Advance Auto Parts 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LIQUIDITY AND CAPITAL RESOURCES

Overview of Liquidity

Our primary cash requirements include the pur-

chase of inventory, capital expenditures and contrac-

tual obligations. In addition, we have used available

funds to repurchase shares under our stock repur-

chase program. We have funded these requirements

primarily through cash generated from operations

supplemented by borrowings under our senior credit

facility as needed.

At December 31, 2005, our cash balance was

$40.8 million, a decrease of $15.5 million compared

to fiscal year-end 2004. Our cash balance decreased

primarily due to cash invested in business acquisi-

tions during 2005, partially offset by cash generated

from our increased earnings during 2005 as com-

pared to 2004. At December 31, 2005, we had out-

standing indebtedness consisting primarily of

borrowings of $438.3 million under our senior credit

facility, a decrease of $31.2 million from 2004.

Additionally, we had $54.6 million in letters of credit

outstanding, which reduced our cash availability

under the revolving credit facility to $145.4 million.

Capital Expenditures

Our primary capital requirements have been the

funding of our continued store expansion program,

including new store openings and store acquisitions,

store relocations and remodels, inventory requirements,

the construction and upgrading of distribution centers,

the development and implementation of proprietary

information systems and our acquisitions.

Our capital expenditures were $216.2 million in

2005. These amounts included costs related to new

store openings, the upgrade of our information sys-

tems, remodels and relocations of existing stores,

including the completion of our physical conversion

of stores acquired in the Discount acquisition to our

Advance Auto Parts store format. In 2006 we antici-

pate that our capital expenditures will be approxi-

mately $260.0 million to $280.0 million.

Our new stores, if leased, require capital expendi-

tures of approximately $170,000 per store and an

inventory investment of approximately $170,000

per store, net of vendor payables. A portion of the

inventory investment is held at a distribution facility.

Pre-opening expenses, consisting primarily of store

set-up costs and training of new store Team Members,

average approximately $20,000 per store and are

expensed when incurred.

Our future capital requirements will depend in

large part on the number of and timing for new stores

we open or acquire within a given year and the number

of stores we relocate or remodel. During fiscal 2005,

we opened 231 stores, including 80 stores acquired

as part of the acquisitions of AI and Lappen Auto

Supply. We anticipate adding at least 170 to 180 new

stores during fiscal 2006, excluding any acquisitions.

Vendor Financing Program

Historically, we have negotiated extended payment

terms from suppliers that help finance inventory

growth, and we believe that we will be able to continue

financing much of our inventory growth through

such extended payment terms. In fiscal 2004, we

entered into a short-term financing program with a

bank for certain merchandise purchases. In sub-

stance, the program allows us to borrow money from

the bank to finance purchases from our vendors. This

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)

Income tax expense for 2004 was $117.7 million, as compared to $78.4 million for 2003. This increase in

income tax expense primarily reflected our higher earnings. Our effective income tax rate was 38.5% for both

2004 and 2003.

We recorded net income of $188.0 million, or $1.66 per diluted share for 2004, as compared to $124.9 million,

or $1.11 per diluted share for 2003. As a percentage of sales, net income for 2004 was 5.0%, as compared to

3.6% for 2003. Our net income for 2003 included the effect of expenses associated with merger and integration

and loss on extinguishment of debt of $35.5 million, or $0.31 per diluted share. These per share amounts reflect

the 3-for-2 stock split declared in 2005.

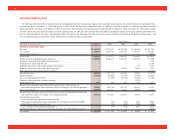

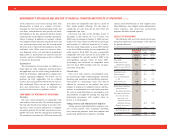

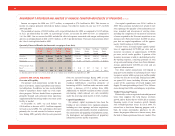

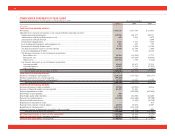

Quarterly Financial Results (in thousands, except per share data)

16-Weeks 12-Weeks 12-Weeks 12-Weeks 16-Weeks 12-Weeks 12-Weeks 12-Weeks

Ended Ended Ended Ended Ended Ended Ended Ended

4/23/05 7/16/05 10/8/05 12/31/05 4/24/04 7/17/04 10/9/04 1/1/05

Net sales....................... $1,258,364 $1,023,146 $1,019,736 $963,725 $1,122,918 $908,412 $890,161 $848,806

Gross profit .................. 600,931 482,050 481,415 450,082 520,898 422,302 416,515 393,656

Net income................... $ 68,647 $ 65,929 $ 60,793 $ 39,356 $ 51,291 $ 53,235 $ 51,393 $ 32,069

Net income per share:

Basic(1) .......................... $ 0.64 $ 0.61 $ 0.56 $ 0.36 $ 0.46 $ 0.47 $ 0.46 $ 0.29

Diluted(1) ....................... $ 0.63 $ 0.60 $ 0.55 $ 0.36 $ 0.45 $ 0.47 $ 0.45 $ 0.29

(1) Amounts reflect the effect of a 3-for-2 stock split of our common stock distributed on September 23, 2005.

28