Advance Auto Parts 2007 Annual Report Download - page 74

Download and view the complete annual report

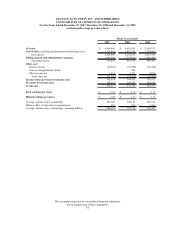

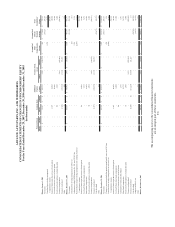

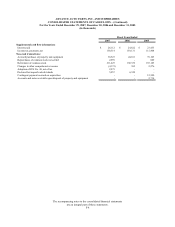

Please find page 74 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

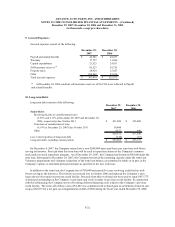

carrying amount of the asset exceeds its fair value, an impairment loss is recognized. Management utilizes an

expected present value technique, which uses a risk-free rate and multiple cash flow scenarios reflecting the range of

possible outcomes, to estimate fair value of the asset. Actual useful lives and cash flows could differ from those

estimated by management using these techniques, which could have a material affect on our results of operations,

financial position or cash flows.

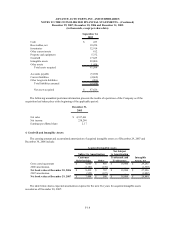

Financed Vendor Accounts Payable

The Company is party to a short-term financing program with a bank allowing it to extend its payment terms on

certain merchandise purchases. The substance of the program is for the Company to borrow money from the bank to

finance purchases from vendors. The Company records any discount given by the vendor to the value of its

inventory and accretes this discount to the resulting short-term payable to the bank through interest expense over the

extended term. At December 29, 2007 and December 30, 2006, $153,549 and $127,543, respectively, was payable

to the bank by the Company under this program and is included in the accompanying consolidated balance sheets as

Financed Vendor Accounts Payable.

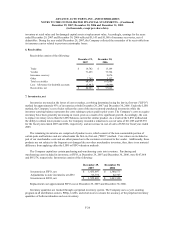

Lease Accounting

The Company leases certain store locations, distribution centers, office space, equipment and vehicles. Initial

terms for facility leases are typically 10 to 15 years, followed by additional terms containing renewal options at five

year intervals, and may include rent escalation clauses. The total amount of the minimum rent is expensed on a

straight-line basis over the initial term of the lease unless external economic factors exist such that renewals are

reasonably assured, in which case the Company would include the renewal period in its amortization period. In those

instances the renewal period would be included in the lease term for purposes of establishing an amortization period

and determining if such lease qualified as a capital or operating lease. In addition to minimum fixed rentals, some

leases provide for contingent facility rentals. Contingent facility rentals are determined on the basis of a percentage

of sales in excess of stipulated minimums for certain store facilities as defined in the individual lease agreements.

Most of the leases provide that the Company pay taxes, maintenance, insurance and certain other expenses

applicable to the leased premises and include options to renew. Management expects that, in the normal course of

business, leases that expire will be renewed or replaced by other leases.

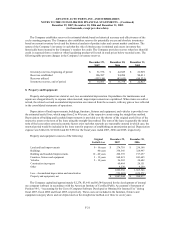

Closed Store Liabilities

The Company continually reviews the operating performance of its existing store locations and closes certain

locations identified as under performing. The Company evaluates and determines if closing an under performing

location results in the elimination of the operations and associated cash flows from the Company’s ongoing

operations or if the Company transferred those operations to another location in the local market. The Company

maintains closed store liabilities that include liabilities for these exit activities.

New provisions established for closed store liabilities include the present value of the remaining lease

obligations and management’s estimate of future costs of insurance, property tax and common area maintenance

reduced by the present value of estimated revenues from subleases and lease buyouts and are established by a charge

to selling, general and administrative costs in the accompanying consolidated statements of operations at the time

the facilities actually close.

From time to time these estimates require revisions that affect the amount of the recorded liability. This change

in estimate relates primarily to changes in assumptions associated with the revenue from subleases. The effect of

changes in estimates for the closed store liabilities and included in selling, general and administrative expenses in

the accompanying consolidated statements of operations. Closed store liabilities are recorded in accrued expenses

(current portion) and other long-term liabilities (long-term portion) in the accompanying consolidated balance

sheets.

F-15