Advance Auto Parts 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

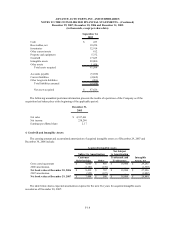

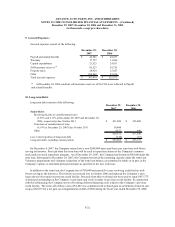

2008 1,087$

2009 1,087

2010 1,059

2011 967

2012 967

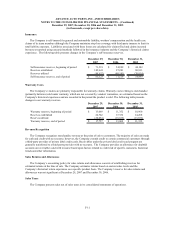

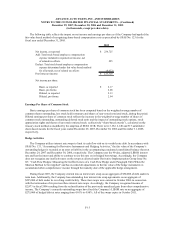

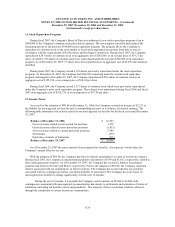

The changes in the carrying amount of goodwill for the years ended December 29, 2007 and December 30, 2006,

respectively, are as follows:

AAP Segment AI Segment Total

Balance at December 31, 2005 16,654$ 50,440$ 67,094$

Reclassification to intangible assets among

other purchase accounting adjustments (561) (32,815) (33,376)

Balance at December 30, 2006 16,093$ 17,625$ 33,718$

Fiscal 2007 activity - - -

Balance at December 29, 2007 16,093$ 17,625$ 33,718$

The carrying amount of goodwill decreased from $67,094 at December 31, 2005 to $33,718 at December 30,

2006 as a result of the completion of certain purchase accounting adjustments associated with the AI acquisition

(Note 3).

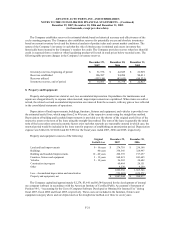

5. Catastrophic Losses and Insurance Recoveries:

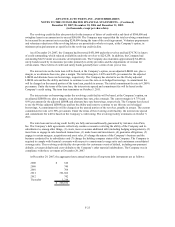

During the second half of fiscal 2005, the Company suffered losses resulting from Hurricanes Katrina, Rita and

Wilma as well as two stores damaged by fire. The Company estimated and recognized the fixed costs of these events

including the write-off of damaged merchandise at cost, damaged capital assets at net book value and required repair

costs. Moreover, these hurricanes caused significant sales disruptions primarily from store closures, stores operating

on limited hours and lower sales trends due to evacuations. The Company also incurred and recognized incremental

expenses associated with compensating team members for scheduled work hours for which stores were closed and

food and supplies provided to team members and their families. While these costs and sales disruptions were not

recoverable from the Company’s insurance carrier, the Company did maintain property insurance against the fixed

costs of the related physical damage including the recovery of damaged merchandise at retail values and damaged

capital assets at replacement cost. Prior to December 31, 2005, the Company and the insurance carrier settled in full

a claim for the retail value of certain merchandise inventory damaged by Hurricanes Katrina and Wilma. The

Company evaluated and recognized a receivable for the recovery of these fixed costs, net of deductibles.

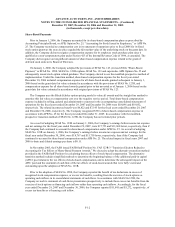

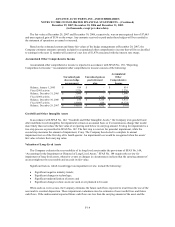

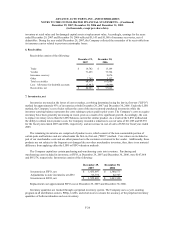

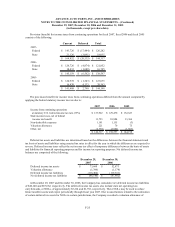

The following table represents the net impact of certain insured fixed costs less recoveries as reflected in the

selling, general and administrative line of the accompanying consolidated statement of operations for the fiscal year

ended December 31, 2005.

December 31,

2005

Estimated fixed costs 15,351$

Insurance recovery of fixed costs, net of deductibles (6,518)

Insurance recovery for merchandise inventories settled

during the year, net of deductibles (8,941)

Net expense (108)$

(a)

(a) Does not include the earnings impact of sales disruptions.

During the years ended December 29, 2007 and December 30, 2006, the Company received additional

recoveries as the Company settled additional hurricane claims and claims from other isolated events for damaged

F-19