Advance Auto Parts 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the director until he or she ceases to be a director. The DSUs are then distributed to the director following his or

her last date of service.

The Company granted six and nine DSUs in fiscal years 2005 and 2004, respectively at a weighted average fair

value of $39.65 and $27.71, respectively. For fiscal years 2005 and 2004, respectively, the Company recognized a

total of $237 and $494, on a pre-tax basis, in compensation expense related to these DSU grants. Additionally, the

DSU Plan provides for the deferral of compensation as earned in the form of an annual retainer for board members and

wages for certain highly compensated employees of the Company. These deferred stock units are payable to the partic-

ipants at a future date or over a specified time period as elected by the participants in accordance with the DSU Plan.

Shares authorized for grant under the LTIP are 8,620 at December 31, 2005 and January 1, 2005. Subsequent

to December 31, 2005, the Company granted 2,049 stock options at an exercise price of $40.45.

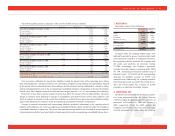

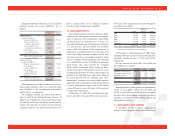

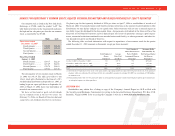

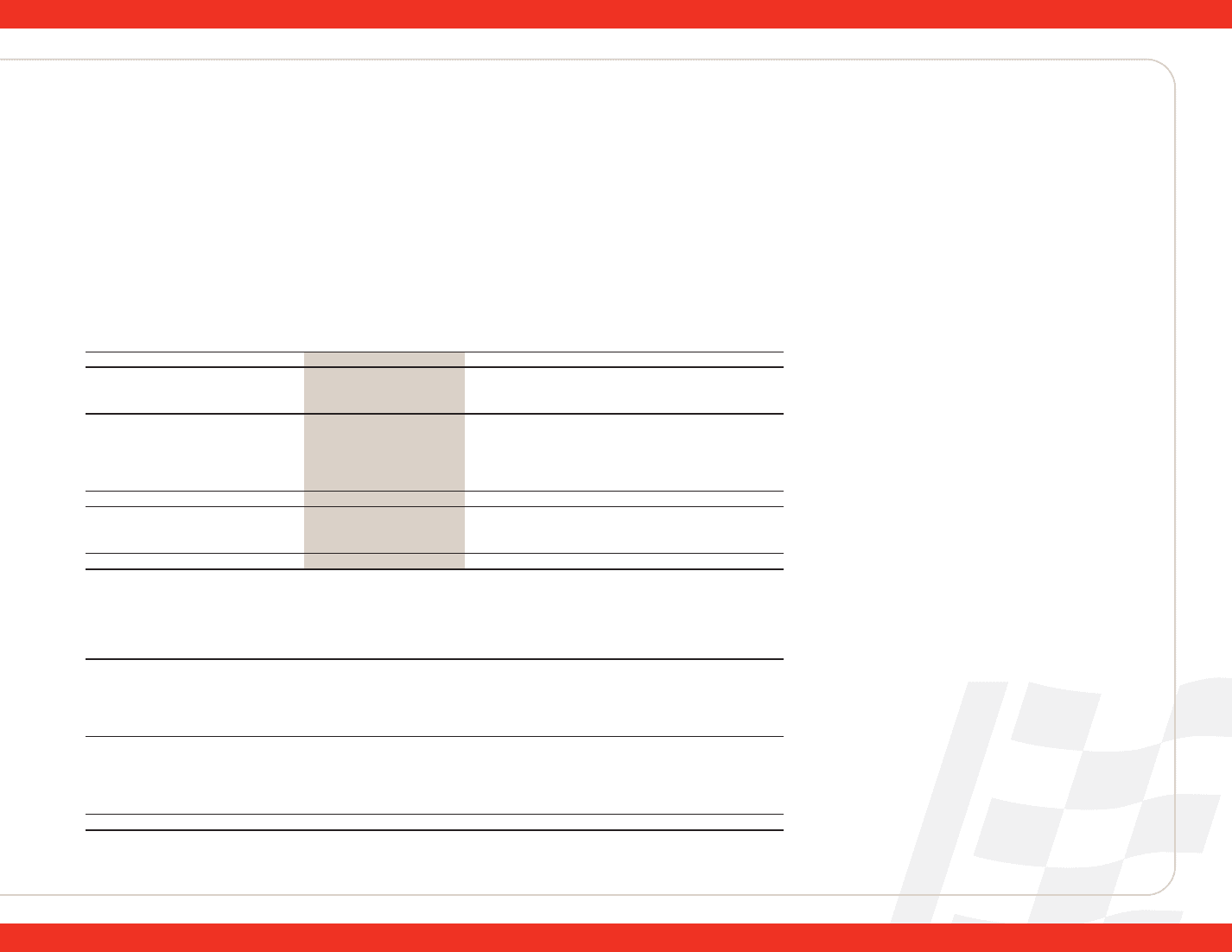

Total option activity for the last three fiscal years was as follows:

2005 2004 2003

Weighted- Weighted- Weighted-

Number of Average Number of Average Number of Average

Plan Shares Exercise Price Shares Exercise Price Shares Exercise Price

Fixed Price Options

Outstanding at beginning of year........... 6,840 $15.77 8,117 $10.03 8,304 $ 8.75

Granted................................................... 2,237 34.01 2,028 26.08 1,878 14.52

Exercised ................................................ (2,727) 10.53 (2,914) 7.03 (1,901) 8.59

Forfeited ................................................. (158) 24.15 (391) 14.93 (164) 14.11

Outstanding at end of year ......................... 6,192 $24.46 6,840 $15.77 8,117 $10.03

Other Options

Outstanding at beginning of year........... —$— — $ — 1,500 $ 6.00

Exercised ................................................ ——— — (1,500) 6.00

Outstanding at end of year..................... —$— —$— —$—

For each of the Company’s option grants during fiscal years 2005, 2004 and 2003, the Company granted options

at prices consistent with the market price of its stock on each respective grant date. Information related to the

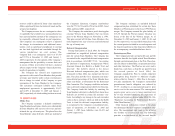

Company’s options by range of exercise prices is as follows:

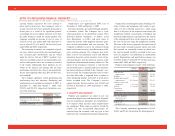

Weighted-Average

Remaining

Weighted-Average Contractual Life Weighted Price of

Number of Exercise Price of of Outstanding Number of Exercise Price of

Shares Outstanding Outstanding Shares Shares (in years) Shares Exercisable Exercisable Shares

$ 5.61–$13.46............................ 1,267 $12.17 3.7 814 $11.46

$14.00–$25.94............................ 1,140 17.12 3.8 977 15.99

$26.21–$29.12............................ 1,588 26.29 5.0 461 26.31

$30.05–$33.37............................ 1,883 33.37 6.1 — 31.49

$33.57–$42.10............................ 314 38.17 6.2 14 39.46

6,192 $24.46 4.9 2,266 $16.52

Advance Auto Parts

I

Annual Report 2005

I

57

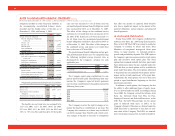

As permitted under SFAS No. 123, the Company

accounts for its stock options using the intrinsic value

method prescribed in APB Opinion No. 25. Under

APB Opinion No. 25, compensation cost for stock

options is measured as the excess, if any, of the market

price of the Company’s common stock at the measure-

ment date over the exercise price. Accordingly, the

Company has not recognized compensation expense

on the issuance of its stock options because the exercise

price equaled the fair market value of the underlying

stock on the grant date. No compensation expense was

required for the fiscal years ended December 31, 2005,

January 1, 2005 and January 3, 2004.

The Company maintains an employee stock pur-

chase plan, which qualifies as a non-compensatory

plan under Section 423 of the Internal Revenue Code

of 1986, as amended. In May 2002 the Company reg-

istered 2,100 shares with the Securities and Exchange

Commission to be issued under the plan. Through

2005 all eligible Team Members could elect to have a

portion of compensation paid in the form of Company

stock in lieu of cash calculated at 85% of fair market

value at the beginning or end of the quarterly pur-

chase period. As a result of the non-compensatory

nature of this plan, the Company has not recognized

compensation expense under APB No. 25. However,

the Company has recognized the value of its stock

issued under the plan as non-cash compensation in

selling, general and administrative expenses of the

accompanying consolidated statements of operations.

There are annual limitations on Team Member elec-

tions of either $25 per Team Member or 10% of com-

pensation, whichever is less. Under the plan, Team

Members acquired 110, 177 and 220 shares in fiscal