t

665,168 527,359 530,206 478,431 709,403 562,861 555,113 493,592

Net income 74,081$ 62,936$ 58,947$ 35,354$ 76,101$ 68,424$ 59,040$ 34,752$

Net income

p

er share:

Basic 0.69$ 0.60$ 0.56$ 0.34$ 0.72$ 0.64$ 0.58$ 0.35$

Diluted 0.68$ 0.59$ 0.56$ 0.33$ 0.71$ 0.64$ 0.57$ 0.35$

Liquidity and Capital Resources

Overview of Liquidity

Our primary cash requirements include the purchase of inventory, capital expenditures, payment of quarterly

cash dividends and contractual obligations. In addition, we have used available funds to repurchase shares of

common stock under our stock repurchase program and to repay borrowings under our credit facility. We have

funded these requirements primarily through cash generated from operations supplemented by borrowings under our

credit facilities as needed. We believe funds generated from our expected results of operations, available cash and

cash equivalents and available borrowings under our term loan and revolving credit facilities will be sufficient to

fund our primary obligations for the next fiscal year.

At December 29, 2007, our cash and cash equivalents balance was $14.7 million, an increase of $3.5 million

compared to fiscal year-end 2006. This increase resulted from an increase in cash flow from operations and proceeds

from the exercise of stock options partially offset by the continued investment in property and equipment, reduction

in our revolving credit facility balance and return of capital to our shareholders through the payment of dividends

and repurchase of common stock during 2007. At December 29, 2007, our outstanding indebtedness was $28.4

million higher when compared to 2006 and consisted of borrowings of $451.0 million under our revolving credit

facility, $50.0 million under our term loan, and $4.7 million outstanding on an economic development note.

Additionally, we had $74.7 million in letters of credit outstanding, which reduced our cash availability under the

revolving credit facility to $224.3 million.

On February 15, 2006, our Board of Directors declared a quarterly cash dividend, the first in our history. We

have paid quarterly dividends of $0.06 per share to stockholders of record for each of our quarters during 2006 and

2007. Subsequent to December 29, 2007, our Board of Directors declared a quarterly dividend of $0.06 per share to

be paid on April 4, 2008 to all common stockholders of record as of March 21, 2008.

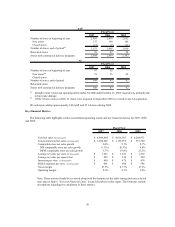

Capital Expenditures

Our primary capital requirements have been the funding of our continued store expansion program, including

new store openings and store acquisitions, store relocations and remodels, maintenance of existing stores, the

construction and upgrading of distribution centers, the development of proprietary information systems,

implementation of proprietary and purchased information systems and our acquisitions. Our capital expenditures

were $210.6 million in 2007. During fiscal 2007, we opened 175 AAP and 21 AI stores, remodeled 77 AAP stores

and relocated 29 AAP stores.

Our future capital requirements will depend in large part on the number of and timing for new stores we open or

acquire within a given year and the number of stores we relocate or remodel. During 2008, we anticipate adding

100 new AAP and 15 AI stores and relocating 10 to 20 AAP stores. We do not plan to remodel any stores in 2008.

We also plan to make continued investments in the maintenance of our existing stores and logistics network as well

as investing in new information systems to support certain initiatives, including our parts availability initiative. In

2008, we anticipate that our capital expenditures will be approximately $170.0 million to $190.0 million.

27