Advance Auto Parts 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Assets,” which provides such beneficial

interests are not subject to SFAS No. 133. This state-

ment amends SFAS No. 140, “Accounting for

Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities—a Replacement of

FASB Statement No. 125,” by eliminating the restric-

tion on passive derivative instruments that a qualifying

special-purpose entity may hold. This statement is

effective for financial instruments acquired or issued

after the beginning of the Company’s fiscal year 2007.

The Company does not expect the adoption of this

statement to have a material impact on its financial

condition, results of operations or cash flows.

3. ACQUISITIONS:

On September 14, 2005, the Company completed

its acquisition of Autopart International, Inc. The

acquisition, which included 61 stores throughout

New England and New York, a distribution center and

AI’s wholesale distribution business, will complement

the Company’s growing presence in the Northeast.

AI’s business serves the growing commercial market

in addition to warehouse distributors and jobbers.

The acquisition has been accounted for under the

provisions of SFAS No. 141, “Business Combina-

tions,” or SFAS No. 141, and, accordingly, AI’s

results of operations have been included in the

Company’s consolidated statement of operations

from the acquisition date to December 31, 2005. The

total purchase price of AI consists of $87,440, of

which $74,940 was paid upon closing with an addi-

tional $12,500 of contingent consideration payable

no later than April 1, 2006 based upon AI satisfying

certain earnings before interest, taxes, depreciation

and amortization targets through December 31, 2005.

Furthermore, an additional $12,500 is payable upon

the achievement of certain synergies, as defined in

the Purchase Agreement, through fiscal 2008. In

accordance with SFAS No. 141, this additional pay-

ment does not represent contingent consideration and

will be reflected in the statement of operations when

earned. Due to the timing of this acquisition, the pur-

chase price has preliminarily been allocated to the

assets acquired and the liabilities assumed based

upon estimates of fair values at the date of acquisi-

tion. This preliminary allocation resulted in the

recognition of $50,439 in goodwill, all of which is

deductible for tax purposes, and is subject to the

finalization of the valuation of certain identifiable

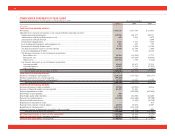

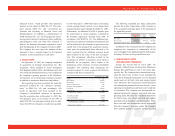

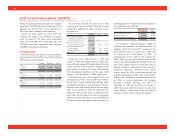

intangibles. The following table summarizes the

amounts assigned to assets acquired and liabilities

assumed at the date of acquisition:

September 14, 2005

Cash .............................................................. $ 223

Receivables................................................... 10,224

Inventories .................................................... 28,913

Other current assets ...................................... 812

Property and equipment ............................... 5,332

Goodwill....................................................... 50,439

Other assets .................................................. 447

Total assets acquired ................................ $96,390

Accounts payable.......................................... (5,690)

Current liabilities.......................................... (3,054)

Other long-term liabilities ............................ (206)

Total liabilities assumed........................... (8,950)

Net assets acquired .................................. $87,440

The following unaudited pro forma information

presents the results of operations of the Company as

if the acquisition had taken place at the beginning of

the applicable periods:

December 31, January 1, January 3,

2005 2005 2004

Net sales............................ $4,337,461 $3,857,646 $3,577,239

Net income ....................... 238,290 189,138 126,207

Earnings per diluted share .. $ 2.17 $ 1.67 $ 1.13

In addition to the AI acquisition, the Company also

completed the acquisition of substantially all the

assets of Lappen Auto Supply during the third quarter,

including 19 stores in the greater Boston area.

4. CATASTROPHIC LOSSES

AND INSURANCE RECOVERIES:

During the second half of fiscal 2005, the

Company suffered losses resulting from Hurricanes

Katrina, Rita and Wilma as well as two stores dam-

aged by fire. The Company has estimated and recog-

nized the fixed costs of these events including the

write-off of damaged merchandise at cost, damaged

capital assets at net book value and required repair

costs. Moreover, these hurricanes caused significant

sales disruptions primarily from store closures, stores

operating on limited hours and lower sales trends due

to evacuations. The Company also incurred and rec-

ognized incremental expenses associated with com-

pensating Team Members for scheduled work hours

for which stores were closed and food and supplies

provided to Team Members and their families. While

these costs and sales disruptions are not recoverable

from the Company’s insurance carrier, the Company

does maintain property insurance against the fixed

Advance Auto Parts

I

Annual Report 2005

I

45