Advance Auto Parts 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

vendors related to cooperative advertising allowances,

volume rebates and other promotional considera-

tions. The Company accounts for vendor incentives

in accordance with Emerging Issues Task Force, or

EITF, No. 02-16, “Accounting by a Customer

(Including a Reseller) for Certain Consideration

Received from a Vendor.” Many of the incentives are

under long-term agreements (terms in excess of one

year), while others are negotiated on an annual basis.

Certain vendors require the Company to use cooper-

ative advertising allowances exclusively for advertis-

ing. The Company defines these allowances as

restricted cooperative advertising allowances and rec-

ognizes them as a reduction to selling, general and

administrative expenses as incremental advertising

expenditures are incurred. The remaining cooperative

advertising allowances not restricted by the

Company’s vendors and volume rebates are earned

based on inventory purchases and recorded as a

reduction to inventory and recognized through cost of

sales as the inventory is sold.

The Company recognizes other promotional incen-

tives earned under long-term agreements as a reduc-

tion to cost of sales. These incentives are recognized

based on the cumulative net purchases as a percent-

age of total estimated net purchases over the life of

the agreement. The Company’s margins could be

impacted positively or negatively if actual purchases

or results from any one year differ from its estimates;

however, the impact over the life of the agreement

would be the same. Short-term incentives (terms less

than one year) are recognized as a reduction to cost of

sales over the course of the agreements.

Amounts received or receivable from vendors that

are not yet earned are reflected as deferred revenue in

the accompanying consolidated balance sheets.

Management’s estimate of the portion of deferred

revenue that will be realized within one year of the

balance sheet date has been included in other current

liabilities in the accompanying consolidated balance

sheets. Total deferred revenue is $12,529 and $17,000

at December 31, 2005 and January 1, 2005, respec-

tively. Earned amounts that are receivable from

vendors are included in receivables, net on the

accompanying consolidated balance sheets, except

for that portion expected to be received after one

year, which is included in other assets, net on the

accompanying consolidated balance sheets.

Preopening Expenses

Preopening expenses, which consist primarily of

payroll and occupancy costs, are expensed as incurred.

Advertising Costs

The Company expenses advertising costs as

incurred in accordance with the American Institute of

Certified Public Accountant’s Statement of Position,

or SOP, 93-7, “Reporting on Advertising Costs.”

Gross advertising expense incurred was approxi-

mately $95,702, $86,821 and $75,870 in fiscal 2005,

2004 and 2003, respectively.

Merger and Integration Costs

As a result of the acquisition of Discount Auto Parts

(“Discount”) in 2001, the Company incurred costs

related to, among other things, overlapping administra-

tive functions and store conversions, all of which have

been expensed as incurred. These costs are presented

as expenses associated with the merger and integration

in the accompanying statements of operations.

For the fiscal year ended January 3, 2004, the

Company incurred $10,417 of merger and integration

and merger-related restructuring expenses and none

for the years ended December 31, 2005 and January 1,

2005, respectively.

Sales Returns and Allowances

The Company’s accounting policy for sales returns

and allowances consists of establishing reserves for

anticipated returns at the time of sale. The Company

anticipated returns based on current sales levels and

the Company’s historical return experience on a spe-

cific product basis.

Warranty Costs

The Company’s vendors are primarily responsible

for warranty claims. Warranty costs relating to mer-

chandise (primarily batteries) and services sold under

warranty, which are not covered by vendors’ war-

ranties, are estimated based on the Company’s histor-

ical experience and are recorded in the period the

product is sold. The Company has applied the disclo-

sure requirements of Financial Accounting Standards

Board, or FASB, Interpretation No. 45, “Guarantor’s

Accounting and Disclosure Requirements for

Guarantees, Including the Indirect Guarantees of

Indebtedness of Others,” as they relate to warranties.

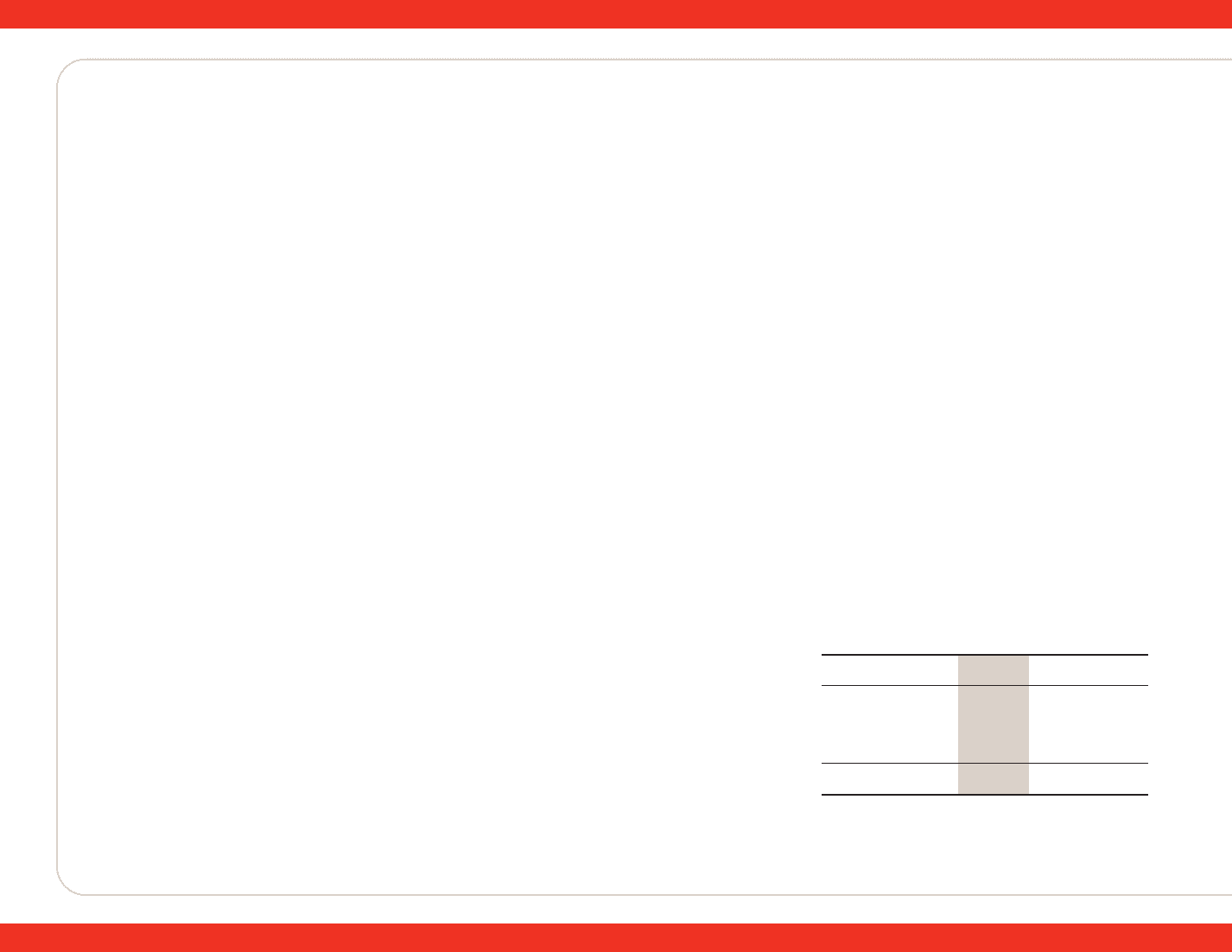

The following table presents changes in our defective

and warranty reserves:

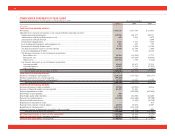

December 31, January 1, January 3,

2005 2005 2004

Defective and warranty

reserve, beginning

of period....................... $ 10,960 $ 15,578 $ 15,620

Reserves established......... 14,268 13,071 13,755

Reserves utilized(1) ............ (13,876) (17,689) (13,797)

Defective and warranty

reserve, end of period .. $ 11,352 $ 10,960 $ 15,578

(1) Reserves at the beginning of fiscal 2004 included $1,656 of

reserves established for the transition of the discontinued

operations of the wholesale dealer network. Substantially all

these reserves were utilized during fiscal 2004.

40

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

For the Years Ended December 31, 2005, January 1, 2005 and January 3, 2004 (in thousands, except per share data)