Advance Auto Parts 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

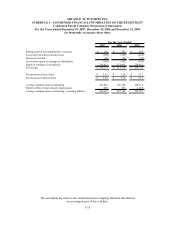

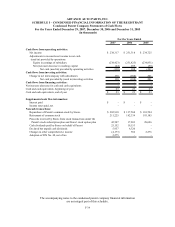

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 29, 2007, December 30, 2006 and December 31, 2005

(in thousands, except per share data)

At December 29, 2007, there are 3,766 shares currently available for future issuance under the LTIP. The

Company issues new shares of common stock upon exercise of stock options and SARs. During fiscal 2007, the

Company’s shareholders approved an amendment to its LTIP which authorized the addition of 3,500 shares.

Subsequent to December 29, 2007, the Company made a series of share-based award grants to employees,

including its newly appointed CEO, other recently hired executives and its annual grant to employees eligible to

receive share-based awards under the Company’s LTIP. Accordingly, the Company granted 1,362 SARs to be

settled in the Company’s common stock at a weighted average conversion price of $34.37 and 283 shares of

unvested shares at a weighted average grant price of $35.13.

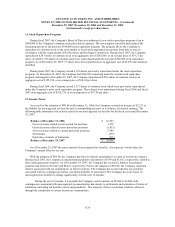

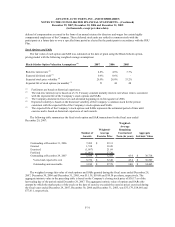

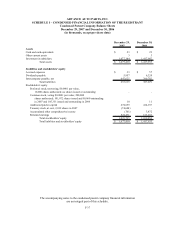

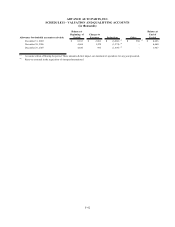

Unvested Stock

The following table summarizes the unvested share awards for the fiscal year ended December 29, 2007:

Number of

Awards

Weighted-

Average Grant

Date Fair Value

Unvested at December 31, 2006 - -$

Granted 160 38.14

Vested - -

Forfeited (30) 38.03

Unvested at December 29, 2007 130 38.17$

The fair value of each unvested share award is determined based on the market price of the Company’s common

stock on the date of grant. The weighted average fair value of unvested shares granted during the fiscal year ended

December 29, 2007 was $38.14 per share.

As of December 29, 2007, there was $19,519 of unrecognized compensation expense related to all share-based

awards (excluding DSUs) that is expected to be recognized over a weighted average period of 1.8 years.

DSUs

The Company granted eight and seven DSUs in fiscal years 2007 and 2006, respectively, at a weighted average

fair value of $41.64 and $38.35, respectively. The DSUs are awarded at a price equal to the market price of the

Company’s underlying stock on the date of the grant. For fiscal years 2007 and 2006, respectively, the Company

recognized a total of $344 and $285, on a pre-tax basis, in compensation expense related to these DSU grants.

Employee Stock Purchase Plan

The Company also offers an employee stock purchase plan, or ESPP. Through 2005 all eligible employees, or

team members, could elect to have a portion of compensation paid in the form of Company stock in lieu of cash

calculated at 85% of fair market value at the beginning or end of the quarterly purchase period whichever was lower.

Effective January 1, 2006, the ESPP was amended such that eligible team members may purchase common stock at

95% of fair market value at the date of purchase. There are annual limitations on team member elections of either

$25 per team member or ten percent of compensation, whichever is less. Under the plan, team members acquired 53,

90 and 110 shares in fiscal years 2007, 2006 and 2005, respectively. At December 29, 2007, there were 1,408 shares

available to be issued under the plan.

F-32