Advance Auto Parts 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Advance Auto Parts, Inc.

I

Annual Report 2005

I

7

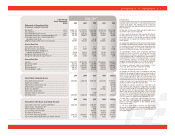

FISCAL YEAR(1)

2005 2004 2003 2002 2001(a)

Reconciliation of Operating Income:

Comparable operating income ............................................................. $408,492 $328,758 $289,441 $231,883 $119,127

Supply chain initiatives.......................................................................... - - - - (10,492)

Impairment of assets held for sale........................................................ - - - - (10,700)

Merger related restructuring ................................................................. - - - (597) (3,719)

Merger and integration ......................................................................... - - (10,417) (34,935) (1,135)

Stock option compensation................................................................... - - - - (8,611)

Operations effect on 53rd week ............................................................ - - 9,210 - -

Operating income ................................................................................. $408,492 $328,758 $288,234 $196,351 $ 84,470

2005 2004 2003 2002 2001(a)

Reconciliation of Net Income and Earnings Per Share:

Comparable income from continuing operations................................. $234,725 $188,027 $155,091 $94,267 $35,652

Add back items from footnote (4) ....................................................... - - (1,207) (35,532) (34,657)

Interest expense in 53rd week.............................................................. - - (368) - -

Loss on extinguishment of debt........................................................... - - (46,887) (16,822) (6,106)

Tax impact of above items.................................................................... - - 18,658 20,235 16,182

Income from continuing operations..................................................... $234,725 $188,027 $125,287 $62,148 $11,071

Income from continuing operations per diluted share (6) .................. $2.13 $1.66 $1.12 $0.57 $0.13

footnotes:

(1) Our fiscal year consists of 52 or 53 weeks ending on the

Saturday nearest to December 31. All fiscal years presented

consist of 52 weeks. The operating results of the 53rd

week in fiscal 2003 have been excluded as reconciled in the

below footnotes.

(2) Net sales for fiscal year 2003 exclude the effect of the

53rd week in the amount of $63,016.

(3) Gross profit for fiscal year 2003 excludes the effect of

the 53rd week in the amount of $28,762. Gross profit for

fiscal 2001 excludes a non-recurring charge of $9,099

associated with our supply chain initiatives recorded in the

fourth quarter.

(4) Comparable operating income excludes certain charges

as included in the following reconciliation of this measurement

to our operating income presented under generally accept-

ed accounting policies in our financial statements con-

tained in the Financial Review of this annual report.

(5) Comparable income from continuing operations

excludes the items in footnote (4) above and the early

extinguishment of debt and cumulative effect of a change

in accounting principle. The following is a reconciliation of

comparable income from continuing operations to income

from continuing operations presented under generally

accepted accounting policies in our financial statements

contained in the Financial Review of this annual report.

(6) Amounts referenced reflect the Company's 3-for-2

stock split, which took effect September 26, 2005.

(7) Excludes Autopart International, Inc. (AI).

(8) Average net sales per store is calculated as net sales

divided by the average of beginning and ending number of

stores for the respective period, excluding AI. The fiscal

2003 net sales exclude the effect of the 53rd week in the

amount of $63,016 million. The fiscal 2001 amounts were

calculated giving effect to the Discount retail net sales and

number of stores for the period December 2, 2001 (the

acquisition date) through December 29, 2001.

(9) Average net sales per square foot is calculated as net

sales divided by the average of the beginning and ending

total store square footage for the respective period, excluding

AI. The fiscal 2003 net sales exclude the effect of the 53rd

week in the amount of $63,016 million. The fiscal 2001

amounts were calculated giving effect to the Discount retail

net sales and number of stores for the period December 2,

2001 (the acquisition date) through December 29, 2001.

(10) Net debt includes total debt and bank overdrafts,

less cash and cash equivalents as presented in our

financial statements contained in the Financial Review

of this annual report.

(a) The fiscal 2001 charges represent only those taken

during the fourth quarter. For more information see the

Selected Financial Data section in the Financial Review of

this annual report.

5-Year Average

Annual Compounded

Growth 2005 2004 2003 2002 2001

Statement of Operations Data:

(in thousands, except per share data)

Net sales(2) ...............................................................................15.2% $4,264,971 $3,770,297 $3,430,680 $3,204,140 $2,419,746

Gross profit (3) .........................................................................17.4% 2,014,478 1,753,371 1,575,756 1,434,407 1,062,152

Comparable operating income (4) ............................................36.1% 408,492 328,758 289,441 231,883 119,127

Comparable income from continuing operations (5) ................60.2% 234,725 188,027 155,091 94,267 35,652

Comparable income from continuing operations

per diluted share (5)(6).................................................................... $2.13 $1.66 $1.39 $0.87 $0.41

Weighted average diluted shares outstanding (6)................................ 109,987 113,222 112,115 108,564 87,474

Selected Store Data:

Comparable store sales growth ………………………………. ........ 8.7% 6.1% 3.1% 5.5% 6.2%

Number of stores, end of period………………………………......... 2,872 2,652 2,539 2,435 2,484

Total retail store square footage, end

of period (in thousands) (7)…………………………………....... 20,899 19,734 18,875 18,108 18,717

Average net retail sales per store (8).................................................... $1,551 $1,453 $1,379 $1,303 $1,346

Average net retail sales per square foot (9) ......................................... $208 $195 $186 $174 $175

Balance Sheet Data:

Inventory............................................................................................... $1,367,099 $1,201,450 $1,113,781 $1,048,803 $982,000

Net working capital ……………………………………………........ 406,476 416,302 372,509 462,896 442,099

Total assets……………………………………………………......... 2,542,149 2,201,962 1,983,071 1,965,225 1,950,615

Total net debt (10) ………………………………………………..... 448,187 433,863 464,598 722,506 972,368

Total stockholders' equity …………………………………….. ........ 919,771 722,315 631,244 468,356 288,571